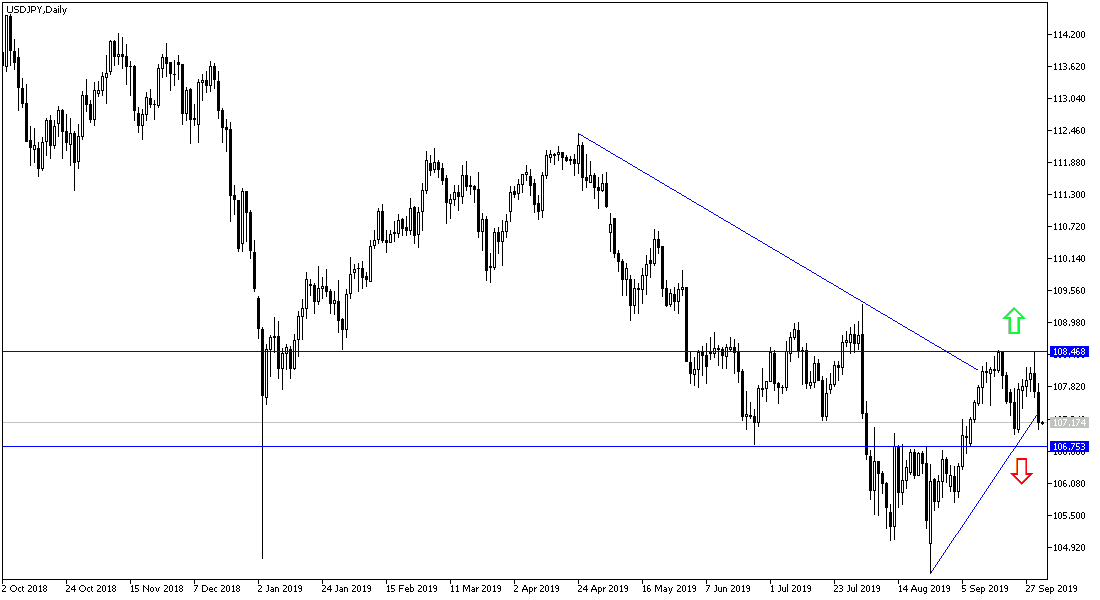

Investors are rushing to buy safe havens again as renewed fears of a failed US-China trade talk round and a bleak Brexit scene, and the yen shrugged off an increase in sales tax in Japan starting this month. All of these factors contributed to the decline of the USD / JPY to the 107.04 support with the new failure of the pair to cross the 108.47 resistance, which confirms the solidity of the general trend, which is still bearish. The Japanese yen's strength was reinforced again by reports that North Korea test-fired a ballistic missile. The US State Department has asked North Korea to refrain from such provocations. Hours before the test, North Korea agreed to resume talks with the United States.

From Japan, data from the Cabinet Office showed Wednesday that Japanese consumer confidence fell to its lowest level in more than eight years in September. The consumer confidence index fell to a seasonally adjusted 35.6 in September from 37.1 in August. The latest confidence index was the lowest since June 2011, when the reading was 35.2. Of the four sub-indices of the Consumer Confidence Index, the index which reflects households' tendency to buy durable consumer goods, fell to 28.1 in September and the income growth index fell to 38.7. Indicators measuring total livelihoods and employment fell to 33.9 and 41.5, respectively, in September.

The survey was conducted on 15 September and involved 8,400 households.

From the US, data from ADP showed that employment in the US private sector rose less than expected in September. Private sector employment increased by 135,000 in September, compared to estimates of an increase of about 140,000. The survey gives an impression of what the US government's official report on US job numbers will release, which is expected to hit weak figures, which will negatively affect confidence in the US currency.

According to the technical analysis of the pair: The USD / JPY pair testing the 107.00 support, and breaching it, will increase the bearish momentum and support a sell-off that could push it to stronger support levels that could reach 106.75, 106.00 and 105.35 respectively. Conversely, any successful attempt by the pair to breach the 108.47 resistance level will support the upside move again.

With the absence of Japanese economic data, the pair's performance will focus on the US session data with the release of jobless claims,PMI for services and US factory orders.