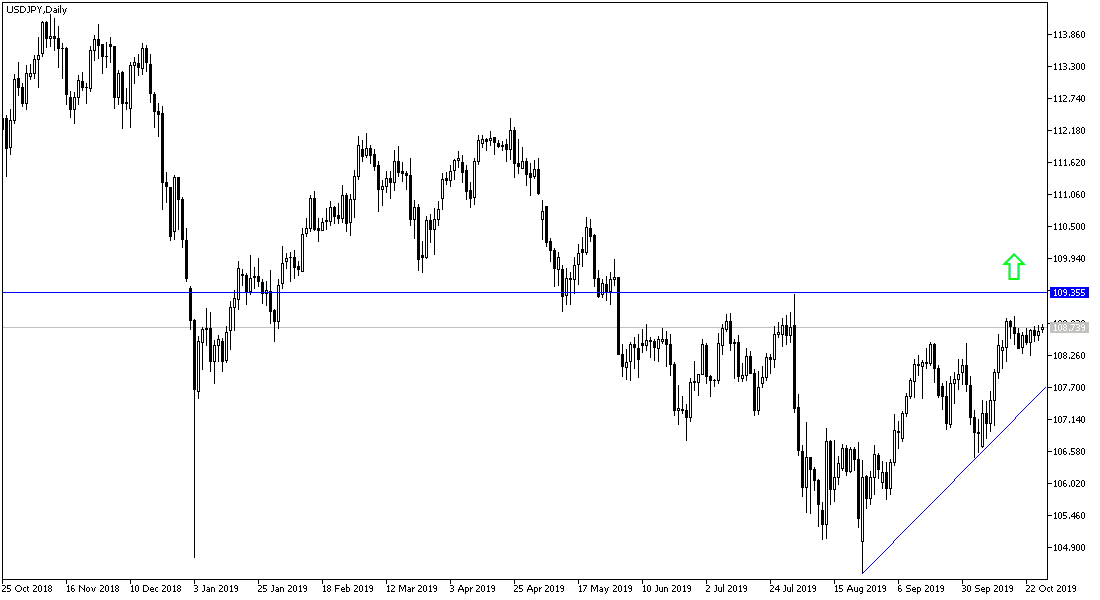

For the eight trading sessions in a row, USD/JPY stabilized between the 108.24 support and the 108.93 resistance, as shown on the daily chart below, and closed last week's trading around 108.66. Technically, this strong performance predicts a strong move in one direction, and the Fed's monetary policy and US employment figures this week will determine what direction, as weaker jobs numbers and US interest rate cuts are going to cause bearish pressure pushing this pair below the 108.00 support. If risk appetite and US economic indicators improve, we may see long-awaited psychological resistance at 1.1000. The US dollar index (DXY) extended its weekly gains above 97.80 resistance last Friday after exceeding the 200-hour SMA within an upward channel. The US currency index continues to rise against a basket of six major rivals amid stalled trade talks.

The US dollar index has recently reached overbought levels, leading to a short-term decline, but the momentum appears to be strong enough for the DXY to rebound well above 98.00 in the coming days.

Investors are worried about the lengthy trade talks between the world's two largest economies, despite optimistic statements from both sides that agreement on the first phase of the dispute resolution is nearing. But as long as there is little on the ground, traders prefer to wait. On the economic front, Markit's initial purchasing managers' indexes for September declined, including manufacturing index and the composite index, which includes both the manufacturing and services sectors. Durable goods orders fell more than expected. Initial jobless claims for the week ending October 18 rose 215K from 212K.

According to the technical analysis of the pair: We are still waiting for a bullish bounce for USD/JPY to the 110.000 psychological resistance to confirm the strength of the recent upward correction. At the same time, the outlooks will threaten the pair to move below 108.00 support, which could increase pressure towards support areas of 107.75, 106.90 and 106.00 respectively. In general it is best to sell this pair from every bullish level.

As for the economic calendar today: The economic calendar has no significant data from Japan or the United States. The pair will be on an important date with the monetary policy announcement of the Bank of Japan and the Federal Reserve later this week. This is in addition to the GDP growth and employment figures from the United States.