USD/JPY rebounded to 108.68 resistance as investors continued to take risks and abandon safe havens amid optimism over the course of trade talks between the United States and China and the possibility of avoiding a chaotic exit from Britain from the European Union. With the lack of significant economic data since the beginning of this week's trading, the focus of investors has been on the announcement of corporate profits. We have seen a drop in profits for some big companies and what worries investors is that many companies that meet or exceed expectations are working to reduce their earnings forecast for next year.

With the Fed preparing to cut interest rates again next week, further cuts are impossible in the remainder of 2019 and the IMF is pessimistic about the course of the US economy as well. If their forecasts come true, it could affect the greenback. At the last annual meeting of the IMF and World Bank in 2019, “participants in these meetings note that the performance of the US dollar is declining”. In contrast, recent discussions between world leaders and policymakers on the over-dependence of the global financial system on the dollar, given its status as a global reserve currency and its use in commodity trade, suggest imminent regulatory shifts.

This is likely to be the case in particular, as a permanent appreciation of the dollar tends to cause trade imbalances and the historically high trade deficit in the United States. Therefore, US President Trump has complained on more than one occasion of the high dollar value compared to other major currencies and other central banks deliberately to ease monetary policy and some measures to weaken their currencies.

Today, Trump said the United States is doing well in China's trade talks.

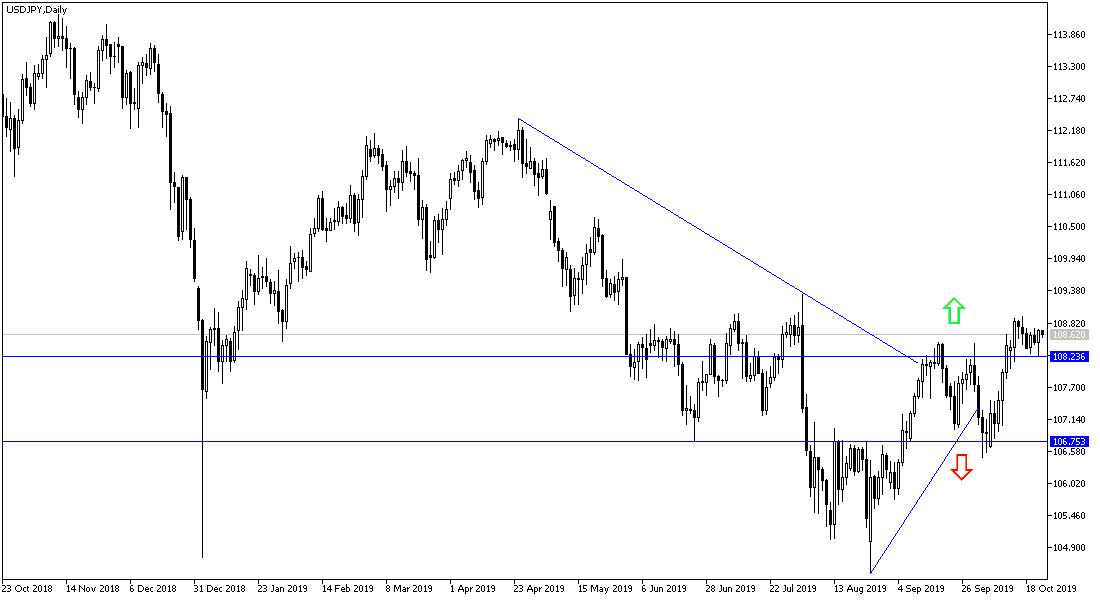

According to the technical analysis of the pair: No change in my technical view of the price of USD/JPY, the current upward correction will strengthen if the pair succeeded in moving towards 110.00 psychological resistance. Conversely, a decline towards the support levels at 108.10, 107.70 and 106.90 will restore the bearish trend again. The return of global trade and geopolitical tensions will certainly benefit the Japanese yen.

On the economic calendar: Japan's manufacturing PMI will be released first. From the US, durable goods orders, jobless claims and new home sales will be released.