USD/JPY fell from the 109.28 resistance, the highest in three months, before settling around 108.60 at the time of writing, after the US dollar came under pressure after the Federal Reserve announced a quarter-point cut in the US interest rate to 1.75% instead of 2.00% and pledge to further ease monetary policy in case of increased risks to the US economy. If a broader agreement is reached to resolve the trade dispute between the United States and China, markets expect the bank to halt the rate cut and will not heed to US President Trump's continued criticism. The bank made the same move at the September and July meetings. Despite the recent cut, the bank stressed that the labor market remained strong and that economic activity rose at a moderate rate.

The split among the Fed's monetary policy committee members remains. FOMC members voted 8-2 in favor of interest rates, with Kansas City Fed President Esther George and Boston Fed Chairman Eric Rosengren in favor of keeping rates unchanged.

Before the bank's announcement, US economic growth slowed much less than expected in the third quarter, as the Commerce Department said real GDP rose 1.9 percent in the third quarter after rising 2.0 percent in the second quarter. Economists had expected GDP growth to slow to 1.7 percent. Stronger-than-expected GDP growth reflects positive contributions from consumer spending, government spending, residential fixed investment and exports. The slightly slower GDP growth than the previous quarter reflects a marked slowdown in consumer spending, which increased by 2.9 percent in the third quarter after a 4.6 percent rise in the second quarter.

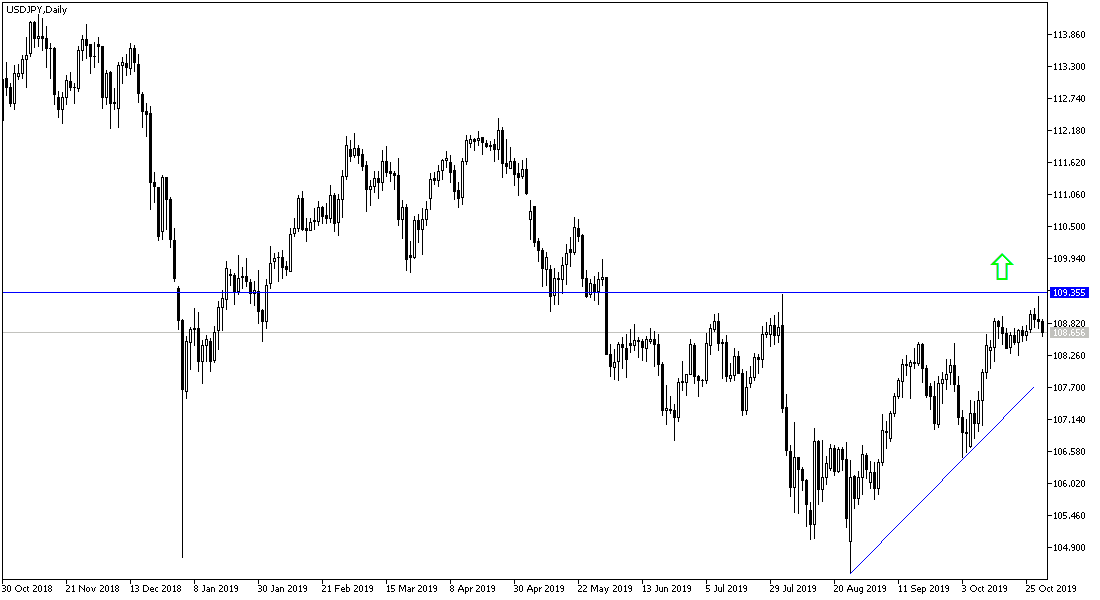

According to the technical analysis of the pair: If the USD/JPY moves below the 108.00 support, the bearish momentum will increase, and bullish bounce outlooks will be lost, which still has a chance. Currently the closest support levels are 108.35, 107.70 and 107.00 respectively. Success in breaching 109.26 resistance will trigger an upward correction to test 110.00 psychological resistance 110.00, which supports the uptrend strength.

As for the economic calendar data today: From Japan, the BOJ monetary policy will be released and the Yen will also react to the release of Chinese manufacturing data. The United States is to announce the Fed's preferred inflation gauge, the country's personal consumption expenditure price index, as well as the US citizen's spending and income rate, jobless claims and the cost of employment index.