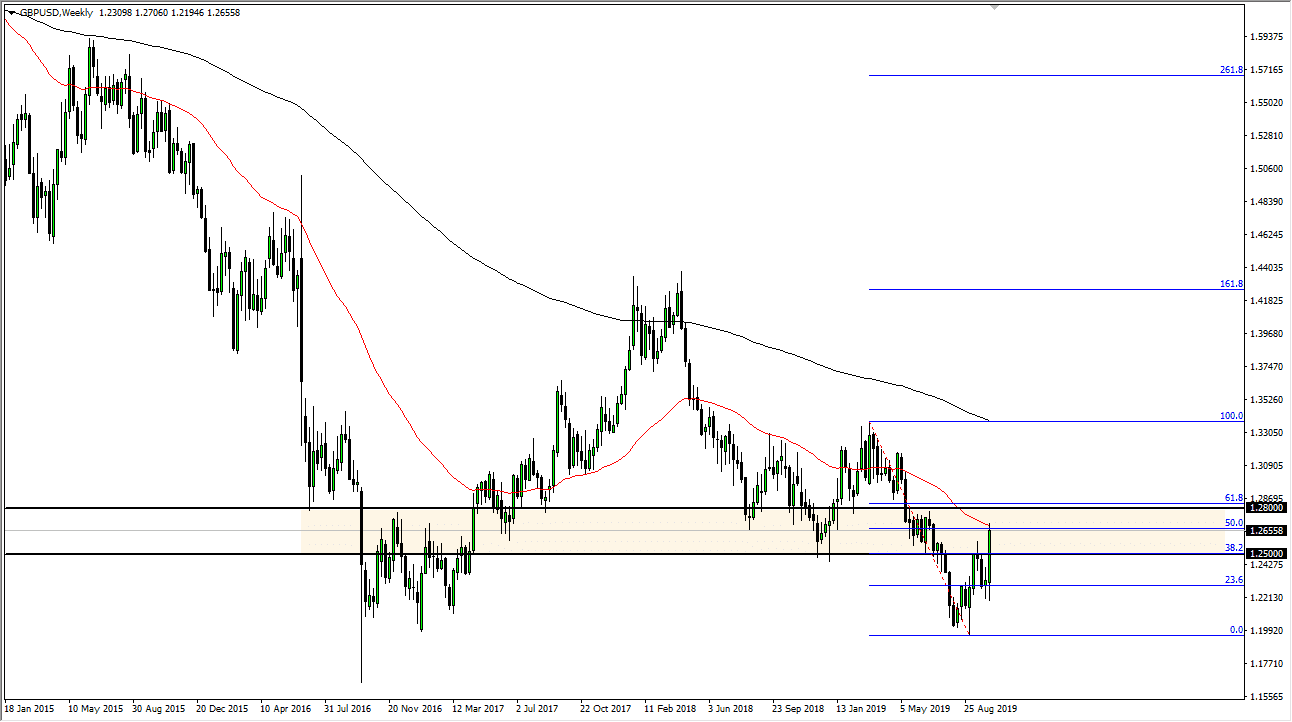

GBP/USD

The British pound had an extraordinarily bullish week, breaking above the 1.25 level handily. The weekly chart did stop directly at the 50 week EMA, and the 1.2650 level. As we close out the week, we are starting to see officials walked back some of the optimism of the trade deal, and of course going into the weekend, just about any type of headline can cross the wire. Keep in mind that a lot of this was done by conjecture and algorithmic trading, as the liquidity was not very deep at times on this move higher. This isn’t to say that the market can go higher, but I believe that between here and the 1.28 level it’s very likely that there will be enough resistance to fade. That being said, the best trade in the GBP/USD pair is to probably leave it alone.

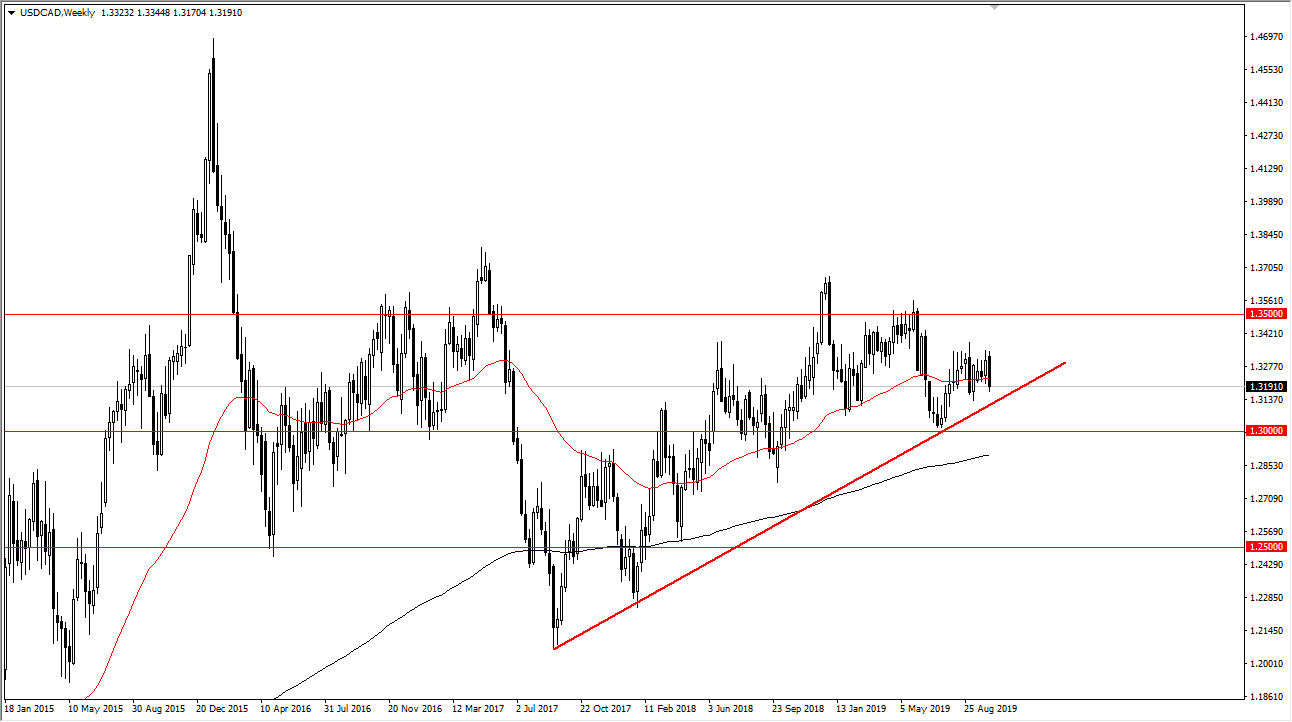

USD/CAD

The US dollar has broken down a bit during the week, slicing through the 50 week EMA against the Canadian dollar. However, there’s a nice uptrend line just below current pricing, so at this juncture, it’s very likely that we will see buyers come back in. If we did break down below the 1.31 handle, then it probably opens up the door to the 1.30 level, but right now I suspect that we are simply going to continue the overall consolidation, meaning that we will probably end up higher by the end of the week.

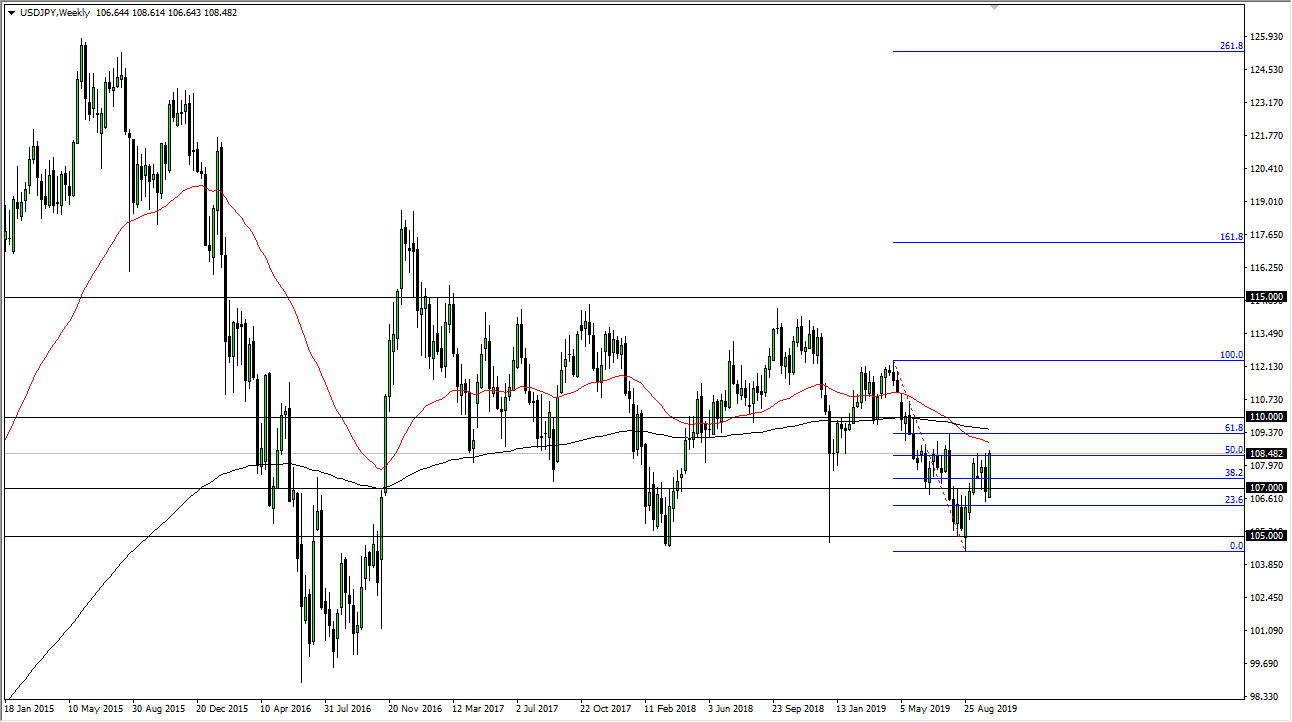

USD/JPY

The US dollar has rallied significantly against the Japanese yen during the week, reaching towards the ¥108.50 level, an area that is also the 50% Fibonacci retracement level. Beyond that, we also have the 50 week EMA sloping lower and heading down towards this area, and let’s not forget that over the weekend some headlines will come out involving the US/China trade talks. With this in mind, keep in mind that there is a significant amount of resistance between here and the ¥109 level, so a pullback would make some sense, but if we can break above the ¥109 level, especially with a gap higher, then the market should go another 100 or possibly even the 250 pips higher.

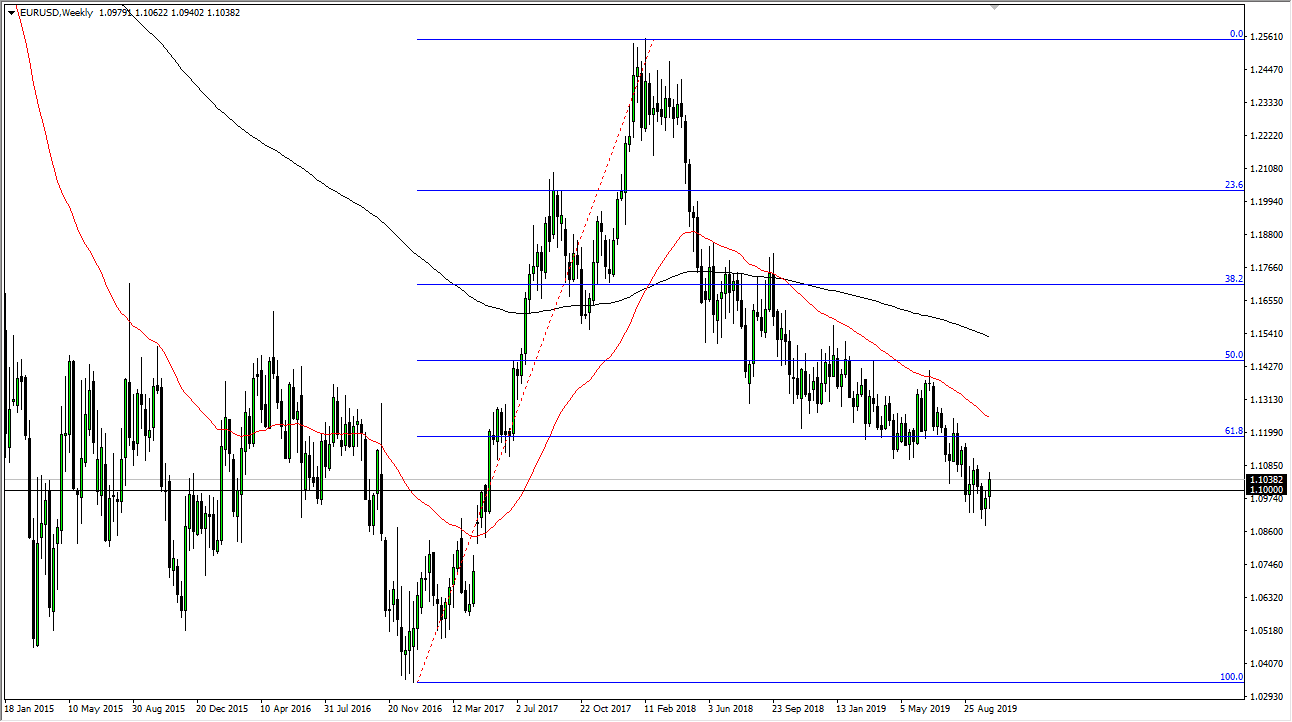

EUR/USD

The Euro initially pulled back during the week, but then shot above the 1.10 level. At this point, the 1.11 level above offers resistance, but I think we probably have the ability to bounce from here as the 1.10 level is obviously a very significant round figure. Overall though, I anticipate that we will have a short-term rally that will only be faded in the end. The downtrend is very much intact, and the fundamentals have not changed.