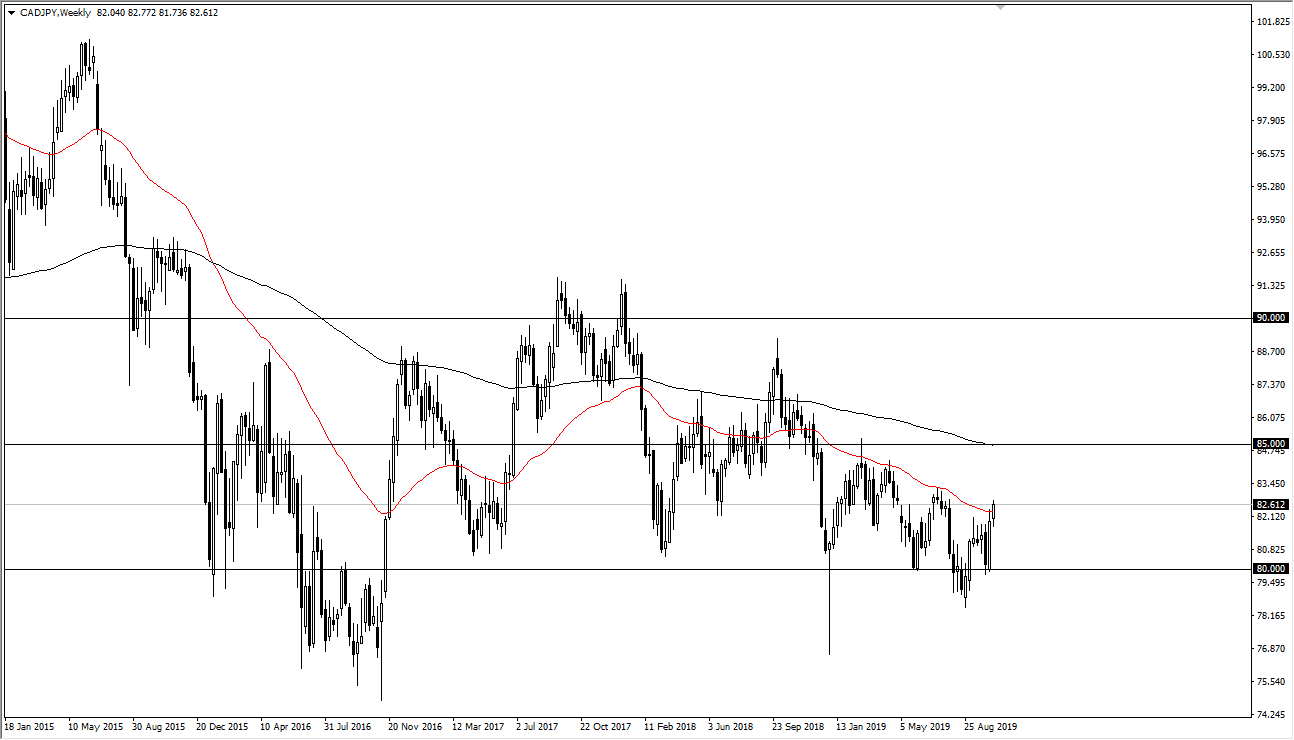

CAD/JPY

The Canadian dollar continued to rally against the Japanese yen during the week but did so in a much more slow and steady manner than the previous week. That being said, we are closing above the 50 week moving average which is substantial, and the clearance of the ¥83 level could open up the door to the ¥85 level. However, keep in mind that we are in the longer-term downtrend, so any signs of weakness in crude oil or risk appetite could send this market back towards the ¥80 handle.

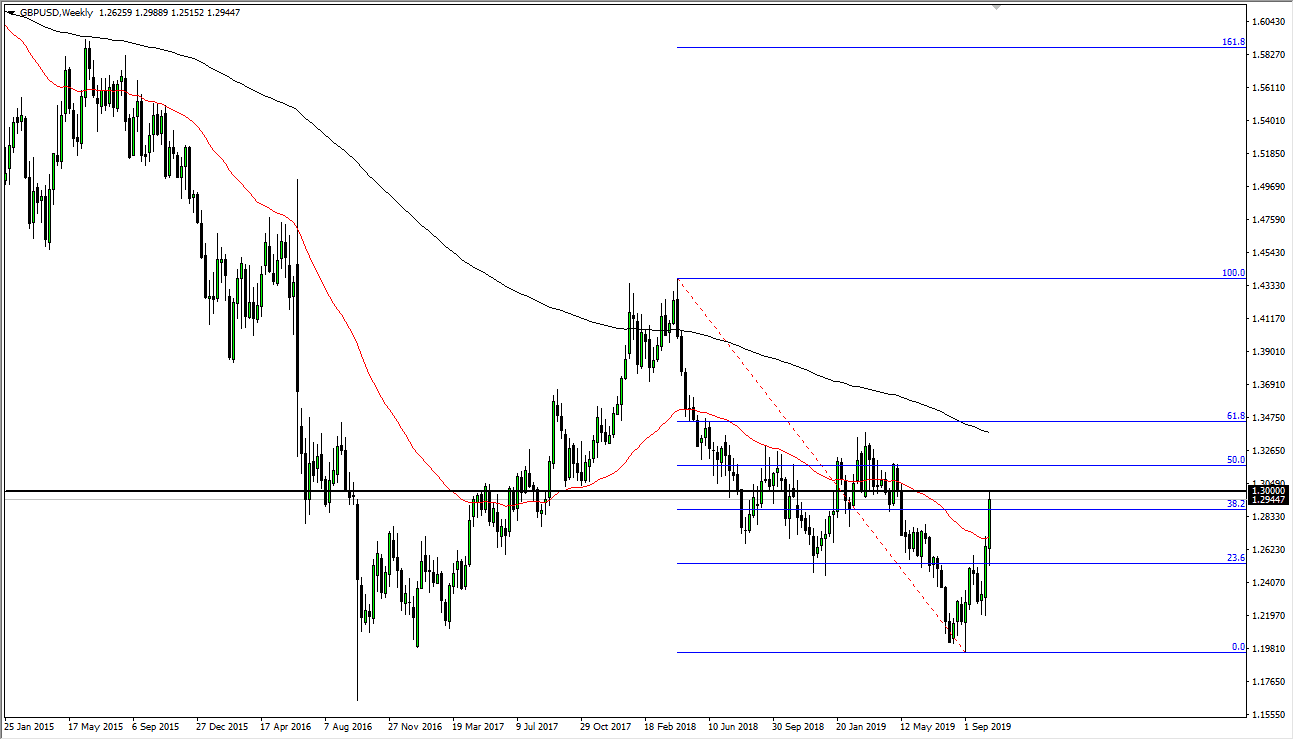

GBP/USD

Quite frankly, I would be lying if I told you what was likely to happen next week. That being said, we have the UK parliament voting over the weekend as to whether or not they want to accept the deal that Boris Johnson got out of the Europeans. The market try to break above the 1.30 level but failed. There’s also the 50% Fibonacci retracement level at the beginning of the breakdown that sent the Pound down to 1.20, so I suspect that the easy move higher has already been done. If the UK Parliament does not accept the deal, we could see fireworks to the downside. I suspect you would start to see support again at 1.26, possibly 1.25 below there.

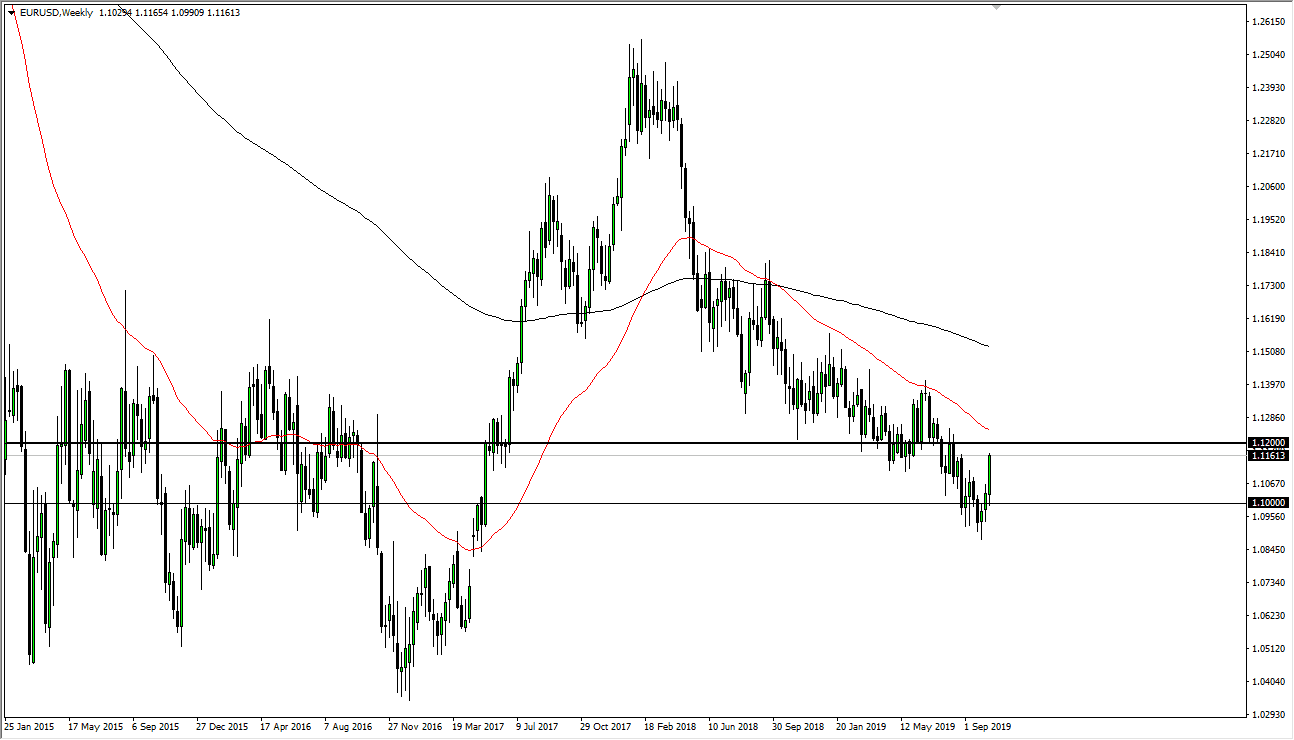

EUR/USD

The Euro is getting dangerously close to changing a trend. However, the 1.12 level above will be very difficult to break through, so I will be watching closely at that area. It features the 200 day EMA on the daily chart, and a significant amount of noise from previous trading. If we can close above 1.12 on at least a daily candle stick, it’s not a weekly candle stick, then you have to begin to entertain the idea that the trend might finally be changing in favor of the Euro. That being said, Brexit has an effect here as well.

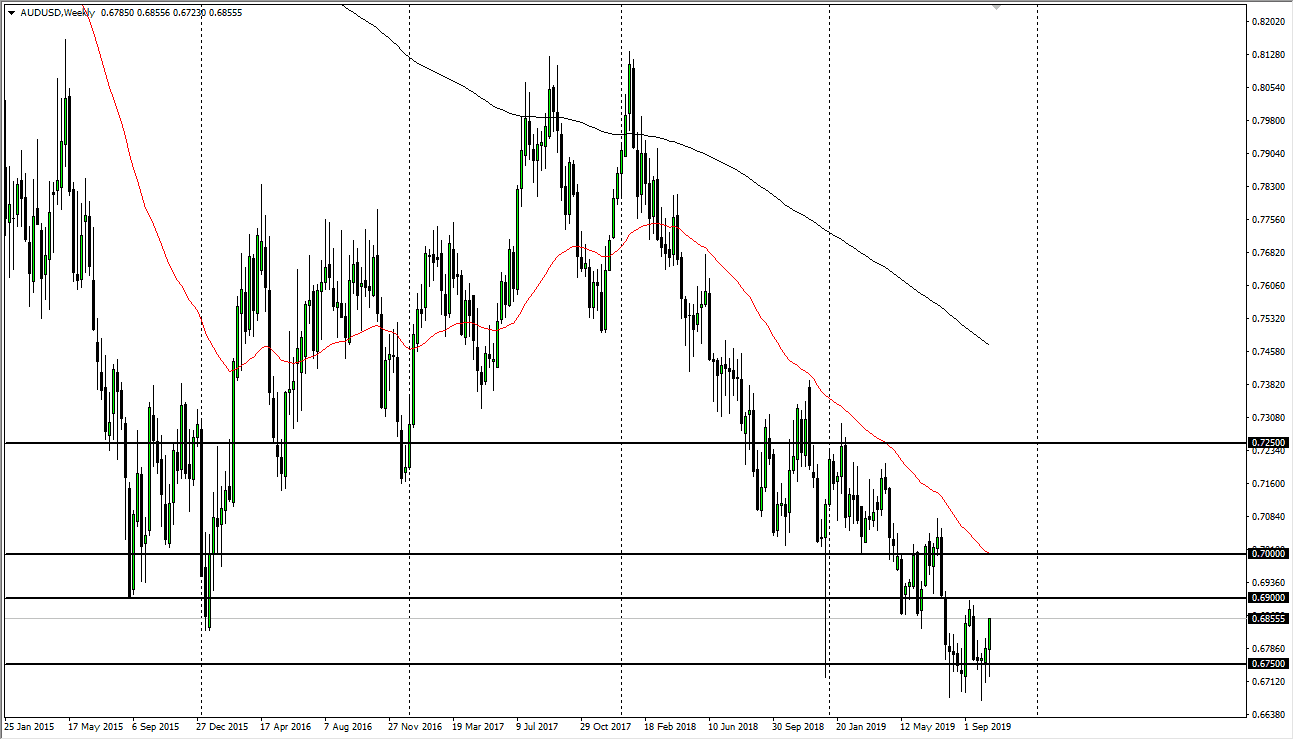

AUD/USD

The Australian dollar initially fell during the week but has found enough support near the 0.67 level to turn around and rally. The rally has been quite impressive over the last couple of days, but the reality is that we are still very much in a downtrend. After all, this pair is going to be held hostage by the US/China trade negotiations, and quite frankly I think a lot of the reason we have rallied is there simply haven’t been headlines. That being said, I expect somewhere between the 0.69 level in the 0.70 level the sellers come back in and push this pair right back down.