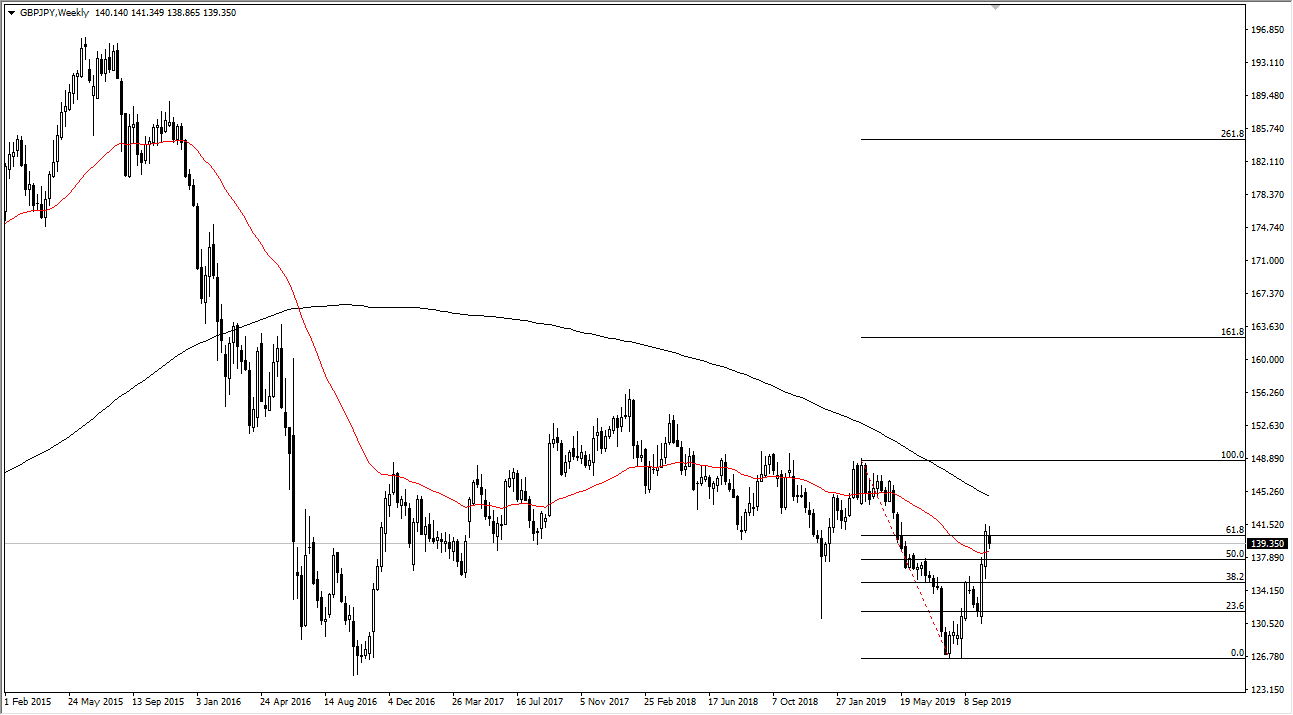

GBP/JPY

The British pound has pulled back slightly against the Japanese yen during the week, finding the 61.8% Fibonacci retracement level, and perhaps even more significantly the ¥140 level, as resistive. I anticipate that we may see a little bit more of a pullback, but I would add that I anticipate that the ¥135 level should offer support. Short-term weakness, longer-term buying pressure is more likely than not. All of that being said, keep in mind that this is a highly risk sensitive pair, and with Brexit going on things can change in the blink of an eye. Not only that, it sensitive to the US/China trade talks as well.

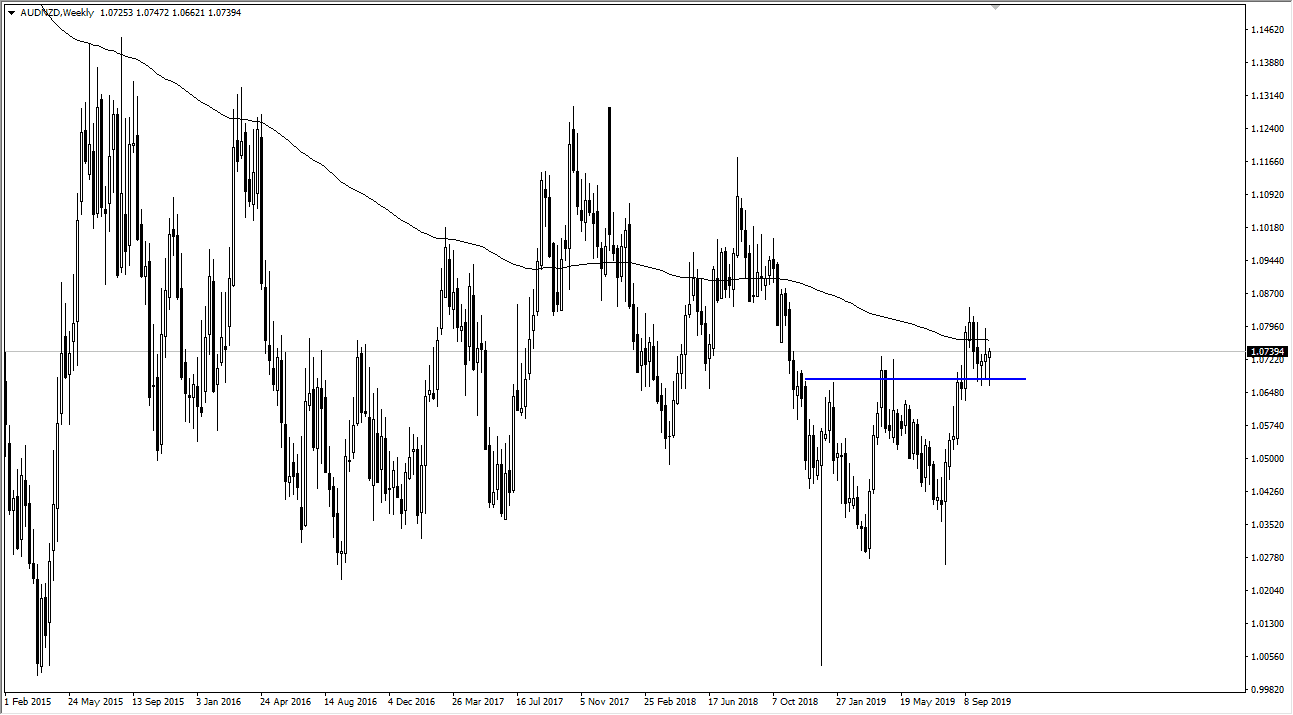

AUD/NZD

The Australian dollar has pulled back against the New Zealand dollar during the week but has bounced significantly from the 1.0650 level to form a hammer. We have seen the market struggle with the 200-week moving average, forming a hammer, shooting star, and then finally this week a slightly higher hammer. This tells me that we are building up a bit of consolidation between the 1.0650 level and the 1.08 handle. I anticipate that we continue to bang around in this area, but it does look like the buyers are starting to make a significant stand.

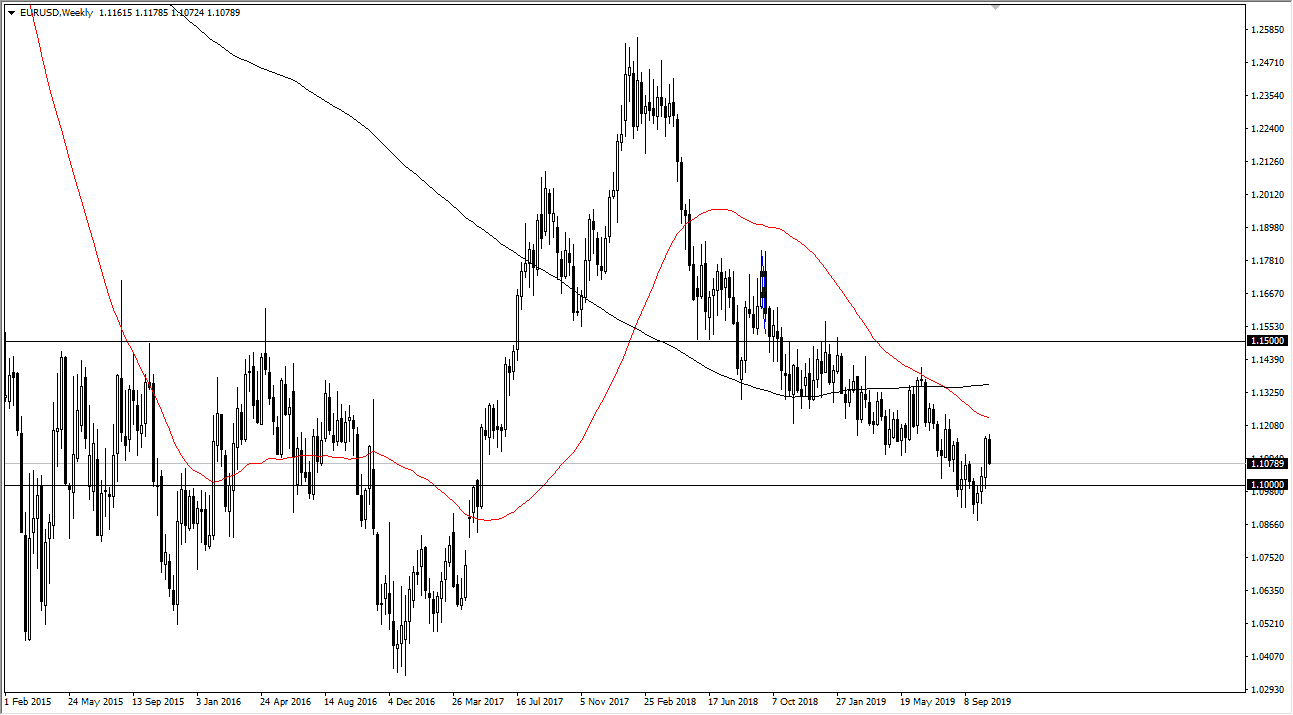

EUR/USD

The Euro fell during the week, showing signs of weakness as almost all of the entirety of trading was to the downside. It’s very likely that this market goes looking towards the 1.10 level to test that level for support. I anticipate that we not only break through it but continued towards the lows. While the rally had been somewhat impressive, looking at the longer-term charts it’s yet just another blip on the radar as far as the buyers making noise in the markets are concerned.

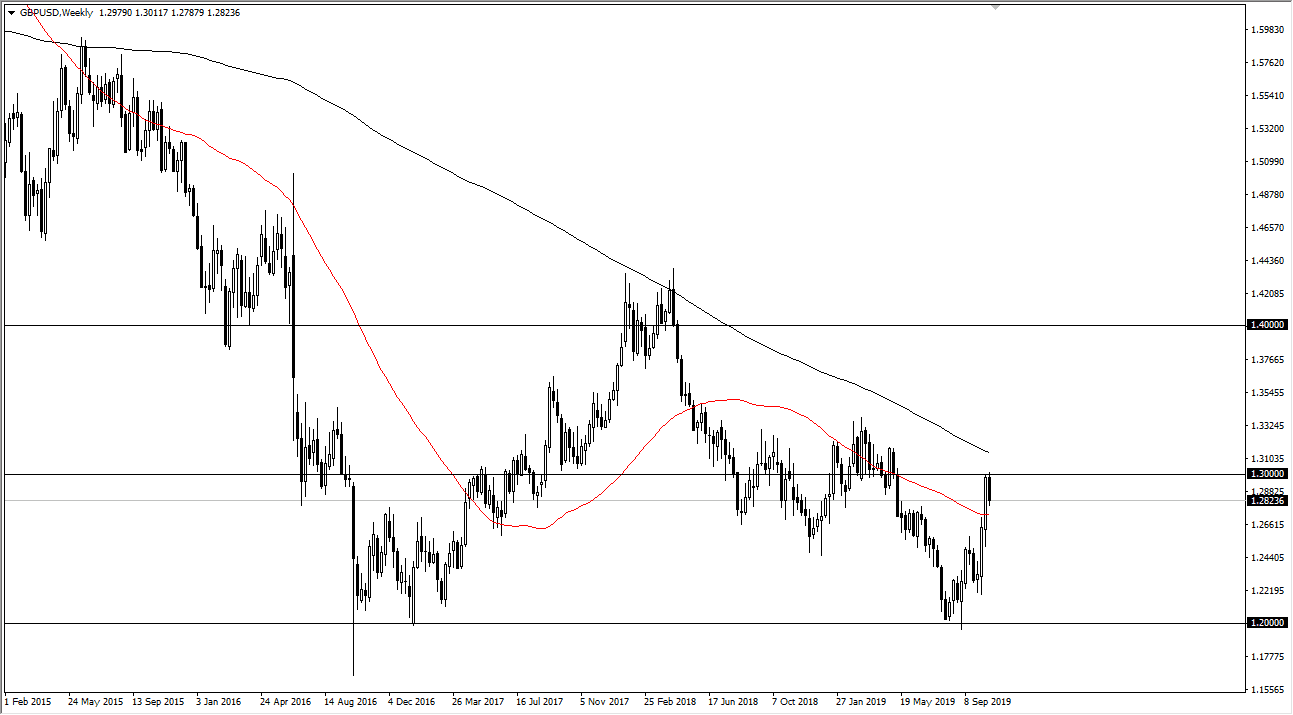

GBP/USD

The British pound has pulled back during the week from the 1.30 level, an area that makes sense as it is a large, round, psychologically significant level and the scene of the most recent breakdown to send the market down to the 1.20 level. While I don’t think we revisit 1.20 anytime soon, a pull back towards the 1.25 level sometime this week or next makes quite a bit of sense before bouncing yet again. If we do turn around a break above the 1.30 level, you would have to think that the market is about to make a major trend change for the long term.