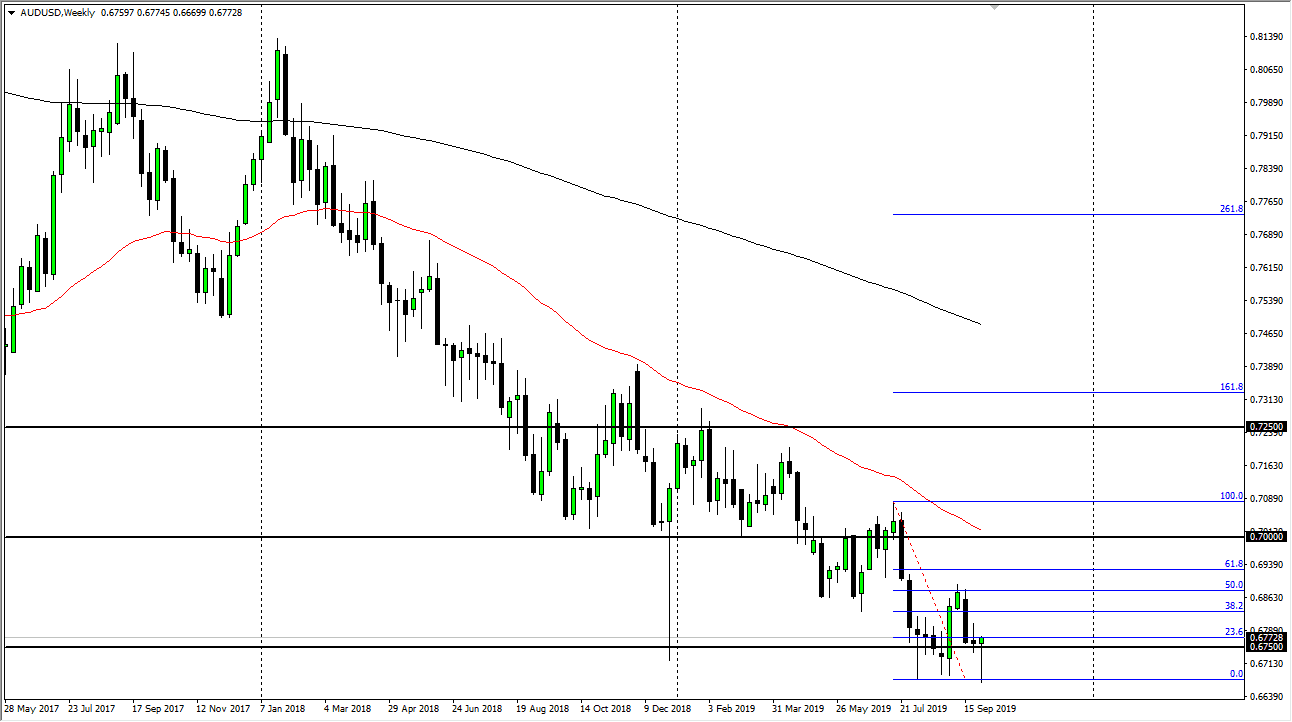

AUD/USD

The Australian dollar fell during most of the week but turned around to show signs of support. At this point, the market looks as if it is ready to continue to consolidate overall, reaching towards the 0.69 level. At this point, it’s very likely that the market may rally a bit during the week, but I would not expect much. However, we could see significant volatility due to the US/China trade talks, which kick off on Wednesday. Obviously, headlines could come into play.

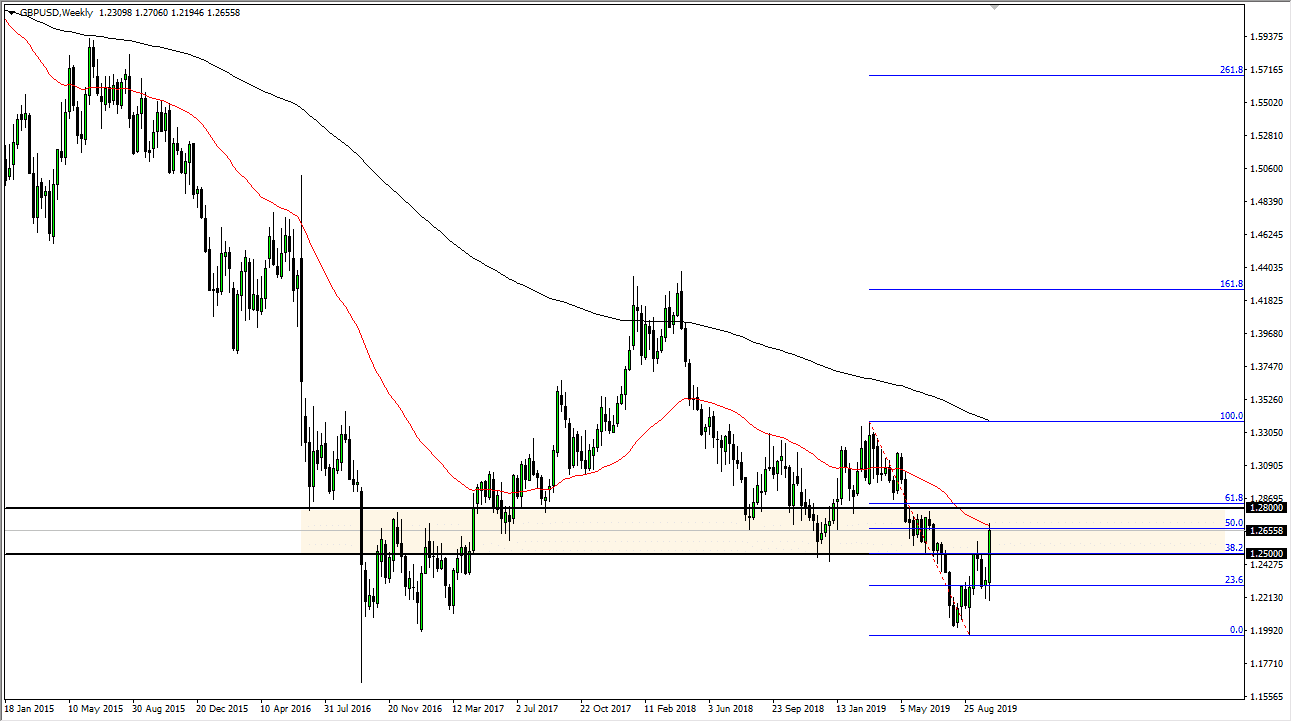

GBP/USD

The British pound has gone back and forth quite a bit during the trading week, dancing around the 1.2350 level. Ultimately, it looks as if the market is ready to make a move, but obviously there’s much more resistance above at the 1.25 level to keep this market down then there is support underneath. A break down below the bottom of the weekly candle stick could send this market looking towards the 1.20 level. I would anticipate a lot of choppy and back and forth trading over the next week or so.

Ultimately, this is a market that will be very difficult to trade, as there will be headline risk in a major way, and of course the never ending drama that seems to be the Brexit. At this point, short-term back and forth range bound trading is probably the most likely situation.

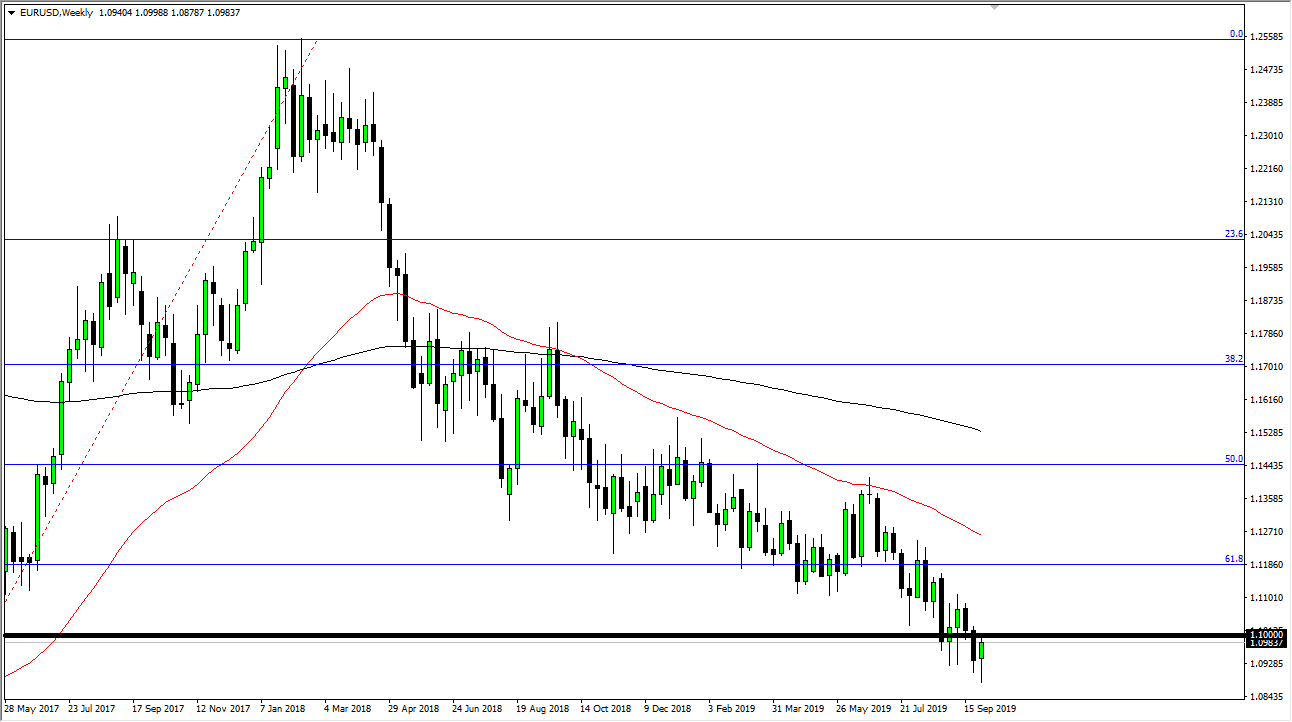

EUR/USD

The Euro initially fell during the week, but then turned around to show signs of life again. The 1.10 level is rather resistive though, and I think it also extends to the 1.11 handle. Signs of exhaustion will be used to start shorting this pair again and I will be looking to fade rallies as they come, because quite frankly this is a negative trend that still looks very strong.

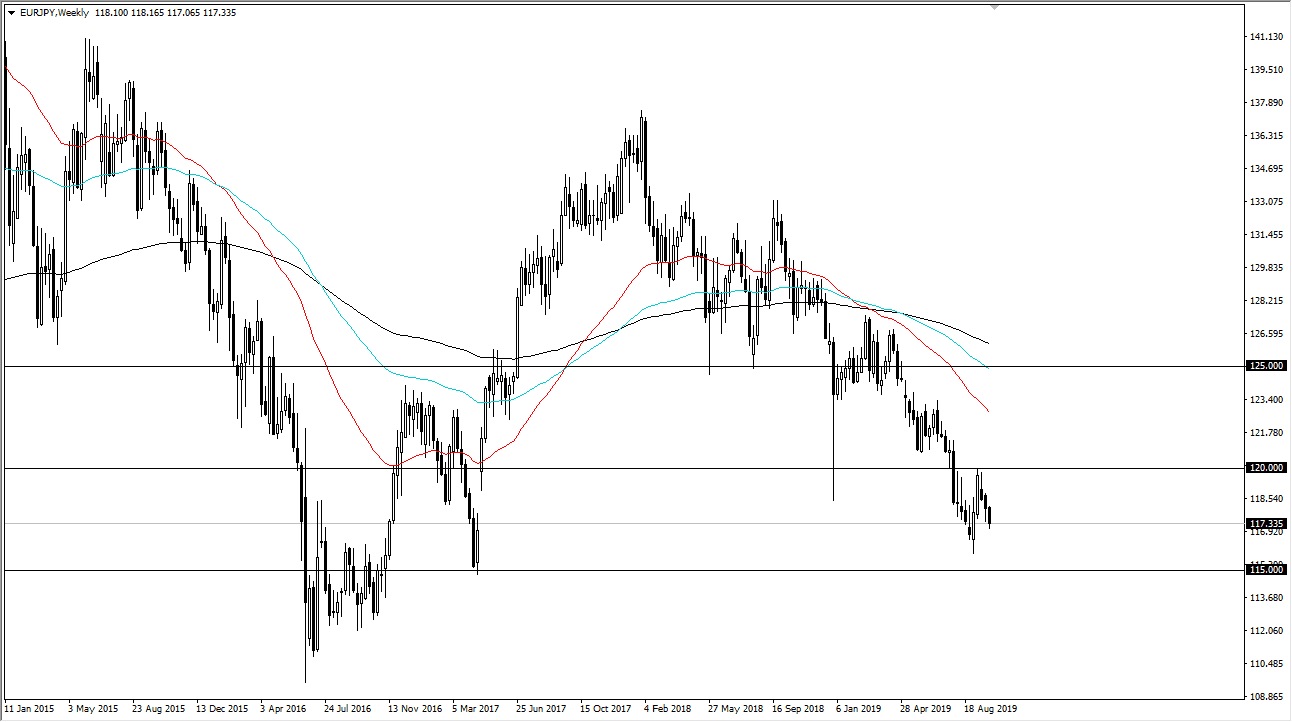

EUR/JPY

The Euro fell during the week again, reaching towards the ¥117 level. This is the bottom of the previous gap that has already been filled, so now the market is free to continue going lower. At this point, it looks like short-term rally should be sold, as the market will go looking towards the ¥115 level underneath.