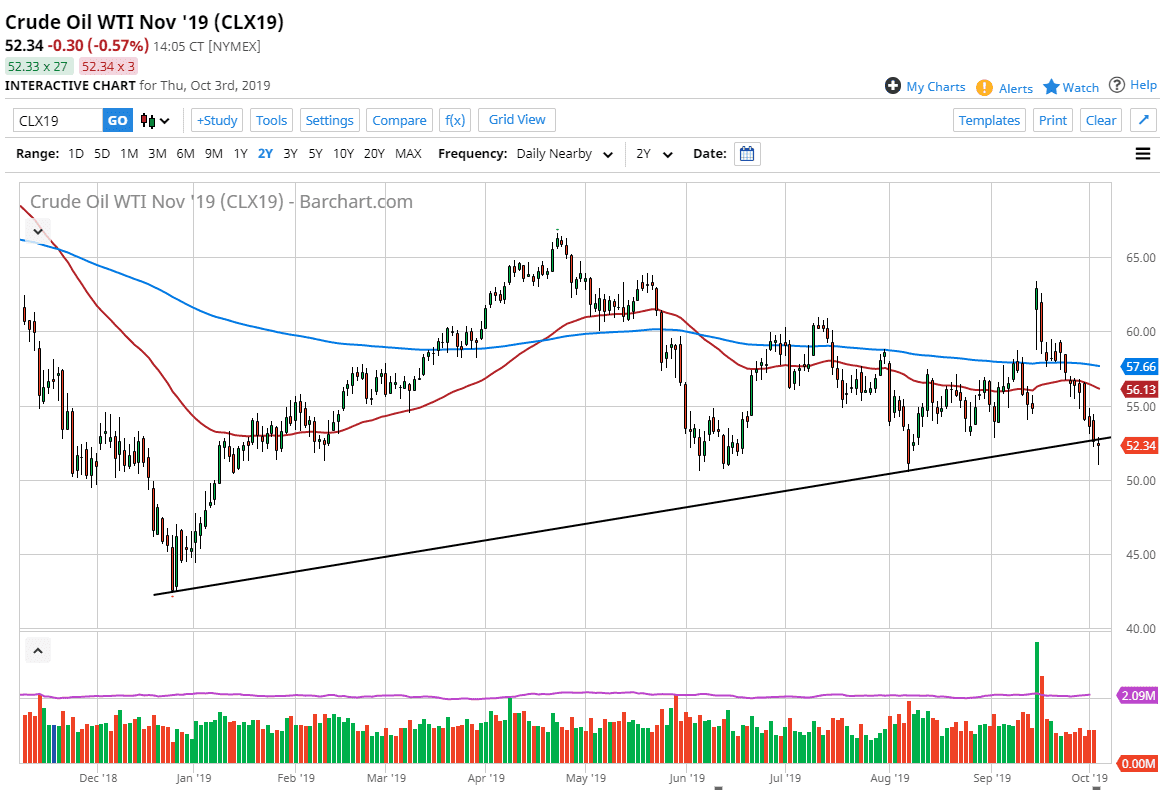

The WTI Crude Oil market fell during most of the trading session on Thursday but found enough support at the psychologically and more importantly, structurally supportive level of $51. By doing so, we have ended up forming a bit of a hammer so the question now is whether or not this market break back above the uptrend line that I have drawn on the chart, and towards the $55 level? I don’t think that there’s any good reason for that to happen other than we may be a bit oversold.

However, if we were to break down below the bottom of the hammer, that’s a very negative sign and means that the market is ready to take a serious attempt at the $50 level. If we break down below $50, then this market is very likely to continue lower, to at least the $45 level to say the least. While that could happen, we are a bit overdone to the downside so I think a bounce makes quite a bit of sense.

The 50 day EMA above is at roughly $56, and that of course would be resistance as well. I think this is a short lived a bounce more than anything else so I’m not looking to put money to work and simply hang onto it, rather I think that a short-term trade is about to present itself. However keep in mind that the Non-Farm Payroll numbers come out during the trading session on Friday, so that will throw a lot of volatility into the marketplace. This may be part of what causes the rally, just as it could cause the breakdown. All things being equal, the demand for crude oil is shrinking as the global economy is doing the same thing. However, I believe at this point the likelihood of a significant and sustained to rally is very low to say the least. I anticipate that we have simply gotten too far ahead of ourselves to the downside and have to rebalance, meaning that we should go higher. That doesn’t make me bullish, it just makes me realize that we have gone too far and too short of the amount of time. Expect a lot of noise during the trading session on Friday, especially right around the 8:30 AM announcement in the United States as jobs will cause a lot of systems the fire on and off.