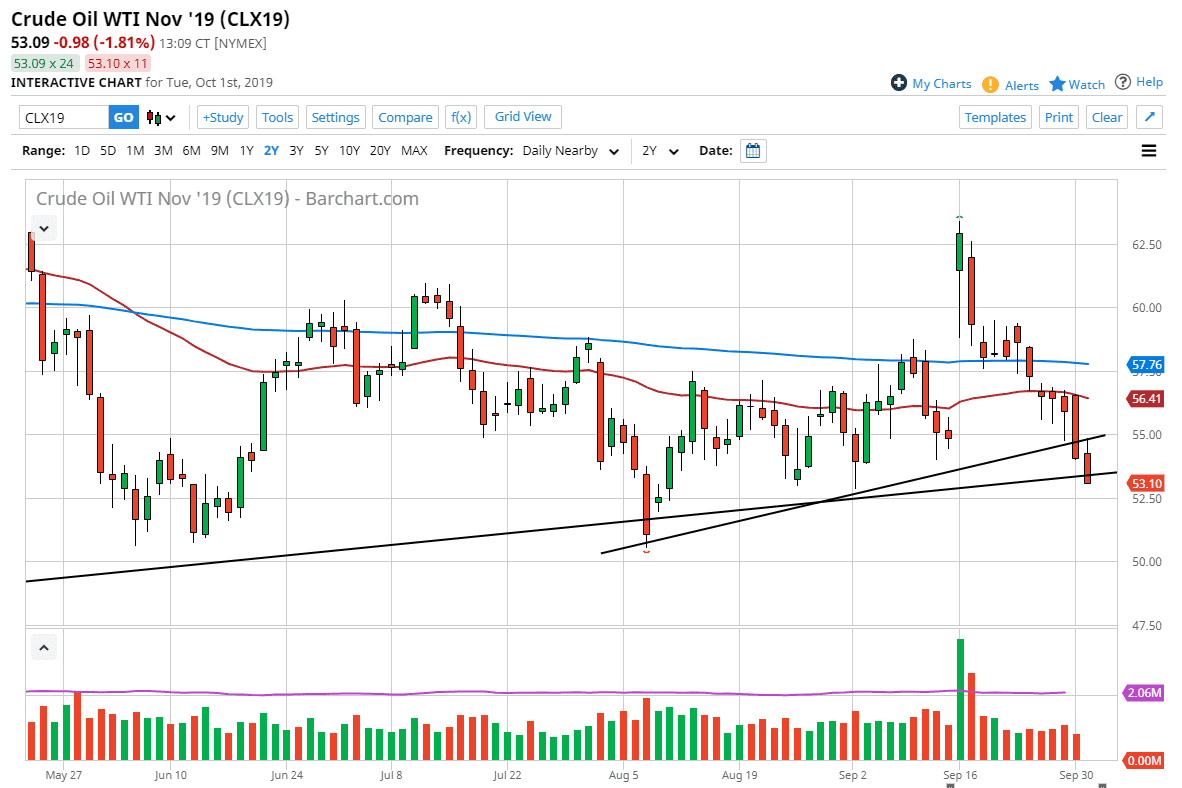

The West Texas Intermediate Crude Oil market has initially tried to rally during the trading session but found enough resistance at the previous uptrend line. We turned right back around from there to fall toward the lower uptrend line. At this point, if the market breaks down below the bottom of the candle stick from the previous session, it’s likely that the market would continue to go even lower. At this point, the $52.50 level would be the initial target, followed by the $51 level.

The crude oil market is going to continue to suffer at the hands of sellers, mainly because there isn’t much in the way of demand longer-term. The gap that recently had formed was due to the drone strike in Saudi Arabia, which of course had a lot of people concerned. As production is already back to previous levels, that entire bullish scenario is gone. Ultimately, this market should continue to find problems with demand, as demand is weakening globally due to a slowing economy.

At this point, the $55 level above should be resistance, so I do think that there is plenty of selling in that pressure area. If we were to break above there, the market could then go to the 50 day EMA, which is even more resistive. As the market has struggled as of late, it’s difficult to imagine a scenario that is bullish for crude oil, unless of course we get something else happening like the drone strike again. There is the possibility of that happening but having said that it’s likely that the markets will stabilize.

The $50 level underneath would be a hard floor in this market, and I don’t necessarily think that we break down through there. However, if we did it would be catastrophic. In the meantime, I think we just simply drift lower and continue to show negative pressure. To the upside, I think we simply look to fade rallies as the demand picture does not look good as half of the world seems to be heading into recession which of course drives down longer-term demand. At this point, since crude oil can’t hold a bid, it’s likely that we continue to see this market so rallies and drift lower. Crude oil will continue to be vulnerable to sudden shocks and headlines going forward.