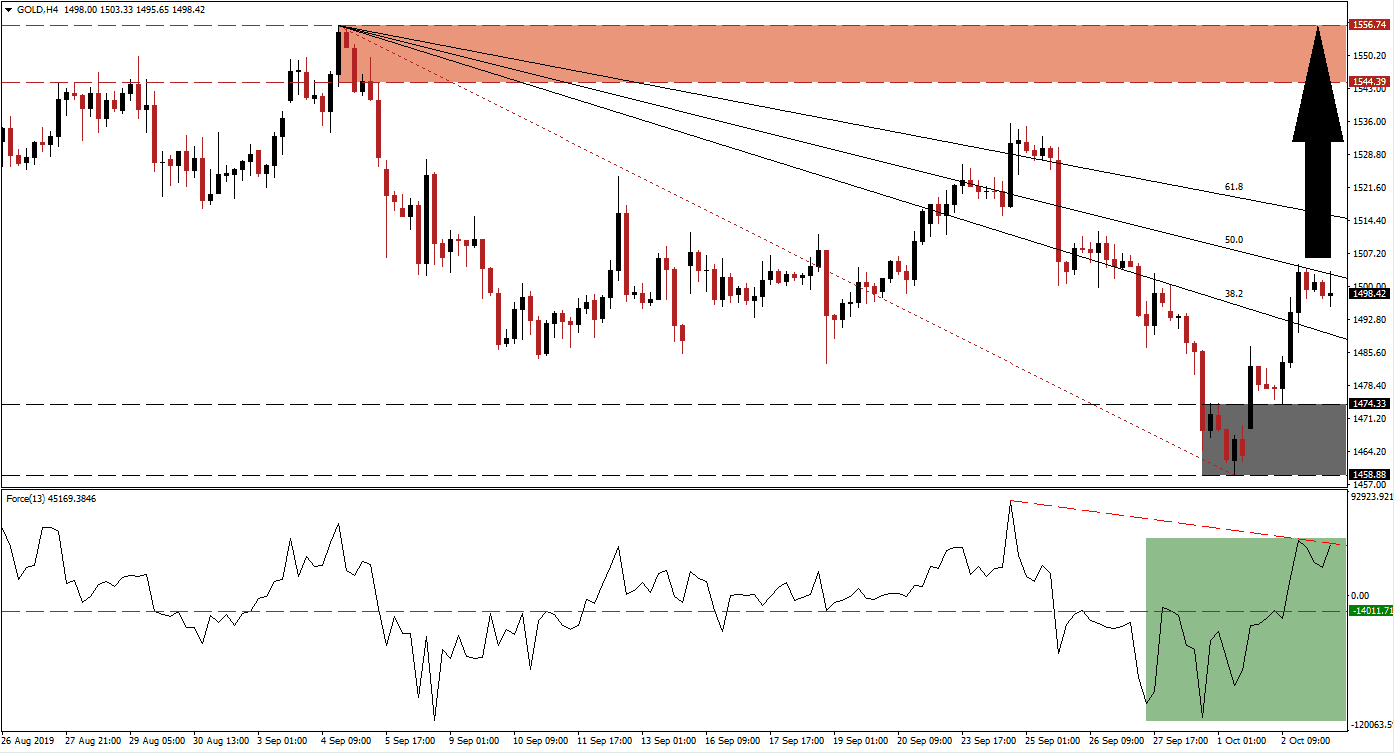

Global economic uncertainty, geopolitical risk and central bank buying are providing a nice floor under gold which has accelerated to the upside after reaching its support zone. The disappointing US ISM Manufacturing Index sparked a fourth-quarter sell-off which further boosted this precious metal. Price action completed a breakout above its descending 38.2 Fibonacci Retracement Fan Resistance Level, turning it into support, but gold paused its advance at its 50.0 Fibonacci Retracement Fan Resistance Level. This is a normal development after a key breakout.

The Force Index, a next generation technical indicator, confirmed the breakout in gold above its support zone as well as above its 38.2 Fibonacci Retracement Fan Resistance Level with a breakout above its own horizontal resistance level. The current pause in price action was mimicked by a slight reversal in the Force Index which gave birth to a descending resistance level as marked by the green rectangle. A breakout above its is expected to lead gold to its next breakout and extend the rally. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

A confirmed push above its 50.0 Fibonacci Retracement Fan Resistance Level is expected to bring enough bullish momentum for a final push above its 61.8 Fibonacci Retracement Fan Resistance Level which will turn the entire Fibonacci Retracement Fan sequence into support. The surge in bullish pressures followed the breakout in gold above its support zone which is located between 1,458.88 and 1,474.33 as marked by the grey rectangle. The current fundamental picture suggests that price action possesses more upside, especially with the prospects of a weaker US Dollar moving forward.

Since gold is priced in US Dollars, an inverse relationship developed and while it may not always be perfect, it has supported the long-term advance in price action. Traders should monitor the intra-day high of 1,504.80 which represents the current peak in the advance, a move above it is likely to result in new net long positions. A confirmed breakout above its 61.8 Fibonacci Retracement Fan Resistance Level will clear gold to spike into its resistance zone which is located between 1,544.39 and 1,556.74 as marked by the red rectangle. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

Gold Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1,497.50

Take Profit @ 1,556.50

Stop Loss @ 1,485.00

Upside Potential: 5,900 pips

Downside Risk: 1,250 pips

Risk/Reward Ratio: 4.72

Failure by the Force Index to complete a breakout above its descending resistance level may lead to a temporary pull-back in price action. This could drag gold down into its support zone which should be taken as a great long-term buying opportunity unless the Force Index records a new low. The intra-day high of 1,486.94 should be monitored, this level marks the high following the breakout above its support zone which was reversed before price action accelerated to the upside. A move below it could result in short-term selling pressure.

Gold Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1,483.25

Take Profit @ 1,462.50

Stop Loss @ 1,491.00

Downside Potential: 2,075 pips

Upside Risk: 775 pips

Risk/Reward Ratio: 2.68