The Australian dollar has initially fallen during the trading session on Tuesday, reaching down towards the previous resistance barrier at the 0.6775 level, as the RBA meeting minutes were released, showing that a couple of the voting members were suggesting that rate cuts could be coming. That of course is very dovish and very negative for a currency, but the reality is that things have turned around, perhaps based upon the idea of the US and China working together. Quite frankly, this is a bit of a broken record at this point and I believe that looking at the longer-term picture is probably necessary in a marketplace that simply has no idea what to do.

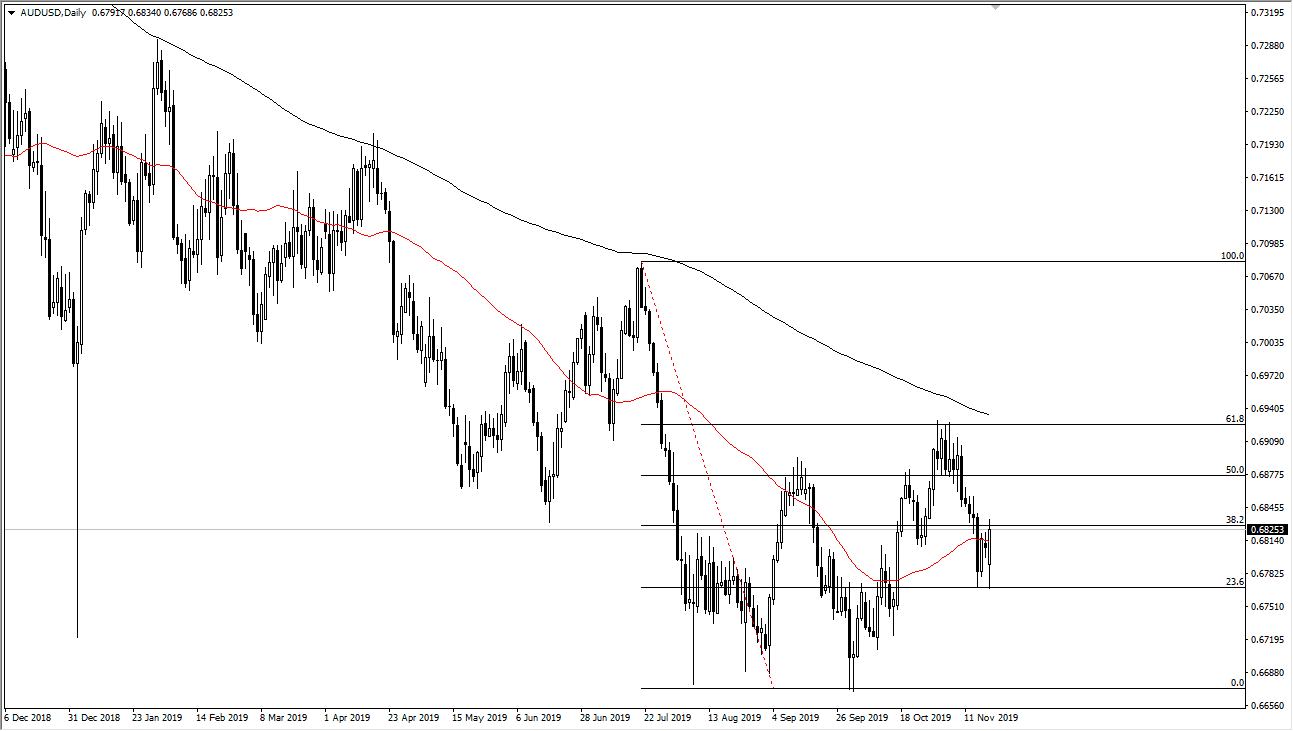

Looking at the chart, the 50 day EMA is slicing right through the middle of the candlestick, and the 200 day EMA above continues to offer massive resistance from the most recent high. I think that’s where we are trying to get to, based upon the fact that we have made “higher lows” as of late. In fact, you can make an argument of a double bottom be informed down at the 0.67 handle, and then again at the 0.6775 level over the last couple of days. While I am not necessarily overly bullish the Australian dollar and I certainly don’t think that the US/China trade situation is going to get any better anytime soon, it seems that traders are starting to believe that the Americans will sign some type of an agreement relatively soon, because of the impending election cycle. I for one think that is groupthink, designed to make stock markets and the like look positive. For what it’s worth, I’m not saying it can’t happen, just that the President of the United States isn’t a typical President of the United States, regardless of what you think of him. Remember, he is not a career politician, and quite frankly is losing money by taking the job. A simple political cycle is probably not much to hang your hat on.

That being said, if we were to break above the most recent high, that would slice through the 61.8% Fibonacci retracement level, and perhaps looking towards the 100% Fibonacci retracement level which is closer to the 0.71 handle. It does look as if we have at least made in intermediate floor in the market underneath that shows the buyers are at least starting to flex their muscles.