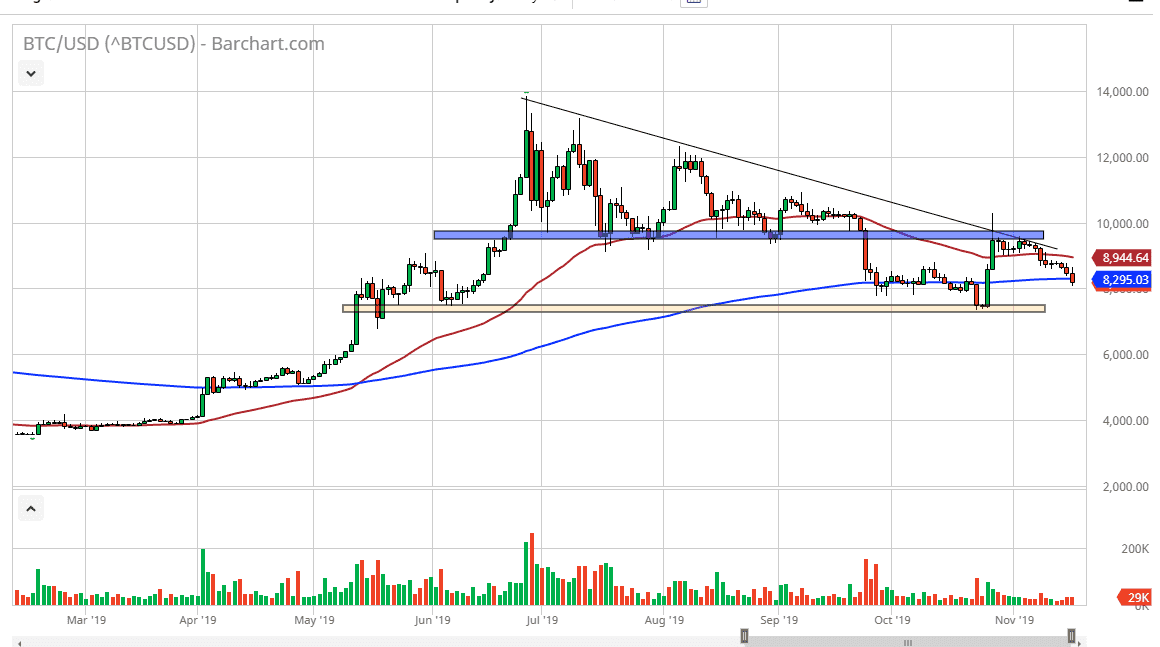

Bitcoin has initially tried to rally during the trading session on Monday, but then rolled over again as we continue to see a lot of negativity. Monday finally saw the market break down below the 200 day EMA, which is something that I have been calling for recently. Now that we are broken through this area, it’s likely that the market will probably go looking towards the support barrier at the $8000 handle, followed by the $7500 level which was the scene of the most recent low. A break below their opens up the door to much lower pricing.

If you been following me here at Daily Forex, you know that I have been suggesting the bitcoin was going to go down to the $4800 level. While we haven’t gotten there yet, that is the measured move for the descending triangle. That of course is more of a longer-term target, so I think at this point it’s likely that the longer-term traders are probably going to continue to hold onto their short positions. This will especially be true now that we are below the 200 day EMA, and now if we break down below that recent low at the $7500 level I don’t see much in the way of support in the short term.

If the market was to rally from here, it’s very likely that the market will find plenty of resistance near the 50 day EMA which is currently just below the $9000 level. That is an area that could cause selling pressure, and at this point is also starting to press against the downtrend line from the descending triangle, so at this point there are plenty of reasons to think that sellers will be out there waiting to punish Bitcoin yet again.

It appears that we have in fact seen a nice rally that has finally run out of steam. The pop higher that we recently got was based upon China discussing that it was going to become more involved in block chain research, but that doesn’t necessarily mean anything for Bitcoin itself. It was just simply a way for the gamblers to get involved and start buying crypto again. At this point, market participants will continue to need to have a lot of patience as the volume has picked up just a little bit, as it still is very anemic regardless.