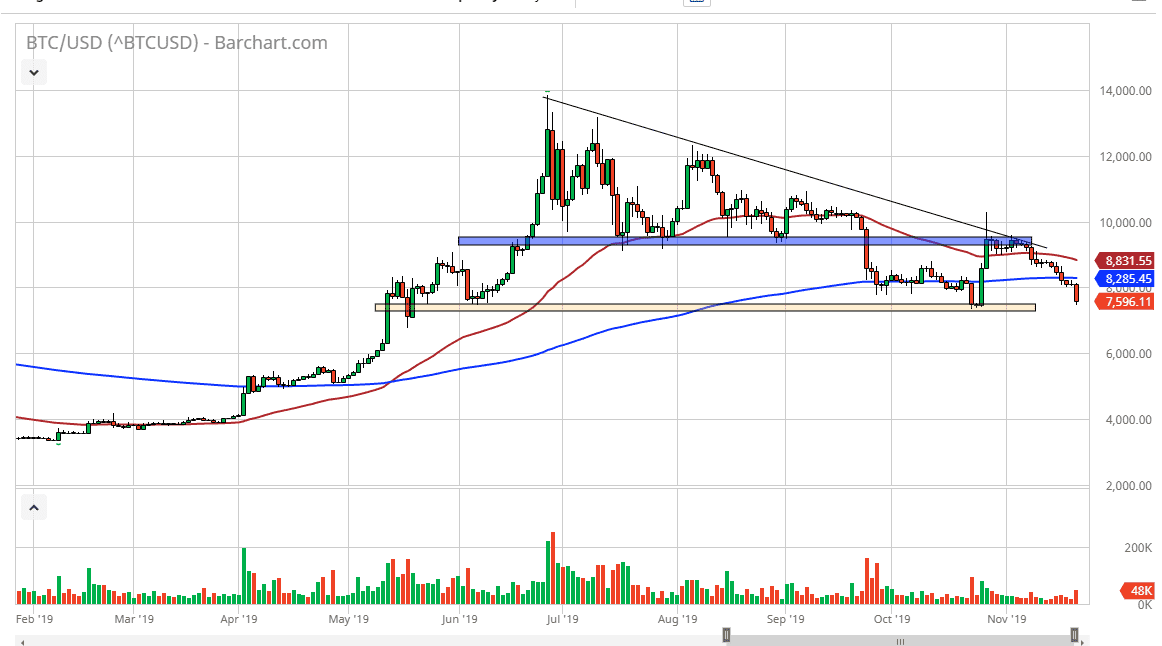

Bitcoin markets have fallen again during the trading session on Thursday, reaching down towards the $7600 level. This is an area that should continue to be rather important, so it will be interesting to see what happens next, but I believe at this point we are probably going to continue to see a lot of volatility. We have crashed into the beginning of the support zone that I had mentioned previously, from the breakdown. In fact, we have wiped out all of the gains from the Chinese suggesting that they were going to invest in researching more block chain applications.

With this, I would anticipate a bit of a bounce in the short term, but I also recognize it as a potential selling opportunity. Overall, the market should continue to be thought of as one that you should be “selling the rallies” as they occur, because quite frankly there’s no value to be had in Bitcoin at the moment. Traders continue to step away from it and volume has only picked up when it was a day that they were selling. Because of this, unless something changes from a fundamental standpoint, it’s difficult to imagine the Bitcoin is going to suddenly pick up again. The biggest movers of Bitcoin recently have been China, be it the announcement about research into block chain or wealthy Chinese moving money out of the country that started the boost higher several months back. Now that we have a lot of concerns in Hong Kong, one would think that Bitcoin would start to pick up again, but it has not.

Further making it less attractive is the fact that it can’t rally with central banks around the world cutting interest rates and loosening monetary policy. That’s the exact thing that Bitcoin is supposed to be fighting, so therefore if it can’t function well in this environment, it’s essentially failing. I look at the 200 day EMA above as resistance, just as the 50 day EMA will be. There is also a trend line that drops down in that general vicinity as well that should cause a bit of selling. I have no interest in buying Bitcoin until we get some type of massive bullish impulsive candlestick. In general, I like the idea of shorting this market at the first signs of exhaustion, as the downtrend has been so relentless over the last several months.