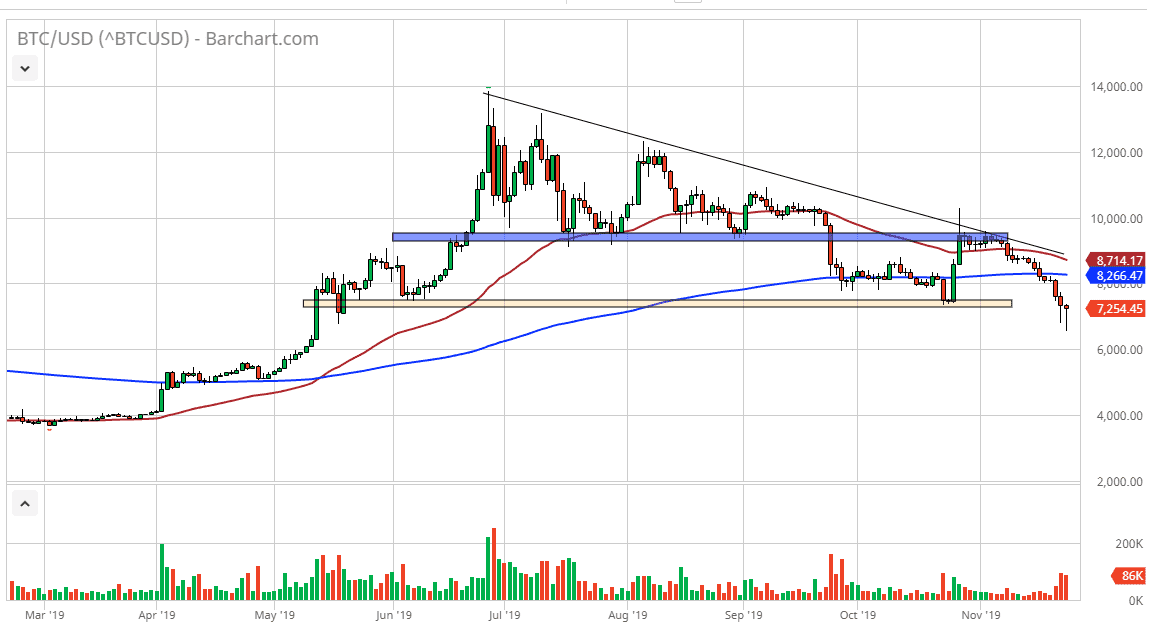

Bitcoin has broken down a bit during the trading session on Monday to show signs of weakness yet again, but we have bounced enough to form a bit of a hammer. The hammer before that of course is a good sign as well so I think it’s only a matter of time before we see a bounce. I think this bounce should be looked at through the prism of the longer-term trend though, as we are most decidedly negative as of late. That being said though, no market goes straight down or out, so at this point a bounce makes quite a bit of sense. The 200 day EMA above, colored in blue at the $8250 region, should offer a bit of resistance. I think a bounce towards that area makes quite a bit of sense, but at the first signs of negativity in that region, I would be a seller.

Beyond that, the 50 day EMA is getting ready to break down below the 200 day EMA, which is what is known as the “death cross.” That is a very negative sign and attracts a lot of longer-term sellers. Beyond that, in that general vicinity you should see a downtrend line come into play just above there as well, and therefore it’s likely to continue to offer selling. The alternate scenario is of course that we just simply break down from here.

In that scenario, if we were to break down below the bottom of the hammer from the trading session from both Sunday and Monday, then it opens up the door to much lower levels. Based upon the descending triangle, there was a target of $4800, and I think it’s only a matter of time before we get down there. There are a whole host of many reasons why we could see sellers come back into this marketplace, but I think in the short term we probably need to bounce a bit in order to find more sellers. In fact, I have no interest in buying this market until we get above the $10,000 level. All things being equal, I suspect selling the rallies continues to work at the first signs of exhaustion, as Bitcoin simply isn’t being adopted, and there are concerns about the Chinese cracking down on money flowing out of the country via Bitcoin, so it’s only a matter of time before there’s even more negativity.