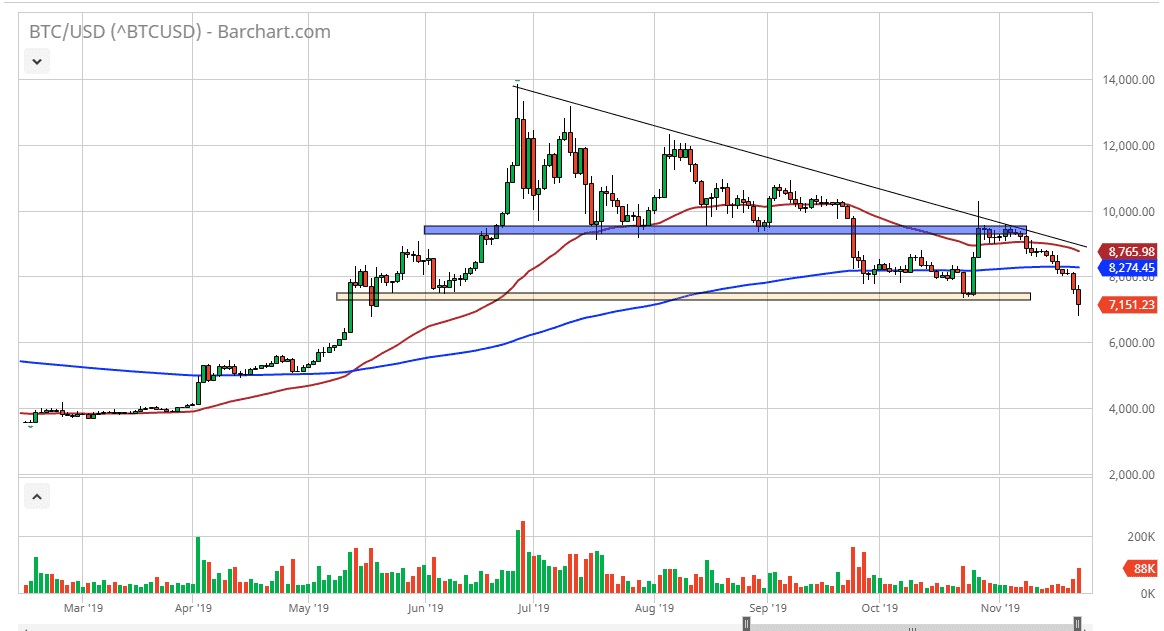

Bitcoin has gotten hammered again during the trading session on Friday, breaking down below the support that we had been seeing for some time. At this point, we are now below the bounce from the Chinese announcing that they were going to invest in researching block chain, which sent traders into the Bitcoin market and start reaching towards the $10,000 level.

The $10,000 level of course is a large, round, psychologically significant figure, but more importantly it’s an area that the market had broken down from previously. Looking at the downtrend line from the previous action, we had pierced it during that weekend, but then could not stay above there. It’s not a huge surprise because most of the trading over the weekend is going to be done in a very illiquid environment and by retail traders. You can see that we have simply drifted lower from there, after initially going sideways. That is not a good sign, and now that we are broken through all of that it’s obvious to everyone out there that the selling continues.

At this point, we did break down through a pretty significant support level because of that, and then reached towards the $7000 level. At this point, a little bit of a bounce would make some sense, but that bounce is something that I more than willing to sell into. The 200 day EMA above is going to continue to be resistance at the $8275 level, assuming that we can even get there. $8000 should also offer a significant amount of resistance as well, and then even lower than that the 7400 level should offer resistance as it was previous support.

All things being equal I think that this market continues to go lower in based upon the descending triangle that we had been working through previously, it measures for a move down to the 4800 level and although I have received several emails questioning that, so far there has been nothing on this chart to suggest that can’t happen. Bitcoin is dead at the moment and the volume shows it as being so. The volume only seems to pick up when there is selling, and that something that should not be ignored as it gives you a clue as to who really believes in the market and in what direction. There is nothing good-looking about this chart right now.