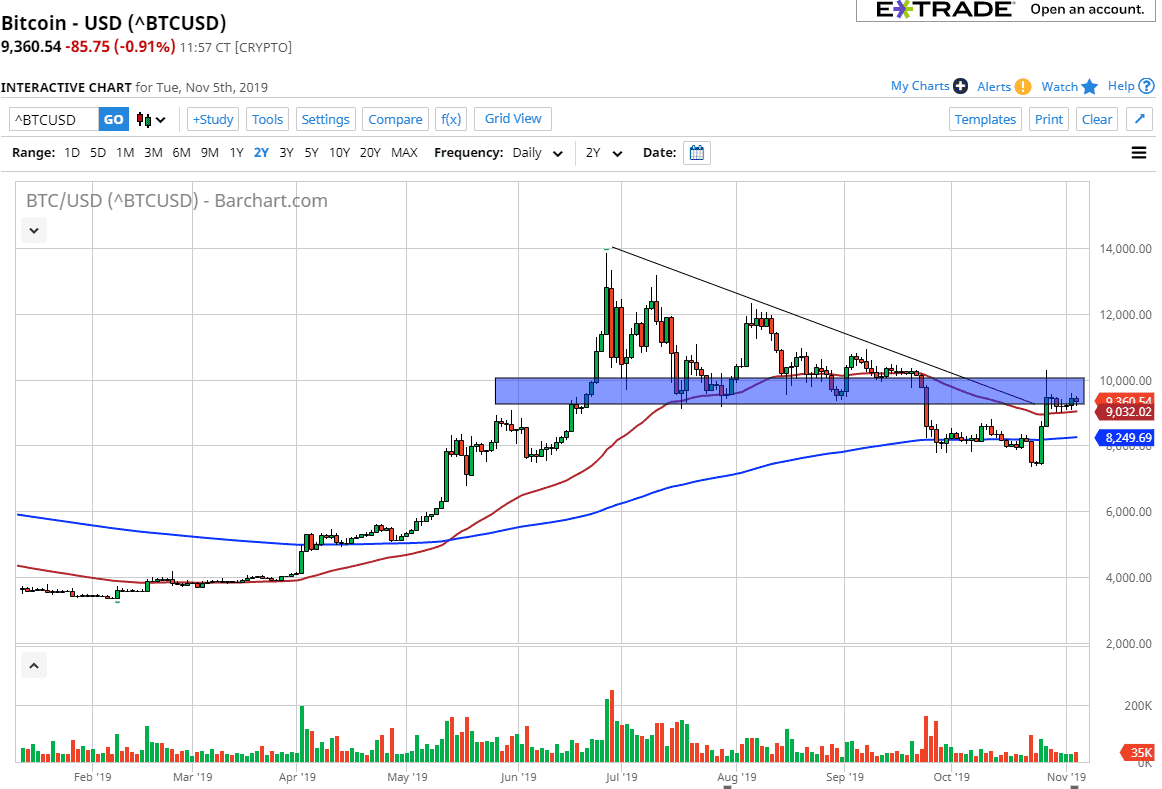

The Bitcoin market has gone back and forth during the trading session on Tuesday, as we continue to test the bottom of the previous descending triangle, as well as test the 50 day EMA which is just below. Because of this, the market will more than likely continue to be very choppy, as we need to make some type of decision for longer-term move. Beyond that, the $10,000 level above will cause a certain amount of psychological resistance, but if the daily candle closes above that level, the market is very likely to continue going higher. On a daily close above the $10,000 level, the market is very likely to go looking towards the $12,000 level next as it would be a major turnaround in attitude.

The market breaking below the 50 day EMA could send this market down towards the 200 day EMA underneath, which should be crucial in and of itself. Ultimately, the market has seen a lot of interest in that area so it makes sense that we would see a bit of support in that region. A breakdown to a fresh, new low though would open up the move down to 4800 which is what is measured by the descending triangle they get broken through. At this point, it looks as if Bitcoin is trying to figure out what to do with itself, and quite frankly that is a bit surprising considering that it has not reacted to both precious metal strength, and other words working against fiat currencies, or has it reacted to the fact that the US dollar shot through the roof during the trading session on Tuesday. In other words, this is a market that is simply dead money at the moment.

However, we will get an impulsive candle sooner or later, and that something that we should be following. That will show a pickup in momentum, and therefore give us an idea as to where we go next. The targets may take some time to get to, but let’s be honest here: Bitcoin can take off like a rocket when it gets moving. With that being the case simply waiting for some type of impulsivity is the best way to trade this market, and then follow right along with it. That being said, the market looks relatively neutral at the point but should make a significant move rather soon.