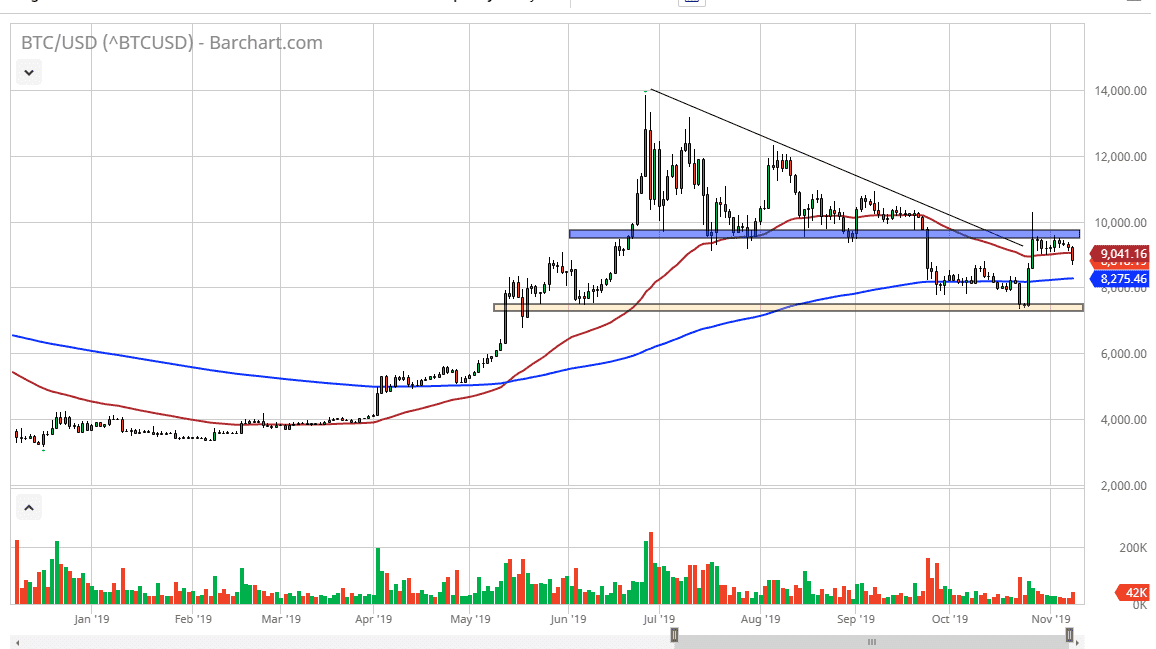

Bitcoin fell during the trading session on Friday, breaking below the 50 day EMA. At this point, the market breaking down below the 50 day EMA suggests that the downtrend is going to reassert its this. At this point in time, the market is very likely to go looking towards the 200 day EMA as we have pulled away from a significant resistance.

If you have been watching my videos on Bitcoin, you know that the area above is significant resistance, and I have called for Bitcoin to break above the $10,000 level on a daily close in order to get long. The bounce that the market had seen over the weekend was based upon the Chinese asserting that they were going to invest more in block chain, but that has almost nothing to do with Bitcoin. It’s just the easiest way to play the idea of Chinese implementation of the block chain research. Since then, we have seen the market go sideways and then Friday finally break down.

This brings us back to the original analysis, which of course was that Bitcoin could not get a bid, even though central banks around the world continue to liquefy markets by doing quantitative easing and interest-rate cuts. However, the Federal Reserve looks very unlikely to continue cutting, so it’s very possible that against the US dollar Bitcoin will struggle, or at least underperform, at least in relation to other pairs such as BTC/EUR or BTC/JPY. Ultimately, this is a market that seems to suddenly not be “anti-fiat currency”, or at least it doesn’t act like it. That being said, now that the Federal Reserve is likely to stay on the sidelines, we are seeing Bitcoin fall.

Furthermore, when you look at the descending triangle that had formed on the chart, it suggested that we were going to go down to the $4800 level. This is a market that should continue to find plenty of sellers as not only do we have a lack of demand for Bitcoin, but the US dollar is still in favor. If that’s going to be the case, this market will continue to drop, not only because of that, but because the only volume that we are seeing in general is on negative days like we have printed on Friday. Selling rallies should continue to work as well, as long as we can stay below the $10,000 level.