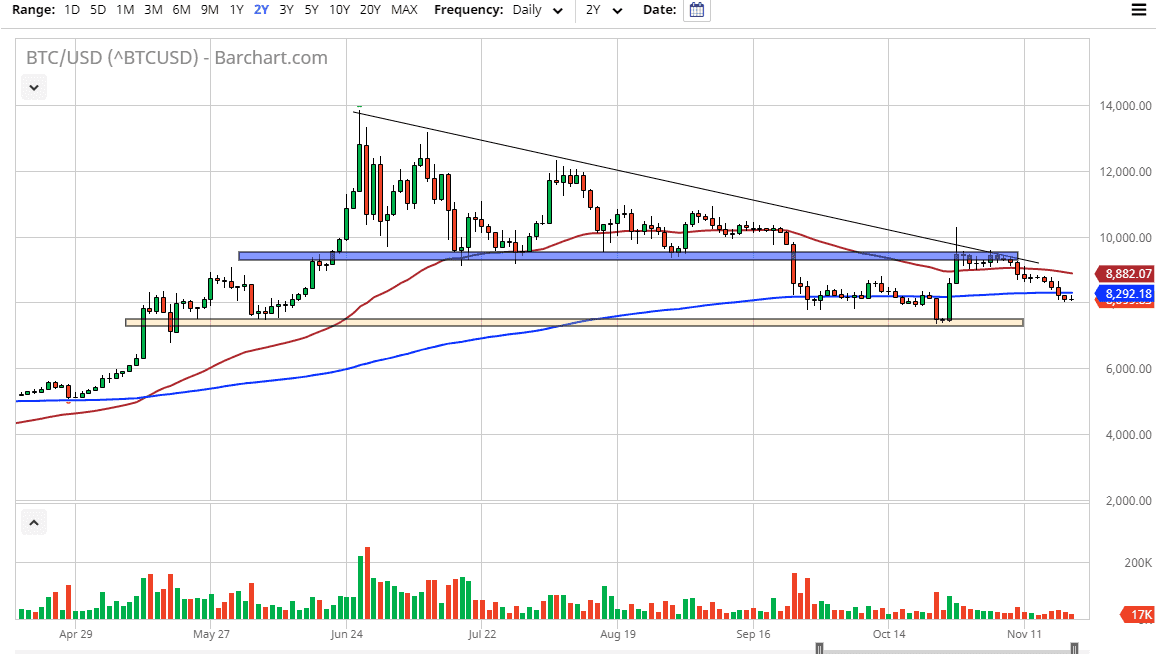

Bitcoin continues to look very anemic, as we initially tried to rally during the trading session on Wednesday but gave back the gains that we had recently achieved as the market reached towards the 200 day EMA. The 200 day EMA is just below the $8300 level, an area that has been important a couple of times in the past and as you can see the 200 day EMA had previously been slicing through a lot of choppy and small candlesticks.

Looking at this chart, it looks as if we will go looking towards the bottom of that spike from the $7400 level and was created by the Chinese mentioning that they were looking into researching more uses for block chain. For some reason, traders decided to buy Bitcoin as a result over the weekend, but you can see that we have done nothing but fall from that move. At this point, the market still has been respecting the downtrend line from previous trading, so therefore nothing much has changed other than there was a bit of retail buying and perhaps blind flailing around over that weekend.

Looking at the chart, the 50 day EMA is starting to slope towards the 200 day EMA, so at this point it’s likely that the market is trying to cross back over for a longer-term move lower, and when you look at the descending triangle above, we had not only broken through a massive support, but we turned back around to crash into the bottom of that triangle, showing signs of resistance. At this point, that resistance should continue to be the “ceiling” of the market, and at this point I suspect that the market participants will continue to start shorting. All things being equal though, I don’t even think we get down there, and as a result I suspect that the $7400 level will we worth paying attention to, because it opens up a move much lower.

The descending triangle suggest a move down to the $4800 level and I don’t see anything on the chart that suggest we can’t do it. I like fading rallies on short-term charts, and I believe the Bitcoin is going to continue to go much lower as it is simply run out of interest and volume is dropping off of a cliff yet again.