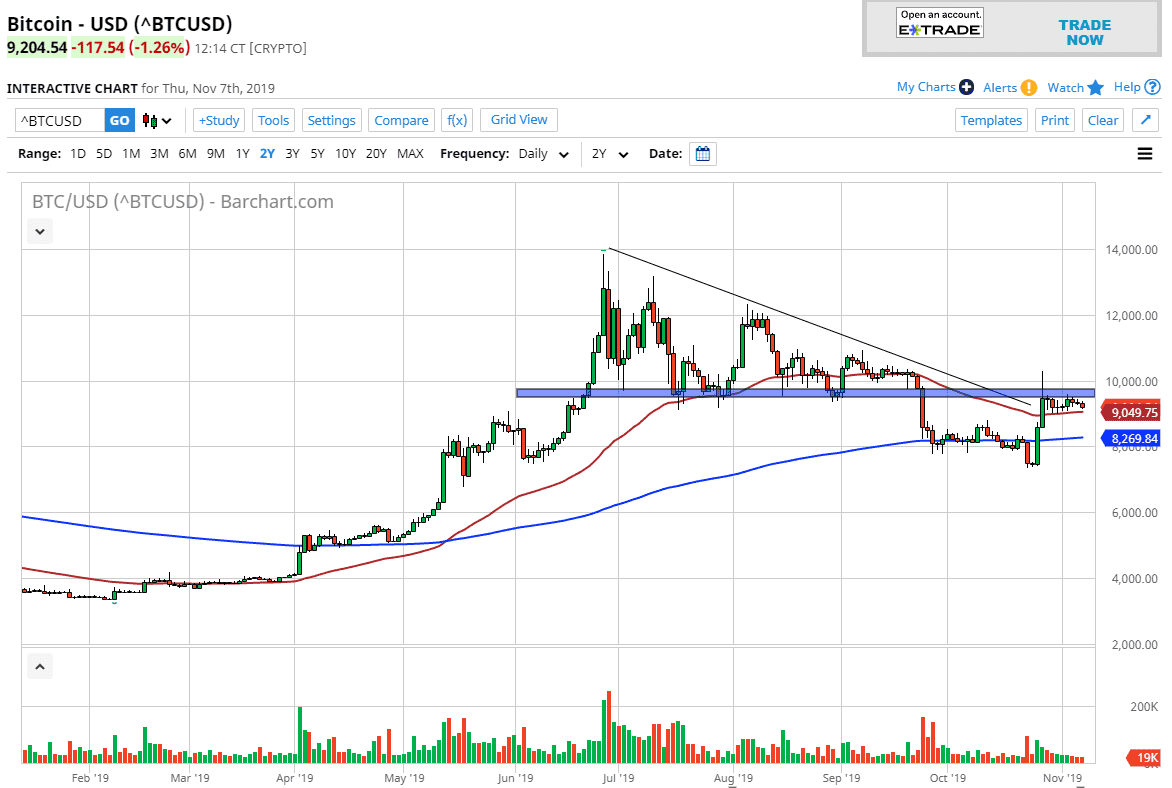

Bitcoin markets have rolled over slightly during the trading session on Thursday, as we continue to grind just below the $10,000 level. At this point, that is an area that needs to be overcome on a daily close in order to be looked at as a bullish turn of events, and at this point it’s obvious that the previous support is now acting as resistance. This is the bottom of the descending triangle that I have marked on the chart, and we have yet to be able to break back into that range. Ultimately, this is why I think Bitcoin rolls over, plus the fact that it simply hasn’t acted as a move against Fiat lately.

The 50 day EMA is sitting just below the trading action this week though, so that is one thing to hang your hat on if you’re bullish. If we were to see some type of massive move higher and a daily close well above the $10,000 level, then fine I would be a buyer. However, if we break down below the 50 day EMA on a daily close then I suspect it’s only a matter of time before market participants drive this market back down to the 200 day EMA, and then eventually the lows near $7400 that we have tested previously. If we break down below there, then we start to fulfill the descending triangle target which is closer to the $4800 level. One thing is for sure, Bitcoin has been lackluster to say the least.

Now that we have bounced back towards that previous support, the market simply can’t get above that area and it suggests that we are in fact going to continue to see a struggle. At this point I believe that market participants are looking for some type of catalyst, but quite frankly we just don’t have it. At this point, I believe that the market will break down rather soon as there seems to be no real interest in going long at this point. At this point, the volume is dropping as well so that obviously isn’t good either. Overall, fading rallies or a breakdown probably works out best going forward, and at this point it’s very likely that the sellers will continue pressure Bitcoin go forward, and therefore I would not expect much in the way of bullishness, but of course follow price and let it lead you in the right direction.