Bitcoin has been getting battered over the last couple of weeks, and at this point I expected to see some type of bounce due to the fact that we had formed a couple of hammers over the last to trading sessions. The fact that we did not bounce, shows you just how negative in this market really is. A double hammer set up is normally very strong. This shows that even technical analysis doesn’t help Bitcoin at the moment, so while I wouldn’t necessarily say it’s over for Bitcoin, it certainly doesn’t look good anytime soon.

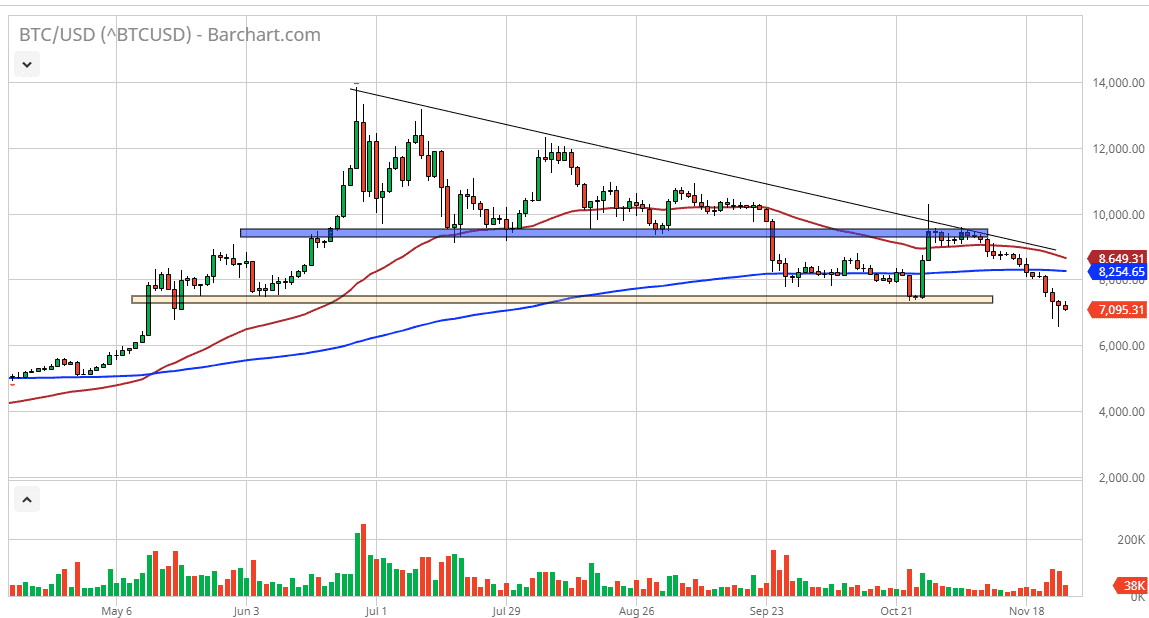

Looking at this chart, the 200 day EMA is close to the $8250 level, an area that had previously been important before the rise that we had seen based upon the Chinese government stating that they were ready to start researching the block chain environment. That being said, the People’s Bank of China has since warned that traders and investors should not suspect that crypto currency and block chain are the same thing. Since that weekend, bitcoin has continued to drift lower.

At this point, if we can break down below the couple of hammers from both Sunday and Monday, that will open up the floodgates for sellers, perhaps giving the market the opportunity to continue going much lower. Based upon the previous descending triangle, Bitcoin could drop down to the $4800 level, which of course seems a bit extreme, but at this point there is nothing on this chart that looks remotely bullish. With that being the case, I think rallies continue to offer selling opportunities until there is a reason to own Bitcoin, but right now unless you are a longer-term investor, there’s nothing on the horizon.

Ultimately, I think that the Bitcoin market will continue to suffer as the Chinese government is suggesting a crackdown could be coming. Remember, Bitcoin is essentially about China these days, more so than any other place. The market could have a bit of a bounce coming, but I think the 200 day EMA will offer significant resistance. Further stressing the bearish case is that the 50 day EMA is likely to cross below the 200 day EMA at this rate, which of course is the so-called “death cross”, with very negative technical connotation. I have no interest in buying Bitcoin, at least not until we would break above the 50 day EMA at the very least.