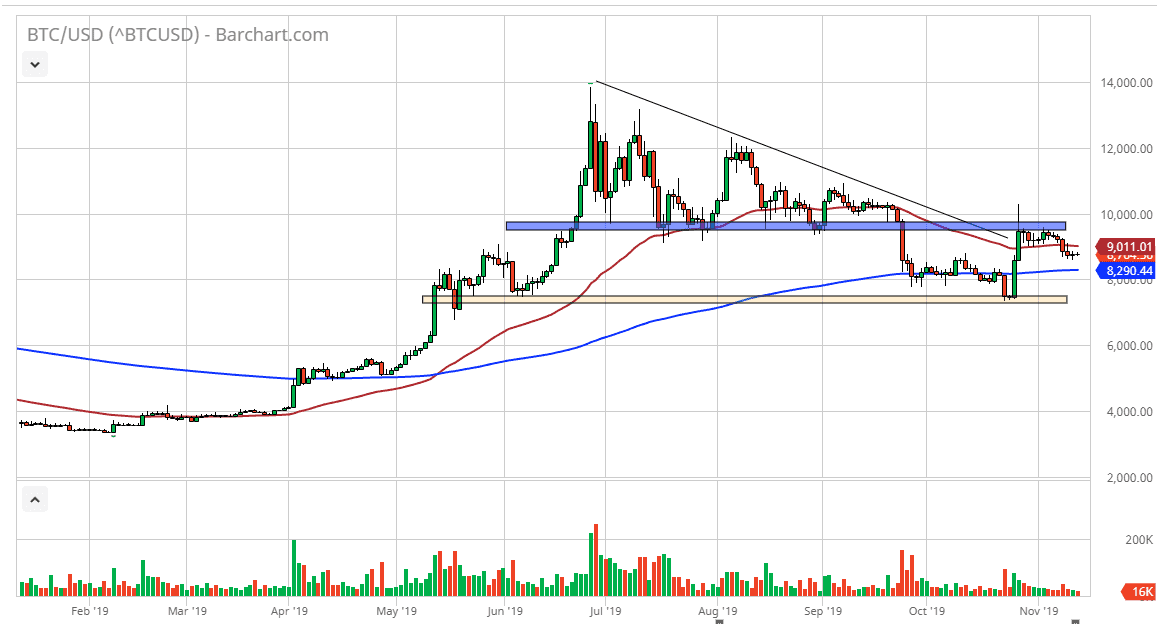

Bitcoin has gone back and forth during the trading session on Wednesday, showing signs of lackluster trading. Quite frankly, there seems to be almost no interest in the crypto currency markets at the moment, and as we are going sideways, it now becomes apparent that there isn’t much in the way of demand or selling. At this point in time, the market is stuck between two major moving averages, and that of course will cause some technical issues as well.

As the 200 day EMA is sitting just below and offering support, the 50 day EMA above is offering resistance. The market is simply stuck between these two levels, and therefore is somewhat uninteresting at this point. Recently we have pulled back from the previous support that made up the descending triangle, and now it is offering resistance. Now, the market simply looks as if it has nowhere to be. If we were to break down below the 200 day EMA, then the market is likely to go towards the lows again near the $7500 level. A break below that level then opens up the door to fulfill the downward target of the descending triangle at the $4800 level.

The US dollar has been strengthening somewhat, but even when there was a runaway from fiat currencies, Bitcoin couldn’t really pick up much in the way of momentum. This is simply a market that has no real catalyst one way or the other, and therefore it’s just going sideways. At this point, the market should continue to be noisy and undecided, but as soon as we get some type of impulsive candlestick, then the market will more than likely make up a significant move just waiting to happen, take advantage of a lot of sleeping traders would be my guess.

If we did break above the $10,000 level on a daily close, the market could go much higher, eventually reaching towards the $12,000 level. This point though, it seems very unlikely that it happens in the short term. Overall, the market continues to be simply killing time in trying to figure out where to go next. If you are a longer-term investor, I suspect that you will probably have an opportunity to buy Bitcoin at lower levels, however I think it’s only a matter of time before we get that surge that tells us which direction to trade.