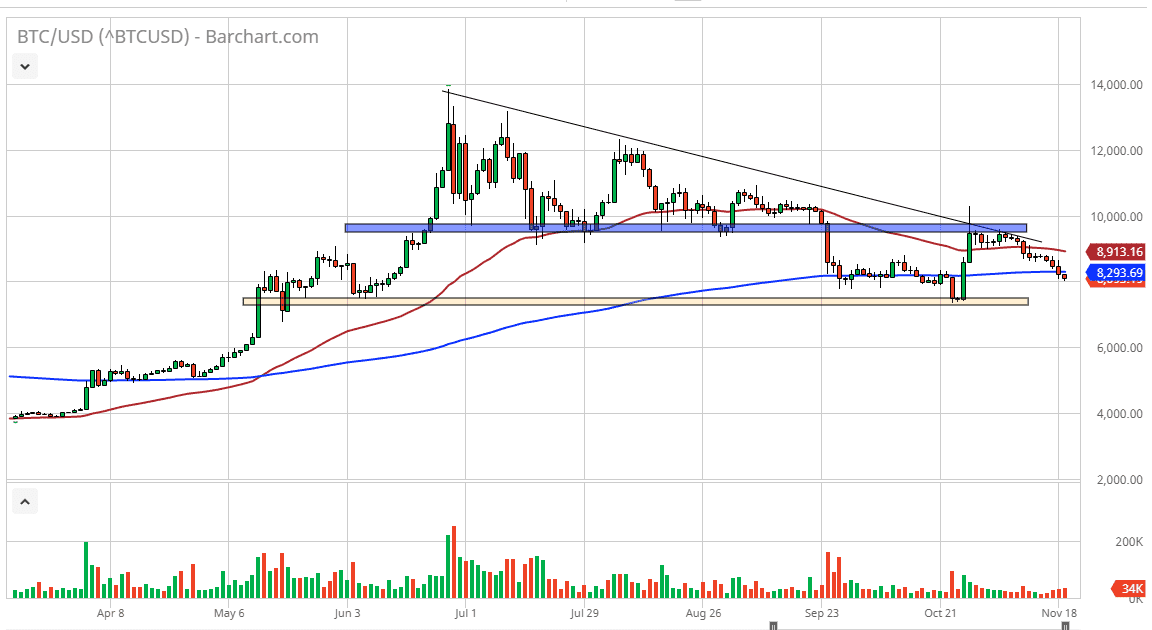

Bitcoin markets continue to show negativity in general, as the crypto currency markets overall have seen a lot of selling pressure. Bitcoin of course is the most important one to follow as it tends to lead the rest of them in direction. With that, it’s very likely that market participants will continue to look at crypto currency with skepticism, and now that the Bitcoin market is below the 200 day EMA, it makes quite a bit of sense that even more bearish pressure starts to present itself.

The $7500 level underneath is a significant level to pay attention to because the market bounce so hard from there. That being said though, it was a bit of a false narrative as this was based upon the idea of China doing more block chain research. For some reason, crypto traders decided that buying Bitcoin was the way to play that. As you can see, that has not worked out very well, as the session ended below the $10,000 level, and has done nothing but fall sense. Now that we are drifting lower, it’s very likely we will revisit that low again.

If that low gets violated, then it gives the market an opportunity to go much lower, perhaps based upon the descending triangle above, reaching towards the $4800 level. However, it could also be stated that the market has formed an even bigger descending triangle, and if that does tend to pan out, this is very likely to send this market down towards the $500 level. I think that’s a bit of a stretch obviously, but clearly, we have further to go to the downside. Breaking down below those most recent lows has me aiming for $4800, recognizing that there will be the occasional bounce that we can take advantage of. At this point, I have no interest in going long Bitcoin, at least not until something substantially changes. We would need to see an impulsive candlestick to the upside or a something to that effect in order for me to go bullish in this market, with an eye on the $10,000 level as potential major resistance. With that, market participants continue to look to short every little bounce as it has paid off quite well since June. Until there is more volume and demand, there’s no reason to think the Bitcoin will be worth buying. We are clearly miles away from taking off to the upside again.