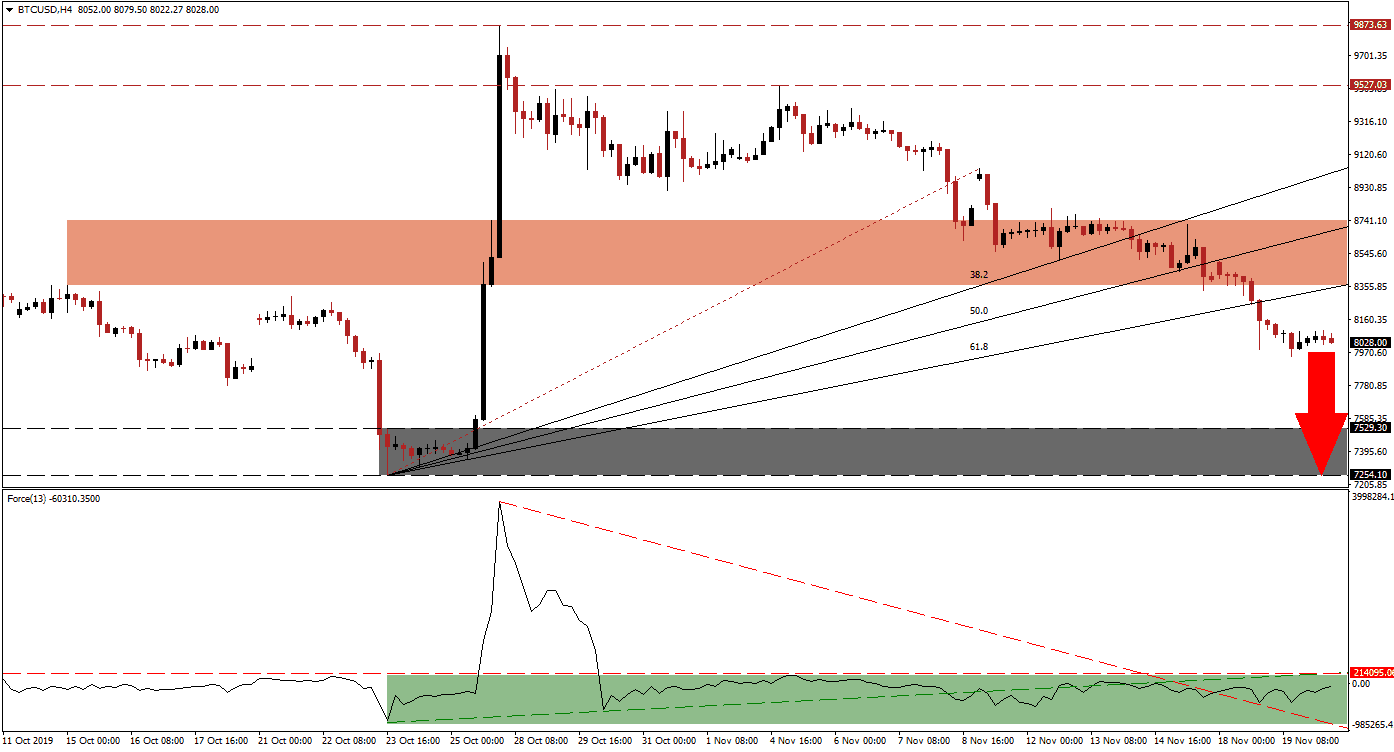

Bitcoin keeps marching to the downside and briefly dipped below the $8,000 level. While this doesn’t represent a technical support level, it does affect psychology and could lead to more selling pressure. Following the price spike at the end of October, which represented the 4th best gain in Bitcoin’s history, trading volume in futures contracts has slumped to a fresh 2019 low. After the BTC/USD completed a breakdown sequence below its re-drawn Fibonacci Retracement Fan sequence, traders should be prepared for more downside as the current bearish trend has more fuel left in the tank.

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level where it arrived after plunging from fresh highs. The breakdown in the BTC/USD below its long-term resistance zone depressed momentum and the Force Index entered a sideways drift in negative territory. This led to a breakdown below its ascending support level, which now represents resistance, while the sideways trend elevated this technical indicator above its descending resistance level as marked by the green rectangle. A reversal in the Force Index is expected after potentially challenging its horizontal resistance level, which is on the verge of being intersected by its ascending support level in another bearish development.

While price action attempted to halt its corrective phase after reaching its wide short-term support zone, an increase in bearish momentum led to the breakdown sequence which took BTC/USD below its entire Fibonacci Retracement Fan sequence and turned its short-term support zone into resistance. This zone is located between 8,358.60 and 8,773.80 as marked by the red rectangle; the 50.0 Fibonacci Retracement Fan Resistance Level is on the verge of crossing above this zone as the 61.8 Fibonacci Retracement Fan Resistance Level has entered it. You can learn more about the support and resistance zone here.

As a result of the breakdown in this cryptocurrency pair below its Fibonacci Retracement Fan sequence, the next support zone awaits price action between 7,254.10 and 7,529.30 which is marked by the grey rectangle. A further breakdown may follow, but it would depend on the build-up in bearish momentum as the BTC/USD is descending. Should an additional breakdown materialize, the next support zone is located between 6,550.99 and 6,033.53 which would close a previous price gap to the upside. The Force Index should be monitored closely, together with the intra-day low of 7,776.8, this represents the low of a previous move to the downside which was reversed before price action accelerated to the downside.

BTC/USD Technical Trading Set-Up - Breakdown Extension Scenario

⦁ Short Entry @ 8,025.00

⦁ Take Profit @ 7,255.00

⦁ Stop Loss @ 8,280.00

⦁ Downside Potential: 77,000 pips

⦁ Upside Risk: 25,500 pips

⦁ Risk/Reward Ratio: 3.02

A double breakout in the Force Index, above its horizontal resistance level and its ascending support level which acts as temporary resistance, could be followed by a breakout attempt in the BTC/USD. Given the current technical scenario, upside potential may remain limited to the intra-day high of 9,040.80 which marks the endpoint of the re-drawn Fibonacci Retracement Fan sequence; the next long-term resistance zone, from where the sell-off emerged, is located between 9,527.03 and 9,873.63.

BTC/USD Technical Trading Set-Up - Limited Breakout Scenario

⦁ Long Entry @ 8,440.00

⦁ Take Profit @ 9,000.00

⦁ Stop Loss @ 8,160.00

⦁ Upside Potential: 56,000 pips

⦁ Downside Risk: 28,000 pips

⦁ Risk/Reward Ratio: 2.00