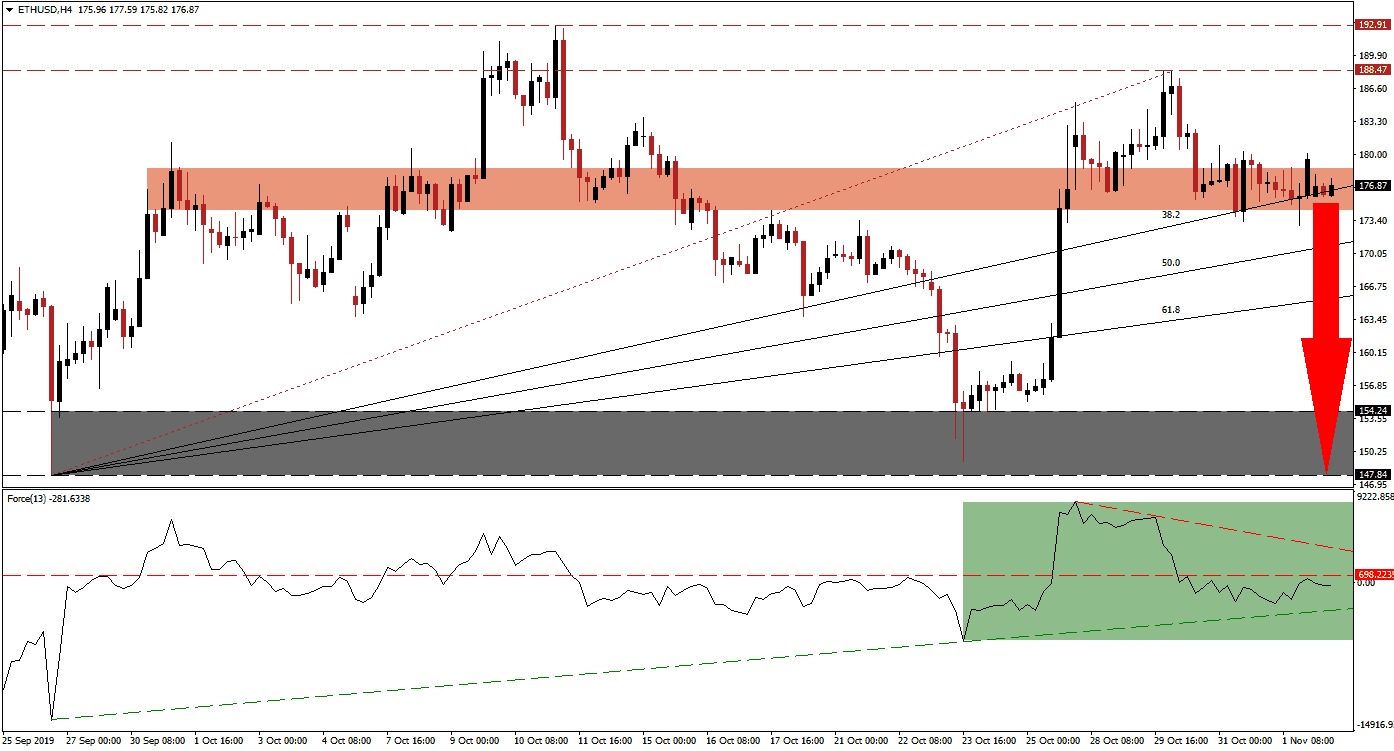

Relative calm has returned to the cryptocurrency market following a strong rally induced by Bitcoin. After traders and investors misinterpreted comments made by Chinese President Xi in regards to blockchain technology, the buying frenzy abated and reality set in once again. ETH/USD reversed from the bottom range of its long-term resistance zone, located between 188.47 and 192.91, and the loss of bullish momentum turned its short-term support zone into resistance. The 38.2 Fibonacci Retracement Fan Support Level is now passing through this zone and pressures for either a breakout or breakdown are on the rise. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next generation technical indicator, points towards the loss in bullish momentum which makes a breakdown more likely. As ETH/USD retreated from its most recent high, which marked a lower high and represents another bearish development for this cryptocurrency pair, the Force Index completed a breakdown below its horizontal support level and turned it into resistance. This technical indicator is also located in negative territory, as marked by the green rectangle, which means that bears remain in control of price action; its descending resistance level is expected to keep downside pressure elevated which could result in a breakdown below its ascending support level.

Following the lower high in price action, the Fibonacci Retracement Fan was re-drawn and ETH/USD is now trading at a crucial juncture which will determine its next move. As the 38.2 Fibonacci Retracement Fan Support Level is crossing through its converted short-term resistance zone, located between 174.37 and 178.59 as marked by the red rectangle, pressures on this cryptocurrency pair are elevated. Together with the loss in bullish momentum as well as fundamental challenges of the Ethereum blockchain, more dApps are switching to other blockchains with Tron and Binance chopping away at Ethereum, a breakdown is likely to follow and turn the 38.2 Fibonacci Retracement Fan Support Level into resistance. You can read more about a breakdown here.

A confirmed breakdown in ETH/USD, followed by a breakdown in the Force Index below its ascending support level, will clear the path for price action down into its next long-term support zone. This zone is located between 147.84 and 154.24 as marked by the grey rectangle and represent a full reversal of the previous advance. Traders should monitor the intra-day low of 163.77, this level marks the last time this cryptocurrency pair was able to bounce higher off of its ascending 38.2 Fibonacci Retracement Fan Support Level; this move led to a breakdown sequence below its Fibonacci Retracement Fan and took price action into its support zone. A breakdown below this level is likely to result in fresh net short positions; the expected move to the downside may partially be fueled by a profit-taking sell-off.

ETH/USD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 177.00

Take Profit @ 149.25

Stop Loss @ 183.00

Downside Potential: 2,775 pips

Upside Risk: 600 pips

Risk/Reward Ratio: 4.63

In the event of a double breakout in the Force Index, above is horizontal resistance level followed by a move above its descending resistance level, ETH/USD could use the 38.2 Fibonacci Retracement Fan Support Level as a launch pad for a breakout above its short-term resistance zone. Given the fundamental scenario, upside potential is likely to be exhausted inside its next long-term resistance zone which is located between 188.47 and 192.91 with the 200 level marking the next psychological resistance level. Any advance into its long-term resistance zone should be viewed as a good short selling opportunity.

ETH/USD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 186.00

Take Profit @ 192.00

Stop Loss @ 183.00

Upside Potential: 600 pips

Downside Risk: 300 pips

Risk/Reward Ratio: 2.00