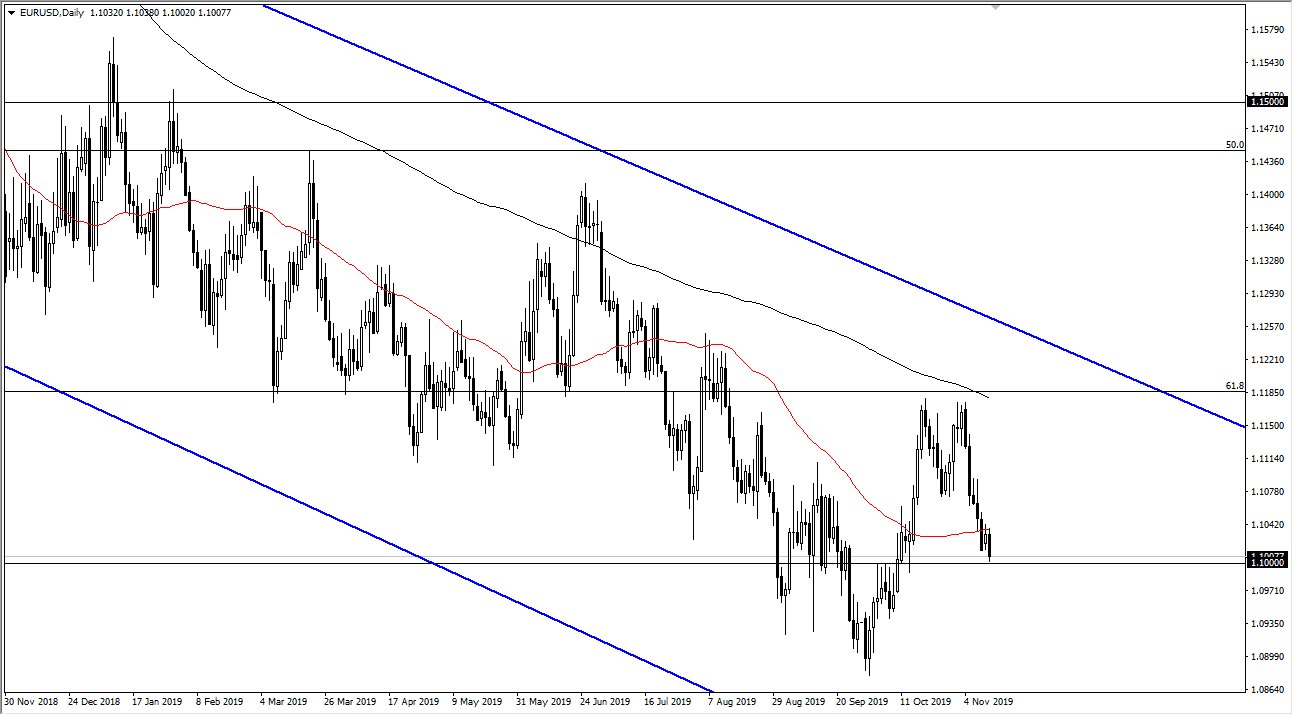

The Euro initially tried to rally during the trading session on Tuesday, reaching towards the 50 day EMA. Ultimately, the market failed to break above there, and now it looks as if we are going to try to slice through the 1.10 level. We have not done so yet, but that’s obviously an area that will cause a certain amount of reaction, as it is a large, round, psychologically significant figure. Beyond that, it’s also important to keep in mind that it’s an area that has seen a lot of resistance recently, so it should now offer a bit of support. That being said though, it has been sliced through previously so it’s not like it would be a new ground. That does in fact make it much more possible.

At this point, if the Euro was to break down below the 1.10 level it’s likely that we could go down to the 1.09 level underneath. That is an area where we have seen a lot of support, and therefore the fact that we have bounced from that level suggests that we are in fact going to continue to see a lot of noise. Overall, I believe that the market will continue to drift lower on the longer-term time frames, and at this point rallies continue to be sold. The US dollar is favored mainly because of the Federal Reserve on the sidelines not doing anything to tinker with monetary policy, at least at the moment. At this point, it’s very likely that markets will pay attention to the European Central Bank in the fact that it is very likely to loosen monetary policy going forward. With that being the case, it’s likely that we will continue seeing a lot of favoritism towards the greenback. Beyond that, the market will break down due to the “risk off” type of situation, as the greenback is considered to be a “safety currency.”

Rallies at this point will continue to be sold into, as the 200 day EMA continues to keep a lid on the market. If we were to break above the 200 day EMA, that could change things, but I don’t expect that to happen anytime soon as we have formed a perfect “M pattern” at that indicator. This indicator is a major longer-term indicator that people will follow to figure out the longer-term trend.