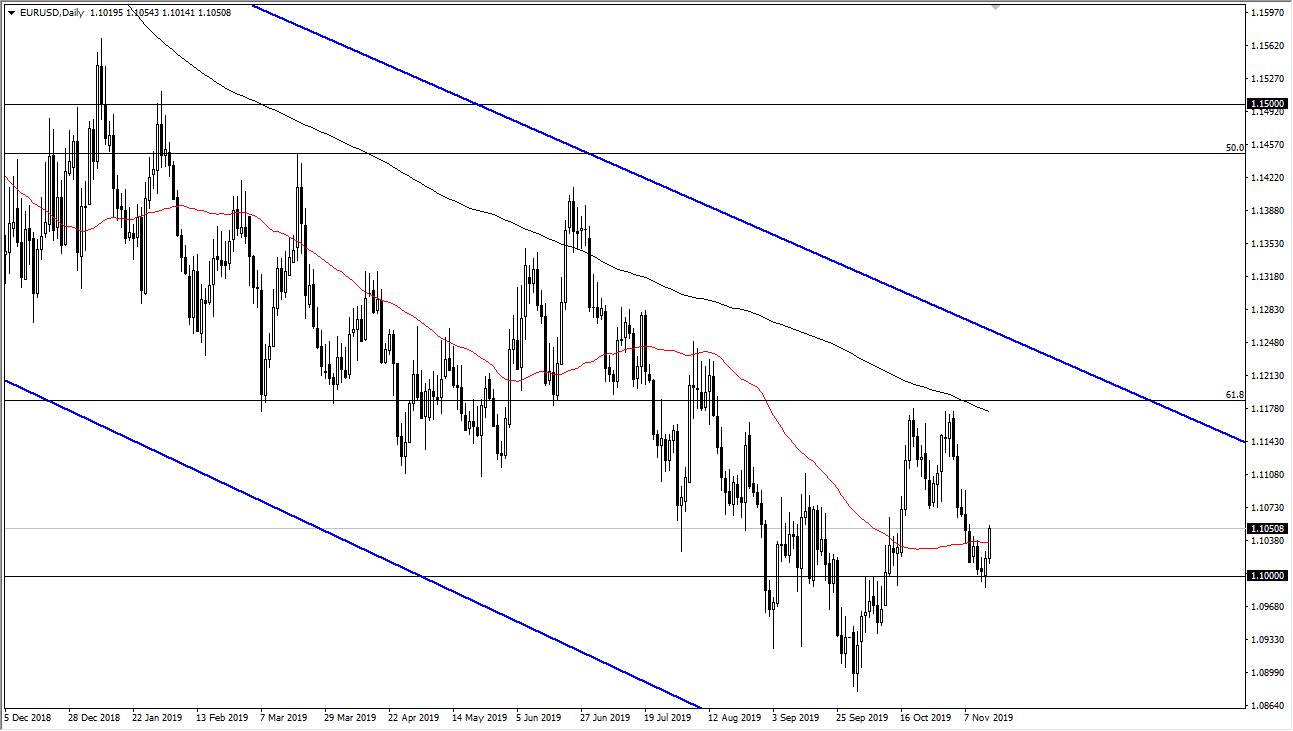

The Euro rallied during the trading session on Friday, reaching above the 50 day EMA in a sign of strength. At this point it’s very likely that the Euro start looking towards the 1.11 level above, which was the bottom of the “M pattern” that we had formed previously. Beyond that, it’s also a large, round, psychologically significant figure and we are overall in a downtrend.

This is a market that shops around quite a bit and unless you are willing to either trade from the short timeframe, or perhaps hang on to trade for several weeks at a time, the Euro isn’t going to be where you want to invest your time and money. In other words, if we do rally from here, I will look for selling opportunities based upon what we have seen of the last three years. The 200 day EMA is just above the “M pattern” that sent the market lower, so it’s not until we break above there that I would be truly impressed with some type of rally.

On the other hand, if we turn around from here and fall below the 1.10 level, I would be relatively aggressive in getting short as we should send this market back down to the 1.09 handle. That’s an area that had caused a significant bounce previously, and I do suspect that it needs to be retested again. With that in mind I like the idea of shorting either break down or a rally that shows the first signs of exhaustion on the longer-term charts as that has worked for almost 3 years in this pair. We are in a longer-term downtrend in channel, and there is nothing on this chart that has changed that.

Keep in mind that the ECB is probably going to be very loose with its monetary policy going forward while the Federal Reserve is sitting on the sidelines. Ultimately that will weigh upon the Euro against the US dollar, but right now it looks as if there is more of a “risk on” type of attitude out there that is bringing down the value of the greenback against several other currencies. With this, I think that we may get a little bit of a rally from here, but I will be looking to short it as it will run out of steam eventually, and then I will be able to take advantage of the longer-term downtrend.