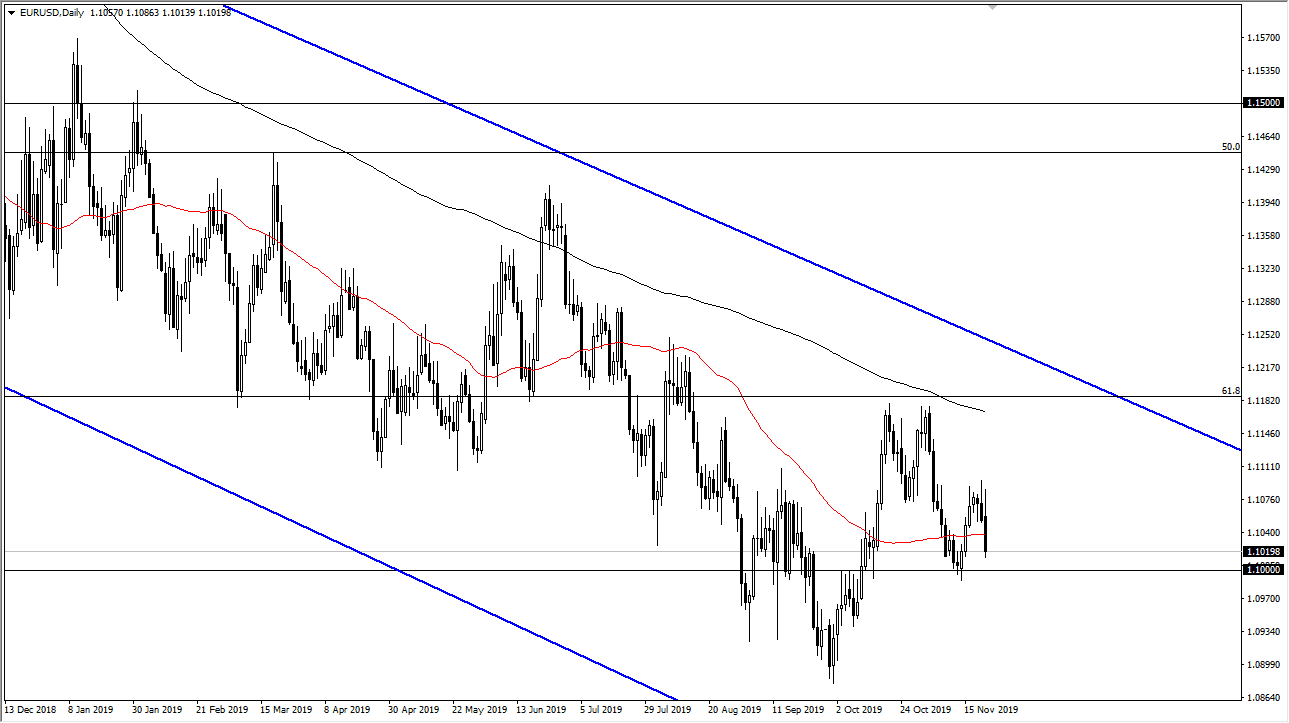

The Euro continues to try to break down through the 1.10 level, as the market has shown itself to be extraordinarily negative. At this point, the market suggests that if we can get through there, then we will go looking towards the 1.09 level underneath. If we break down below there, then the market is likely to go down towards the 1.0750 level. At this point, the market is likely to continue to see a lot of selling on short-term rallies, as the Euro is essentially “dead money” right now. That being said, this is one of the worst Forex pairs to trade, as it has no real ability to hold a trend without making a lot of noise.

High-frequency traders continues to do massive damage to the trade ability of various Forex pairs, and with the Euro being 0.2 pips at most brokerage firms, this is the main reason that it gets so much attention by HFT firms. As you can see, it causes erratic movement, but if you zoom out from a longer-term standpoint you can see that we have been grinding lower for a couple of years. Every time the Euro tries to gain its own footing, then we see selloff orders coming in near the 200 day EMA.

Currently, it looks as if the market is shrinking its way into the weekend, as there is more of a “risk off” feel out there. However, this is also a market that bounces occasionally, and therefore I think that it wouldn’t be a lot to expect the 1.10 level to cause that short-term bounce. That being said, it’s very likely that the 1.11 level above offers resistance, and it’s probably going to continue to be a scenario where we are simply going back and forth but with more of a downward slant than anything else. Longer-term traders continue to hold the Euro short but will be forced to not looking at the chart very often, as the chop will make you nauseous paying attention to it. That being said, if we were to break above the 200 day EMA on a weekly chart, then I more than willing to start entertaining the idea of a trend change. So far though, we do not have it and therefore it looks like you have to remain short of this market, and simply think of it more as an investment than anything else.