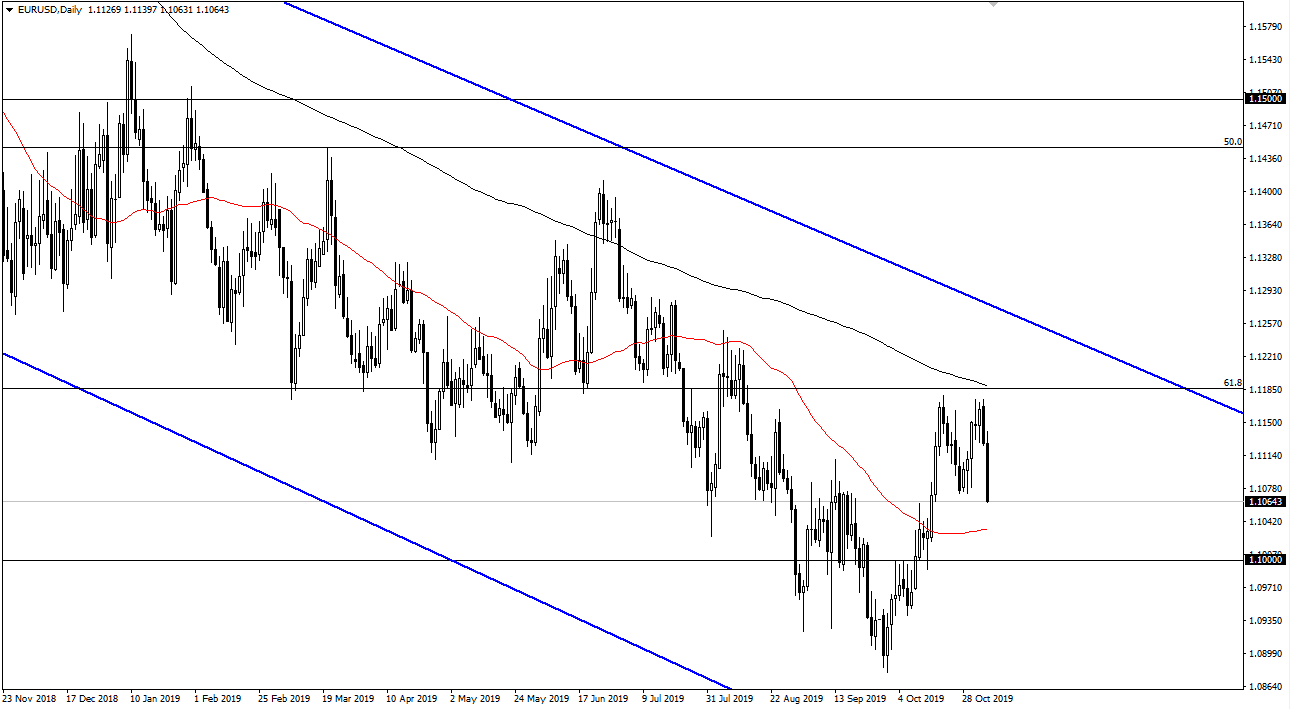

The Euro broke down significantly during the trading session on Thursday, as the ISM Non-Manufacturing PMI figures have been much better than anticipated. This drove money into the US dollar in general, and as a result we have seen the EUR/USD pair break down. The fact that we are broken through the lows of last week suggests to me that the market is probably going to continue going lower, perhaps down to the 1.10 level underneath, and then possibly the 1.09 level.

Beyond that, the 200 day EMA above has offered resistance, and we have formed a short-term double top in that region. I like shorting rallies on signs of exhaustion on short-term charts, as there is no real momentum to the upside anymore in the fact that we have made a “lower low” suggests that we have further to fall. Don’t be wrong, it doesn’t necessarily mean that we are going to break down drastically or fall apart. However, this market has been grinding lower for some time and it’s likely that we will continue to see negativity.

As the European Central Bank is likely to continue loose monetary policy while the Federal Reserve is on the sidelines, that does help the US dollar by default. At this point, if the market somehow turns around and breaks above the 1.12 handle, it’s likely that it would be a complete change in attitude. A daily close above the 200 day EMA would kick off that move and could send this market towards the 1.14 handle above. When you look at the longer-term chart though, it does show that we are likely to go much lower, and that these rallies continue to show signs of exhaustion. Looking at this chart, the 200 day EMA continues to cause issues. And therefore, it’s likely that we continue to go much lower as long as we can stay below there. Longer-term I suspect that the market is going to go down to the 100% Fibonacci retracement level underneath at the 1.04 handle. To be wrong, it doesn’t happen anytime soon, but it looks as if longer-term traders will continue to face the downward side. Fading rallies on short-term charts continue to be the best trade, as this pair does tend to be very choppy and volatile. Longer-term moves tak an extraordinarily patient trader to take advantage of. At this point, position sizing will be crucial.