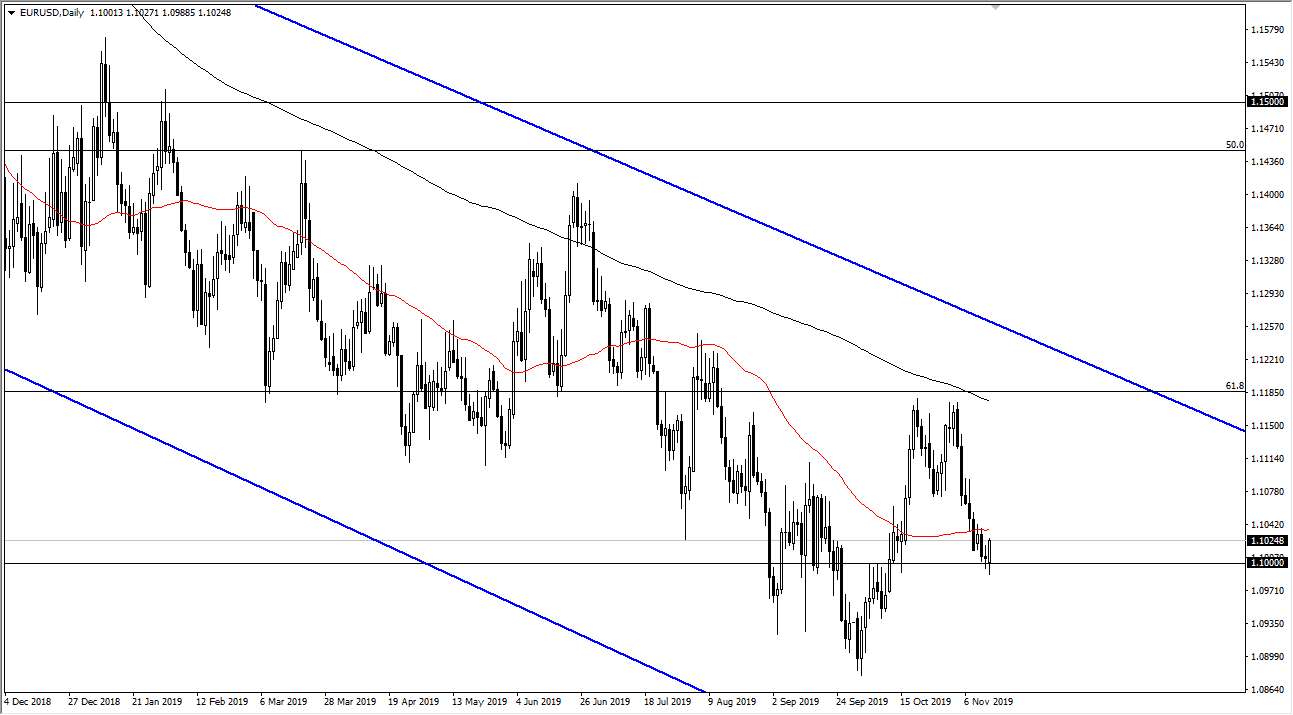

The Euro initially fell a bit during the trading session on Thursday, breaking below the 1.10 level before rallying significantly and reaching towards the 50 day EMA. The 50 day EMA is just above and should offer some resistance. Even if it doesn’t, I don’t care because I recognize that every time this market bounces, the sellers come back in and start punishing the Euro again, in why wouldn’t it?

Germany has narrowly avoided a recession in the short term, and it’s likely that we will see a lot of noise in the short term, but I think that noise will eventually wear out, and then of course momentum well. One that momentum starts to fail I will be shorting the Euro as over the last three years it has paid off quite well, as there are plenty of examples of every time that the market rally sellers come back in. With the European Central Bank looking likely to develop more monetary policy, it’s likely that the Euro will continue to suffer in general. After all, the Federal Reserve is somewhat on the sidelines and of course the economic numbers at the United States are surprising to the upside, while Germany is mired in malaise.

Looking at the chart, it makes sense that the 1.10 level has offered a bit of support, because it is a large, round, psychologically significant figure. A bounce from there doesn’t mean much other than people are paying attention to these large figures. This is an area that has been a resistance barrier in the past, so therefore it makes sense that you would see a certain amount of support. To the upside, one of the most interesting areas for me will be the 1.11 level, because it is basically where the “M pattern” broke down through during the trading session about a week ago. Ultimately, this is a market that should revisit the downside, as the “M pattern” tested the 200 day EMA. We are in a downtrend, and you should not think anything different. In fact, it’s not until we break above the 1.12 level that I would be convinced that we are going to go higher and perhaps changed the trend. Right now, we have a lot of work to do to make that happen for any sustainable trade. Fading rallies will continue to work and has paid off quite nicely for months