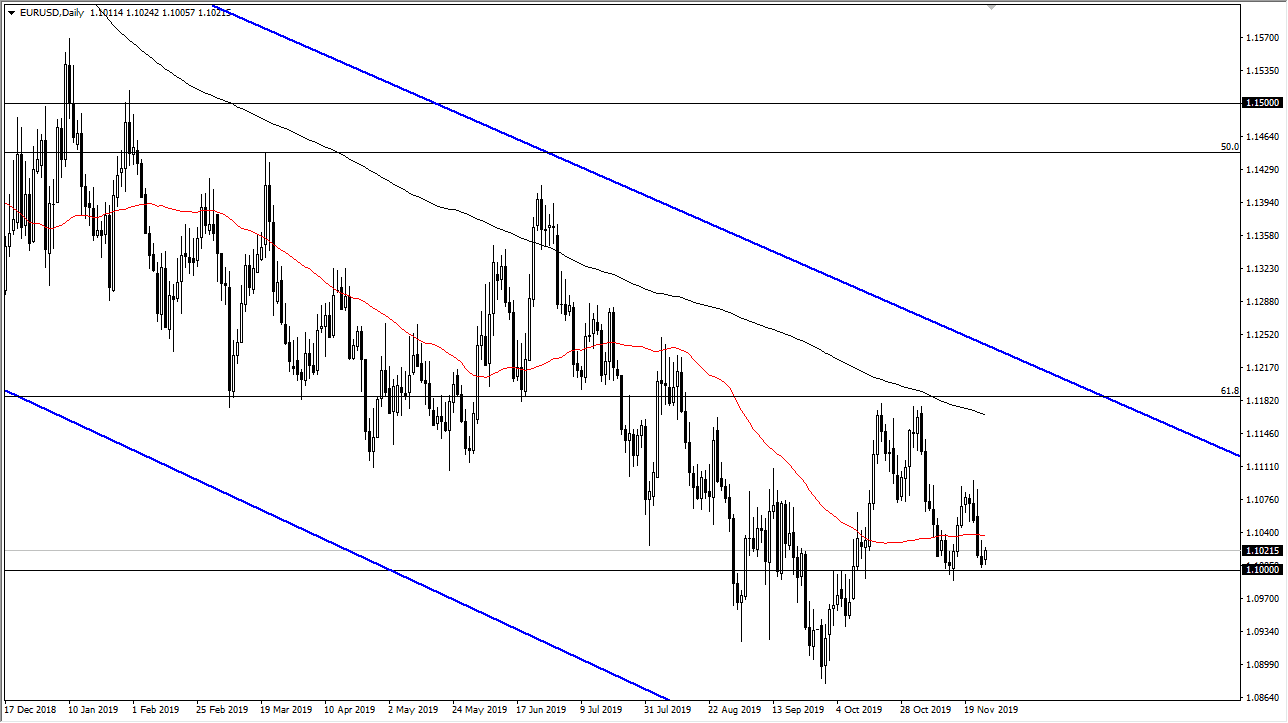

The Euro bounced slightly during the trading session on Tuesday, showing the 1.10 level to be supportive. At this point, the market continues to look at this large, round, psychologically significant figure as an area that people will pay attention to. The fact that we bounce from here suggests to me that we will continue to go back and forth between the 1.10 level and the 1.11 level above. The 50 day EMA slicing through the middle of it and going sideways suggests that the short term trend continues to be lackluster to say the least.

If we were to break down below the 1.10 level, then the market could go down to the 1.09 level next which did see a lot of buying pressure previously. Breaking below that level allows the market to go looking toward the major gap down at the 1.0750 level. That’s an area that should see a lot of support, and therefore I think that we would pause in that general vicinity. To the upside, the market sees a lot of resistance at the 1.11 handle, and at this point should find plenty of sellers. That being said, if we can break above the 1.11 level, then the market will probably go looking towards the 200 day EMA which is painted in black on the chart. Recently, we had tested the 200 day EMA region and ended up forming a bit of a “double top.” It is because of this that I suspect that we would have plenty of sellers on a return to that moving average. Quite frankly, I think it’s easier to simply short this market on signs of exhaustion, because we are in a longer-term downtrend anyway.

The European Central Bank is likely to continue easing interest rates, and of course going more balance sheet expansion. This could work against the value of the Euro currency longer-term, especially with the Federal Reserve standing on the sidelines and not loosening its monetary policy as it once was. Because of this, the interest rate differential and the attitude of the central bank should continue to drive this pair lower. Don’t be wrong, we will get the occasional hiccup to the upside, but on signs of exhaustion I am more than willing to step in and start trading this pair. It’s been choppy for the last couple of years with a downward slant, and quite frankly I don’t see anything different at this point.