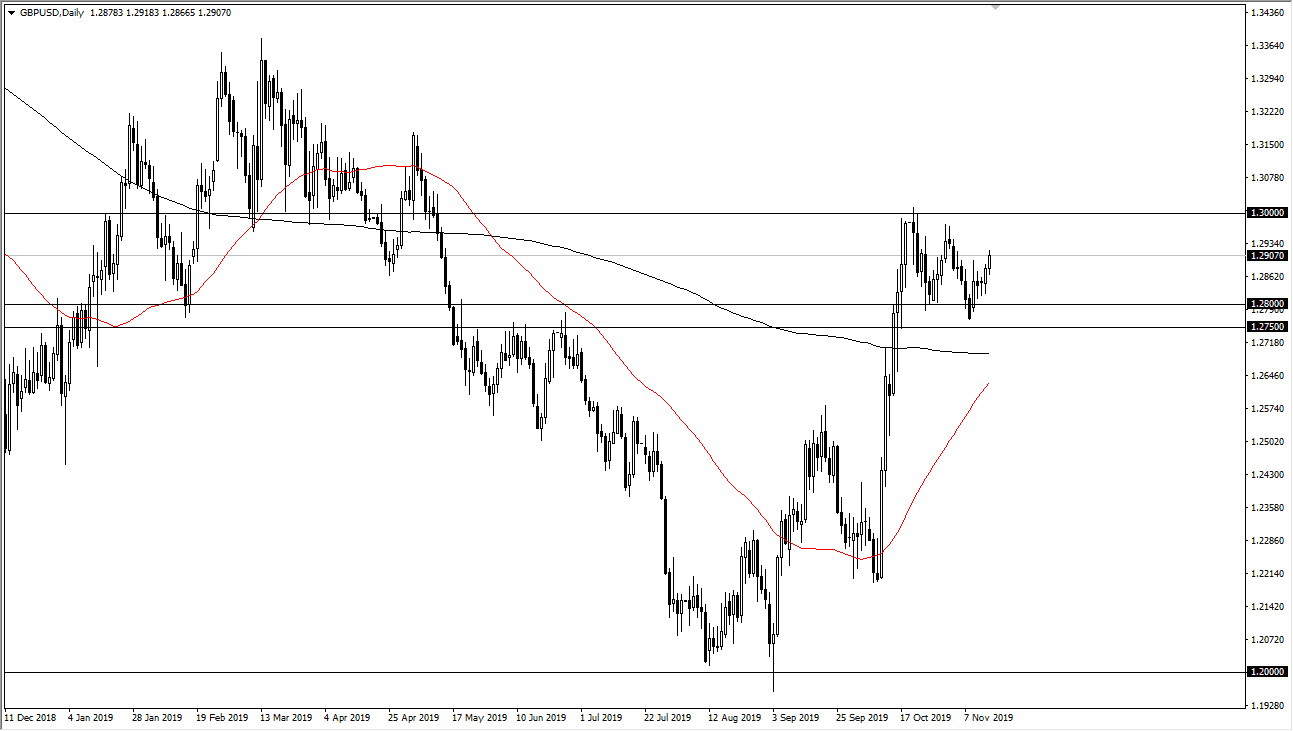

The British pound has been rallying during the trading session on Friday, continue in the same pattern that we have seen for some time. It is currently trying to build a bullish flag; which the rest of the world clearly sees I as well would imagine. This is one of the great things about some technical patterns, they become so obvious that the rest of the world follows right along with it. I do think that eventually the British pound will break out, and when it does this bullish flag will be looked back by a lot of traders as “the most obvious signal.”

By breaking above the 1.30 level it opens up a move to the 1.33 level initially, which is a major resistance barrier above. There is a lot of market structure of there that could cause some issues but based upon the measurement of the bullish flag we have further to go. I think we would mainly because it would have a lot of short sellers covering their positions. It would also probably have something to do with the Brexit situation getting solid or at least moving forward. This is the one thing that is keeping this market from going higher, all of the nonsense involving Brexit. As Nigel Farage has suggested that the Brexit Party isn’t going to try to disrupt the Tory seats, that should have Boris Johnson being able to pass some type of deal.

With this I still like the idea of buying the British pound on short-term dips and I recognize that the 200 day EMA sitting just below the flag is also a sign of very strong support as well. You may have to be very patient, but eventually you should get momentum to the upside. Based upon the pole of the flag we could go as high as the 1.38 level eventually, but that’s a longer-term call. From historical standpoint we are very low, meaning that there will be plenty of value hunters out there willing to pick up Sterling at these low levels. If we were to break down below the 200 day EMA I suspect there’s plenty of support done at the 1.25 level as well, so at this point I have no interest whatsoever in shorting the British pound. I believe that most people understand that the trend is in the process of changing, and therefore there should be plenty of traders to jump on board.