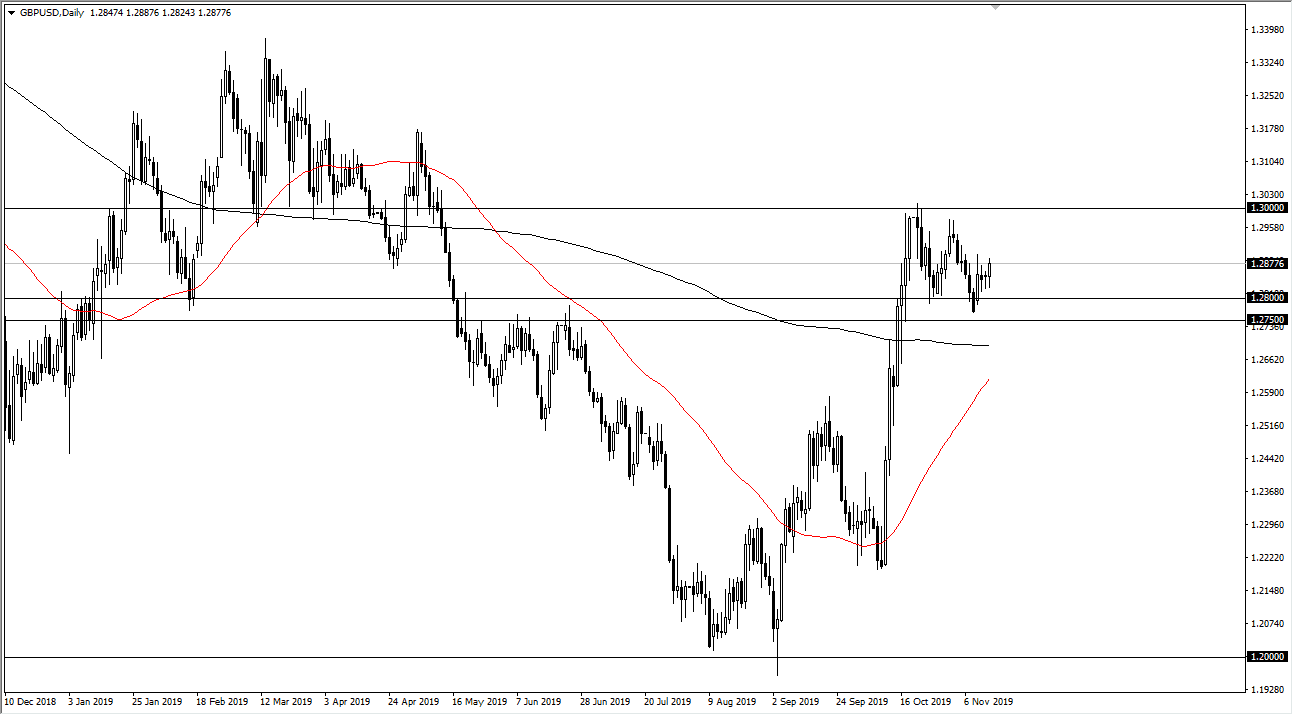

The British pound has initially pulled back a bit during the trading session on Thursday, but then turned around to show signs of strength in recovery yet again. When I look at the longer-term chart it’s easy to see that there is a bullish flag forming on the daily chart. The bottom of the flag is closer to the 1.2750 level, and then underneath there we have the 200 day EMA. Both of those areas should cause plenty of support.

To the upside, the 1.30 level is a major resistance barrier if we can break above there it’s likely that the market will kick off too much higher levels. The initial target would be the 1.33 handle but based upon the pole on the bullish flag we could be looking at a move all the way to the 1.38 level. That’s a big move, and obviously one that would take quite a bit of time to fulfill. Short-term pullbacks continue to be picked up as value, and as things stand right now, I think it’s very likely that will continue to be the way this pair behaves. After all, Nigel Farage has suggested that the Brexit Party won’t run for Tory seats, and therefore it almost guarantees a “pro Brexit” Parliament coming out of the special elections.

I don’t think that this pair is going to break out easily, because a lot of people have been burned in this pair over the last couple of years in one direction or the other. Looking at this chart, I think that it’s obvious the direction you should be trading but quite frankly it’s going to take some time to get to where we’re going. I have no interest in shorting the British pound because I truly believe that it has bottom that down at the 1.20 level, and even beyond that it’s historically cheap so I know a lot of longer-term traders going to be out there buying British pounds and simply hanging onto them. Look for value, add to a core position, and then build up a larger core position if you are a longer-term trader, because I believe we have seen the worst of the British pound trade for a cycle, if not some type generation. Beyond that, it may get a bit of a boost down the road as the European Union is probably going to struggle going forward, and perhaps the UK has saved itself.