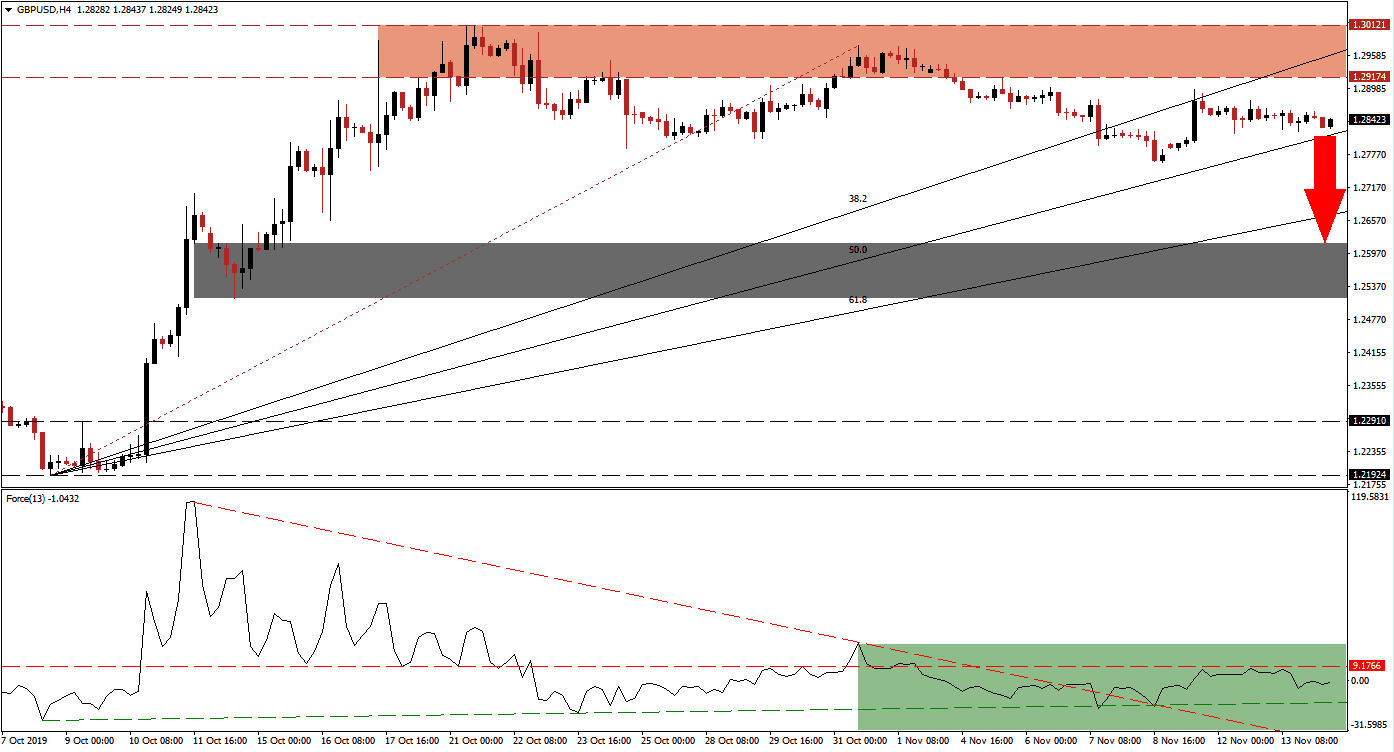

With the December 12th election approaching, UK Prime Minster Johnson’s Tories are expanding their lead in the polls. This has eased the risk of a no-deal Brexit and kept the British Pound well supported after a strong advance across the board, but bearish trading signals are appearing which suggests that a profit-taking sell-off my be brewing. The GBP/USD started to form a series of lower highs and lower lows following the first breakdown below its resistance zone; this led to a gradual increase in bearish pressures and made another breakdown likely. You can learn more about a resistance zone here.

The Force Index, a next-generation technical indicator, remains confined to an area below its horizontal resistance level and its shallow ascending support level in negative conditions as marked by the green rectangle. After the first breakdown in price action, the Force Index lost bullish momentum and plunged below its horizontal support level which turned it into resistance. As the GBP/USD reversed back into its resistance zone with a lower high, this technical indicator advanced but was rejected by its descending resistance level. While a sideways trend allowed the Force Index to cross above it now, overall bearish pressures are on the rise and expected to extend the breakdown sequence in this currency pair.

As the 38.2 Fibonacci Retracement Fan Resistance Level entered the resistance zone, located between 1.29174 and 1.30121 as marked by the red rectangle, breakdown pressures have increased further. The GBP/USD is now drifting sideways towards its 50.0 Fibonacci Retracement Fan Support Level from where a breakdown is likely to trigger the next section of the corrective phase. Forex traders should monitor the intra-day low of 1.27639 which marks the low of the second breakdown below its resistance zone. A move lower will convert the 50.0 Fibonacci Retracement Fan Support Level into resistance and increase selling pressure. You can learn more about the Fibonacci Retracement Fan here.

While US economic data remains mixed and the phase one trade negotiations derailed on several issues, the long-term prospects of the GBP/USD remain to the upside. An extension of the breakdown is expected to come to an end after price action moves into its short-term support zone which is located between 1.25157 and 1.26150 as marked by the grey rectangle. Despite the Tory lead in the polls, Brexit has divided the country and until after the election, a degree of uncertainty is keeping a lid on the upside potential of this currency pair. A move in price action into its short-term support zone should be viewed as a great long-term buying opportunity.

GBP/USD Technical Trading Set-Up - Breakdown Extension Scenario

⦁ Short Entry @ 1.28400

⦁ Take Profit @ 1.26150

⦁ Stop Loss @ 1.29000

⦁ Downside Potential: 225 pips

⦁ Upside Risk: 60 pips

⦁ Risk/Reward Ratio: 3.75

Should the Force Index manage to sustain a breakout above its horizontal resistance level, turning it back into support with the aid of its ascending support level, the GBP/USD may follow suit with its third breakout attempt above its resistance zone. The short-term technical picture suggests more downside while the long-term conditions favor an increase in price action. The next resistance zone awaits this currency pair between 1.31470 and 1.31928.

GBP/USD Technical Trading Set-Up - Breakout Scenario

⦁ Long Entry @ 1.30150

⦁ Take Profit @ 1.31750

⦁ Stop Loss @ 1.29450

⦁ Upside Potential: 160 pips

⦁ Downside Risk: 70 pips

⦁ Risk/Reward Ratio: 2.29