Gold markets initially fell during trading on Tuesday, reaching towards the vital $1450 level that I have been talking about. However, we did find enough support in that area to turn things around and form a nice-looking hammer. This reversal could in fact be due to Donald Trump suggesting that if a deal with China doesn’t go forward, substantial tariffs will be levied.

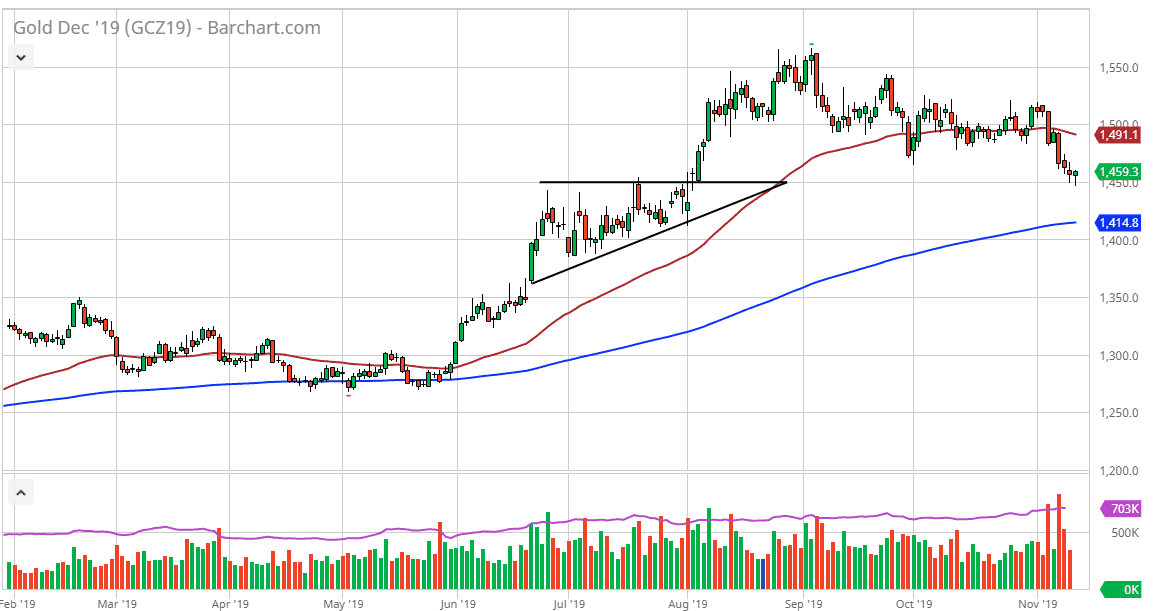

Recently, there had been some hope that the US and China were getting closer to some type of an agreement, at least for the so-called “Phase 1” part of the trade deal. The comments made during the session on Tuesday fly in the face of that, so it’s very likely that a little bit of “risk off” could come back into the marketplace, favoring gold. The $1450 level offering support makes quite a bit of sense, as it was the top of a major ascending triangle. By offering resistance there previously, and now there is a certain amount of “market memory” when it comes to that area. In other words, those who had been short of gold previously will more than likely trying to get out of their position at either a small loss or better yet break even if it’s at all possible. Beyond that, there are a lot of traders who have missed this trade in looking to take advantage of it. If that’s the case, then they’ll be buying here as well. It does makes sense that gold continues to rally from here, so I like the idea of buying unless of course we get a daily close below the $1450 level, which could open up a move down to the 200 day EMA.

The 50 day EMA is closer to the $1491 level, so that would be the initial target on a shot higher. There is a lot of short time frame choppiness between here and there though, so I’m not looking forward to taking off straightaway, unless of course there is some type of headline that moves the markets as such. At this point, I am bullish but also somewhat cautiously optimistic as opposed to as concerned as I was about the market just 24 hours ago. I stated that the market needed to save itself somewhere in this general vicinity, and so far, it looks as if it is trying to do exactly that. Obviously, the risk appetite of traders around the world will be a massive influence on what happens here.