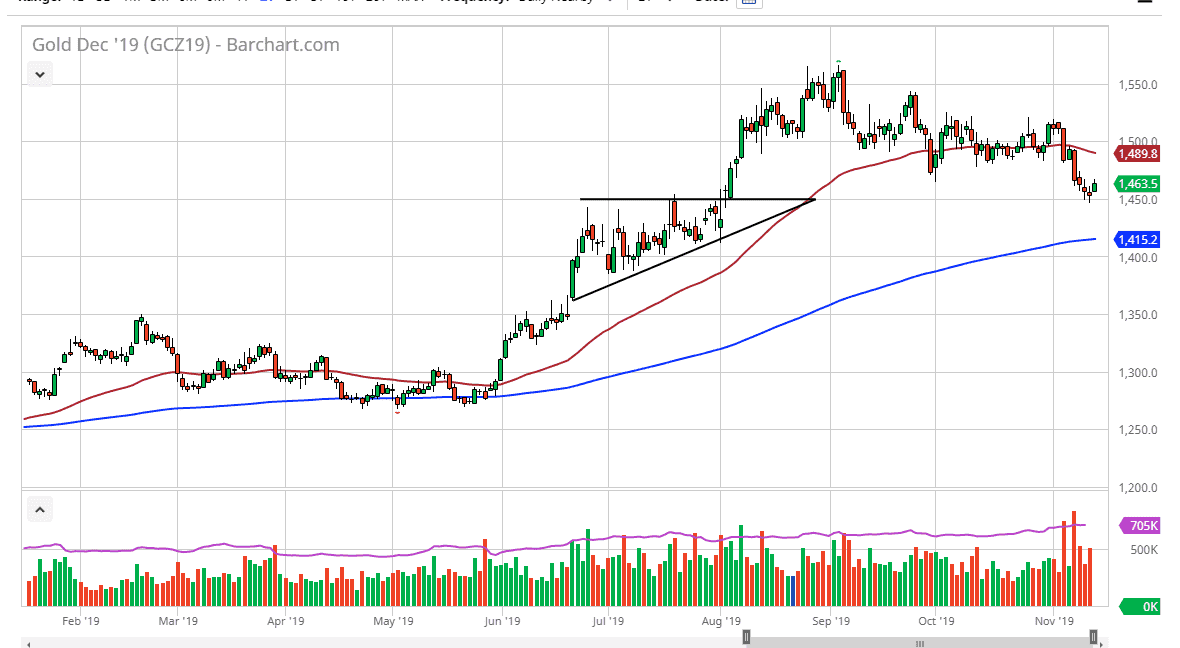

Gold markets rallied a bit during the trading session on Wednesday, as the $1450 level seems to have offered a bit of a floor. As a result, it looks as if the market is going to bounce from the $1450 level, which is exactly where it needed to save itself for the most part. It was the top of an ascending triangle, and therefore will have previously offered a lot of resistance which should now offer a lot of support. All things being equal, it now looks as if the market is likely to go higher, perhaps reaching towards the 50 day EMA.

The $1500 level above there would of course be an area that would attract a lot of attention, due to the large, round, psychologically significant aspect of that figure. Breaking above there then as the market looking towards the $1510 level. All things being equal, I believe that short-term pullback should be buying opportunities unless of course we were to break down below the hammer from the session on Tuesday. If that does happen, then the market will probably go looking towards the 200 day EMA, which would be closer to the $1415 level. If that gives way, it is a very negative sign as longer-term traders will look at gold as it is possibly in a downtrend again.

All things being equal though, there are so many problems out there right now it’s almost impossible to imagine a scenario where gold doesn’t go higher or that there certainly some kind of huge “risk on” type of situation. Yes, the stock markets are trying to go higher but all things being equal we are about due for some type of negative headline to shock the markets again. Keep in mind that the US/China trade war situation continues to be a major issue, and as long as that’s going to be the case it’s likely that there is still bit of a bit for gold. Beyond that, there is also the significant threat of central bank easing of monetary policy, although the Federal Reserve seems to be on hold. With this, there are still plenty of reasons to think that gold should go higher over the longer term but obviously we have seen a significant pullback as of late so it will be interesting to see whether or not that is another value created that people are willing to jump in.