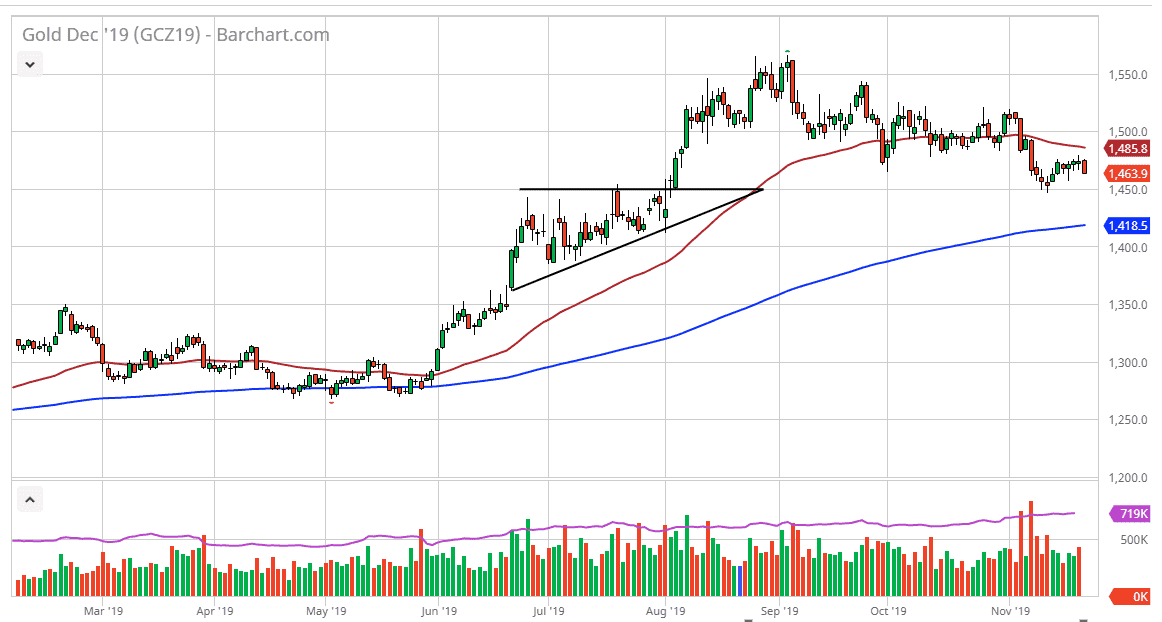

The gold markets pulled back a bit during the day on Thursday as we continue to see a lot of volatility around the world. The $1450 level underneath has been massive support previously, just as it had been massive resistance before. With the top of an ascending triangle, so therefore it makes quite a bit of sense that we could see buyers and sellers at that area based upon “market memory.” That in mind, I am looking at this potential pullback as a signal that we are going to try to reestablish this level as important.

Beyond that, the 38.2% Fibonacci retracement level is right there at the $1450 level, and of course we have the 200 day EMA underneath should continue to show signs of support. Ultimately, this is a market that should find plenty of buyers underneath, especially considering that the gold markets are very sensitive to risk appetite around the world. This is something that gold is very good at measuring, so pay attention to whether or not risk assets such as stocks are rising, or perhaps safety assets such as the Swiss franc in the Japanese yen are gaining. Gold itself is struggling, but as you can see of the last couple of months we have gently pulled back, and that of course is a good sign for the longer term uptrend.

The 50 day EMA above is going to continue to offer a certain amount of psychological resistance, at the $1485 level. Beyond that, we also have a massive resistance barrier at the $1500 level. If we were to break above there, the market then is free to go much higher than that as it will have cleared a major psychological level that attracts a lot of headline noise. At that point it would be a market that was continuing an uptrend after digesting a lot of gains, something that is perfectly normal. Keep in mind that the US/China trade talks continue to throw headlines around the world that will affect risk appetite as well, so with that in mind gold will probably be reactive to those noises. Those seem to be never ending, so keep in mind that gold markets will probably be very erratic going forward, but I do think that there is plenty of support underneath it should continue to keep this market somewhat afloat. Selling is something I’m not interested in doing right now.