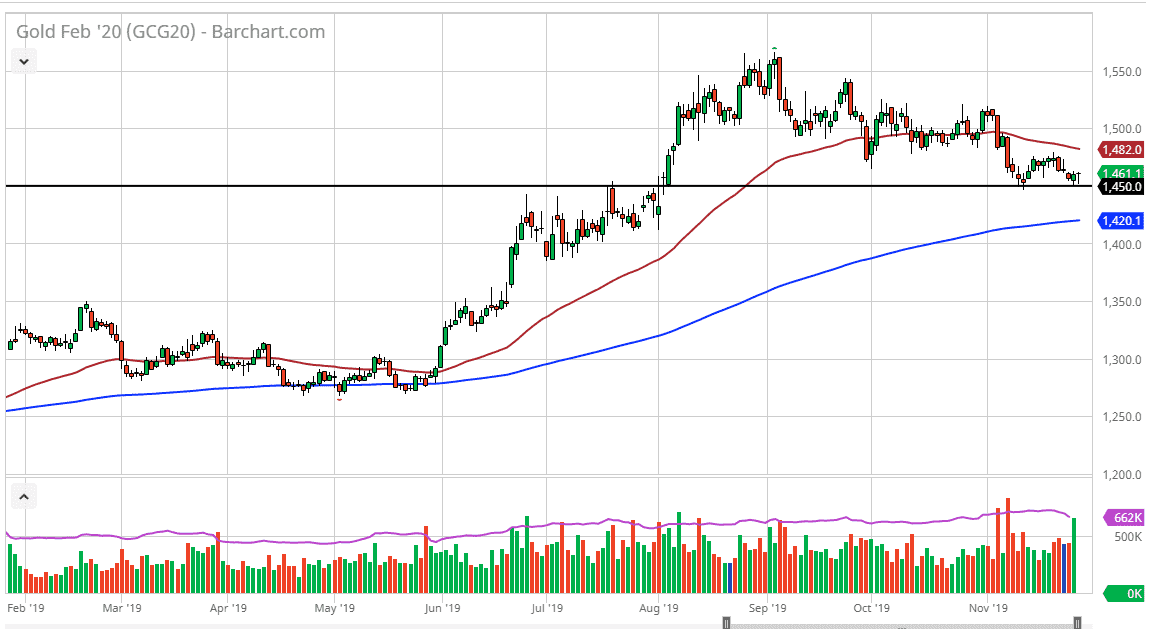

Gold markets have fallen a bit during the trading session on Wednesday but have also found plenty of support near the $1450 level. That’s an area that has been support previously, as well as resistance. It’s the scene of the top of an ascending triangle, which should now offer support based upon “market memory.”

Looking at the chart, the fact that the market has ended up turnaround in forming a hammer for the day is a very bullish sign. At this point, the market will continue to find a lot of support underneath, as the $1450 level has proven itself to be important more than once. The question now isn’t necessarily whether or not that level is going to be important, but whether or not we are forming a “double bottom”, or are we going to break down below there and go much lower. If we do, then the market goes looking towards the 200 day EMA which is found at the $1420 level. A breakdown below that level would be very negative in general and could kick off a negative trend.

At that point, the $1400 level would be tested, and then perhaps breaking down below there could send this market even lower. At this point in time, the market participants have enjoyed a strong rally until the last couple of months, but it should be looked at as a very slow dissent, and for what it’s worth we are finding buyers at the 38.2% Fibonacci retracement level. As things stand right now, it looks very likely that the market is going to try to bounce from here and perhaps reach towards the most recent high from last week. If we can break above there, then the market is probably going to go to the $1500 level or even higher.

At this point in time, it’s likely that the markets will continue to see a lot of volatility, based upon a whole host of things when it comes to geopolitical growth, the US/China trade situation, and of course Brexit. Overall, the market is going to continue to be an issue, and therefore headlines could be very distracting to the markets. The Federal Reserve is on the sidelines currently, and that could change the overall outlook of gold. All things being equal though, we are at a “do or die” type of situation. With all of the noise that we have out there right now, it’s likely that falling technical analysis will be the only way to go.