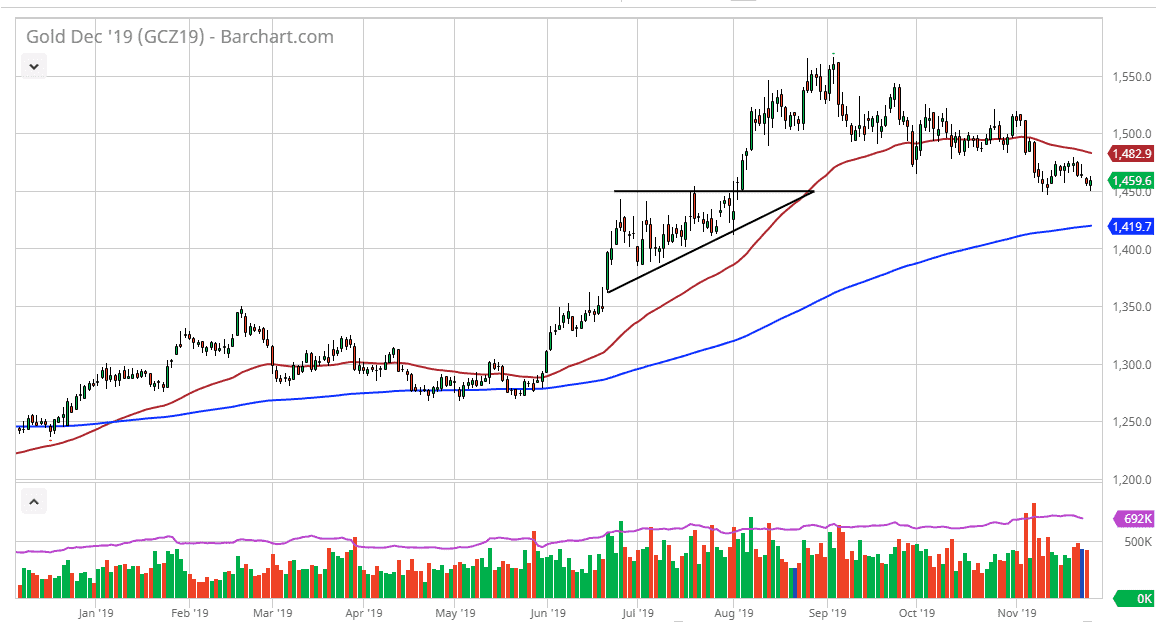

Gold markets initially fell during the trading session on Tuesday, reaching down towards the $1450 level, an area that has been crucial more than once. That area has been previous resistance based upon the ascending triangle that I have marked on the chart, and therefore I think it’s very crucial to see this area hold as it was so important in the past. At this point, the market has tested the $1450 level for a second time during the trading session on Tuesday, forming a potential “double bottom.”

That being said, this is not a market that’s ready to simply explode to the upside, and of course there are a lot of moving pieces when it comes to whether or not people are buying gold. Central banks around the world continue to loosen monetary policy but unfortunately the most important one, the Federal Reserve, has stopped. That works against the value of gold, so therefore I’m not as bullish as I could be under typical circumstances. Beyond that, there are a lot of back and forth between the United States and China, which is playing absolute havoc with gold as it gets bought when people are worried about the trade situation getting worse. Otherwise, if the US/China situation gets a good headline, gold turns around and falls apart.

At the $1450 level, it appears that the buyers are trying to make a stand, it is also the 38.2% Fibonacci retracement level, so it is worth paying attention to in that sense. However, if we were to break down below there, it’s likely that the market will go looking towards the 200 day EMA which is closer to the $1420 level. Breaking below there would be rather negative, perhaps opening up the door towards the $1350 level. That would probably be accompanied by some type of really good news, as that will have people running away from gold and into riskier assets that can build up more alpha.

To the outside though, if we can break above the 50 day EMA at the $1482 level, then it’s likely that the market will go looking towards the $1500 level, perhaps even the $1510 level next. It could also kick off the next leg higher on the longer-term chart, reaching towards the highs again. I do think that eventually gold could take off to the upside but right now it is still in a very precarious position.