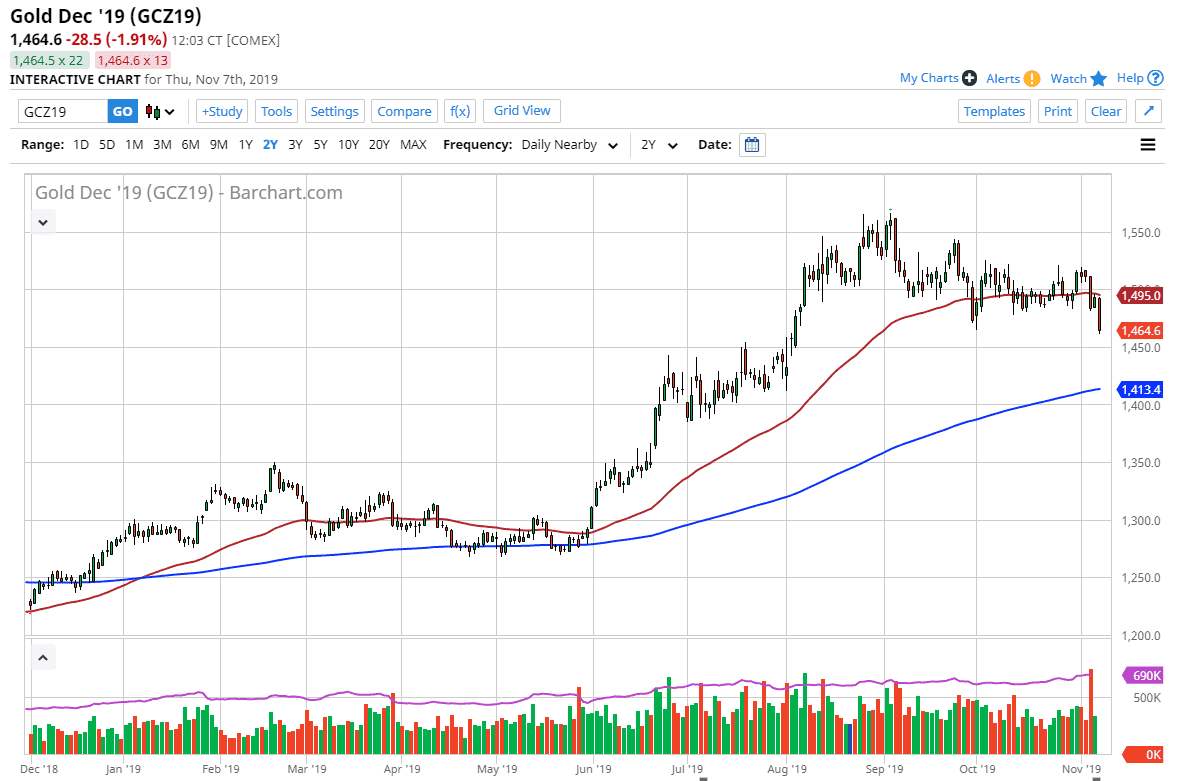

Gold markets got hammer during the trading session on Thursday, as we have broken below the important $1475 level. At this point, the market has broken through significant support and now we need to look at this market to the prism of being in an uptrend, but also that there is a lot of pressure. The pressure of course is building due to the fact that there is more optimism when it comes to the US/China trade relations. As it looks like tariffs are going to be peeled back, this of course is a very significant turn of events when it comes to the markets, and the risk appetite is obviously changing drastically. Remember, gold quite often will be a trade that people get involved in to express risk appetite, and if the US/China situation cleared itself up that would be a huge boost for riskier assets.

That being said, the $1450 level underneath should be rather supportive, and it will be interesting to see whether or not the market holds that area. I would not necessarily be a seller of gold, but I do recognize it simply jump in in and buying here is going to be difficult. We need to see how the market reacts at $1450 in order to place a trade. Ultimately, it’s very likely that will cause some type of bounce, but if it were to slice right through there then it’s difficult to imagine how the market would bounce at that point. It could in fact be the end of the uptrend in that scenario.

For what it’s worth though, there are still plenty of problems just waiting to rise to the surface, and that of course can have a major influence on where we go next. This pullback has been rather benign until the trading session on Thursday, so perhaps waiting to see how the market closes out the week might be the best way to approach what happens next as we have yet to see whether or not this breakdown will stick. All things being equal, the close of business on Friday should give us quite a bit more in the way of information when it comes to what’s going to happen with gold. If we were to break down significantly on Friday and close below the $1450 level, that would of course be very negative. Otherwise, if we get a significant bounce that might be a buying opportunity.