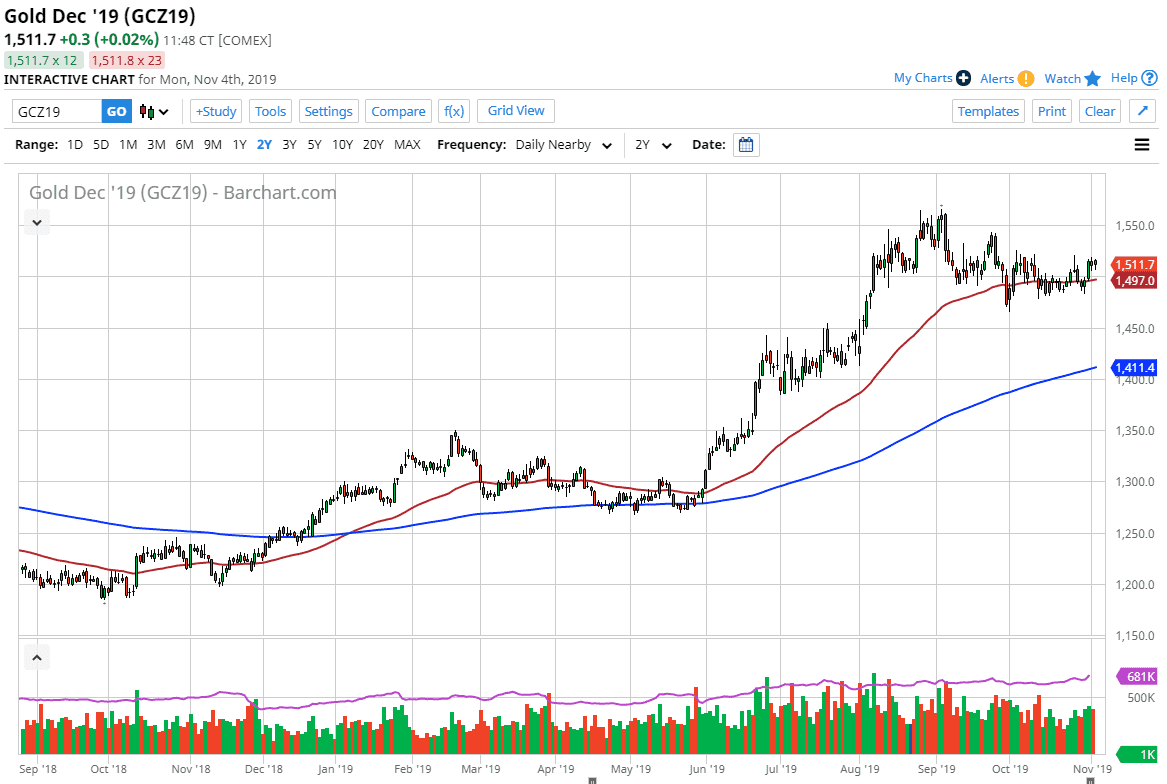

Gold markets initially pulled back during the trading session on Monday to kick off the week, but then turned around to show signs of life, as the market has been forming a bit of a “rounded bottom” type of situation. The 50 day EMA sits just below, offering a bit of support. The 50 day EMA is also starting to turn higher, so that of course is a good sign. It sits just below the $1500 level which will also offer a lot of support based upon the psychology of round figures.

All things being equal I believe that dips are still opportunities to buy gold “on the cheap”, as the market has been grinding higher for quite some time and it now looks as if central banks are going to continue the loose monetary policy that they have been starting for quite some time. Beyond that, there is a lot of concern out there from a geopolitical stance it makes sense that gold would go higher.

Underneath, I believe that the $1450 level will be massive support, and therefore as long as we can stay above there the uptrend will be somewhat intact. That was the scene of the top of an ascending triangle, so breaking down below there would suggest a lot of negativity coming down the road. All things being equal, gold should continue to find buyers as we seemingly are only one headline away from chaos at this point.