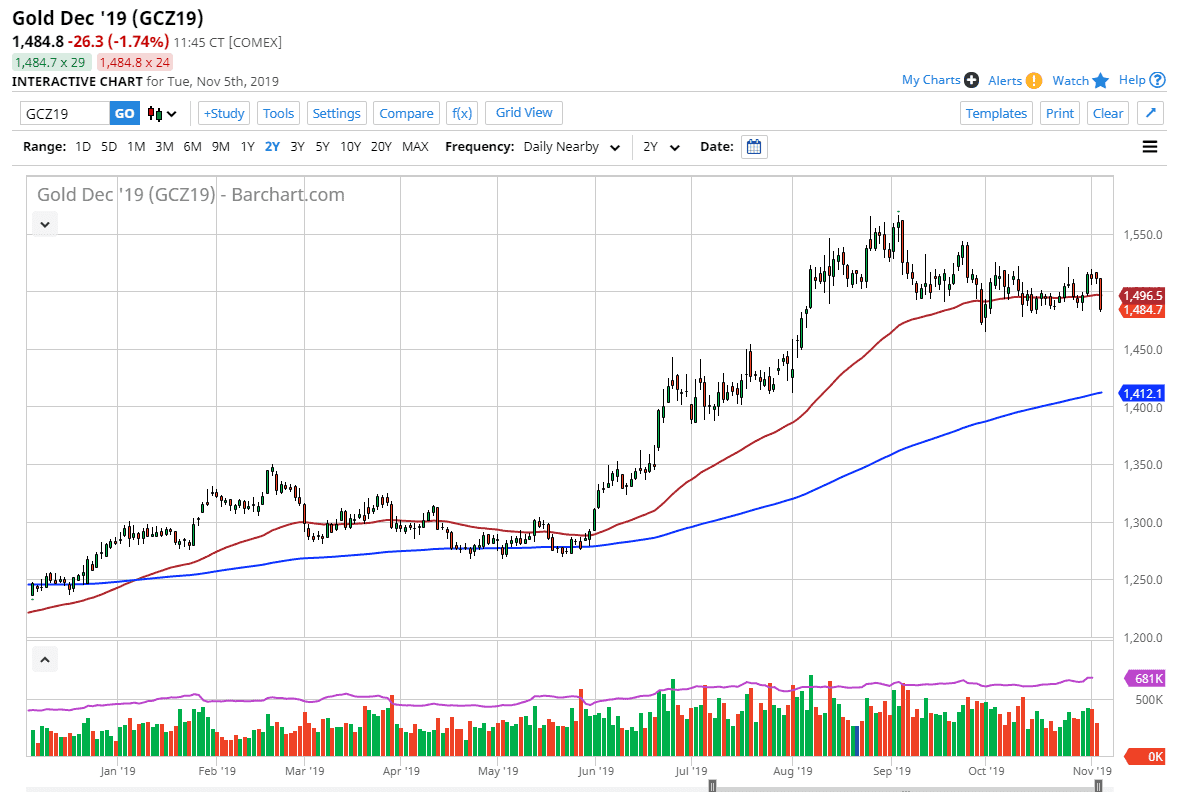

Gold markets fell rather hard during the trading session on Tuesday, slicing through the 50 day EMA like it wasn't even there. That being said though, the market has stopped right at major support, so the next 24 hours could be rather crucial. At this point, if we bounce from here, it will save a bit of strength than the uptrend. The 50 day EMA is relatively flat, so it suggests that the market is simply grinding away more than anything else.

If the market was to break down below the $1485 level, then we could see this market reach down to the $1450 level next, an area that features a gap as well as was previous resistance based upon an ascending triangle. That being the case, the market is very likely to find plenty of reasons to make a move here, not the least of which was the massive move that we had seen in the US dollar during the trading session. The ISM Non-Manufacturing PMI figures came out much stronger than anticipated, so we started seeing the US dollar pickup major strength as a result. Ultimately, it looks as if the market is going to continue to pay attention to US dollar strike more than anything else and as a result you should pay attention to the US Dollar Index. If you don’t have access to that futures contract, then the EUR/USD pair can give you an idea as it is the largest part of that contract.

If the market gives away the $1450 level, it almost certainly will need to fall further and “reset” as far as the uptrend is concerned. While I do like the idea of gold longer-term, the trading session on Tuesday certainly was a “shot across the bow” of the gold bugs. Simply put, the next 24 hours or more than likely going to be very crucial for the outcome of the gold markets going forward, and therefore should be paid close attention to. If we do break out to the upside, the $1540 level and then the $1560 level would both be targets. That being said, although things a very negative towards the end of the session on Tuesday, we are still technically in consolidation so that may help put a slightly positive spin on what has been a rather tough day for the gold markets.