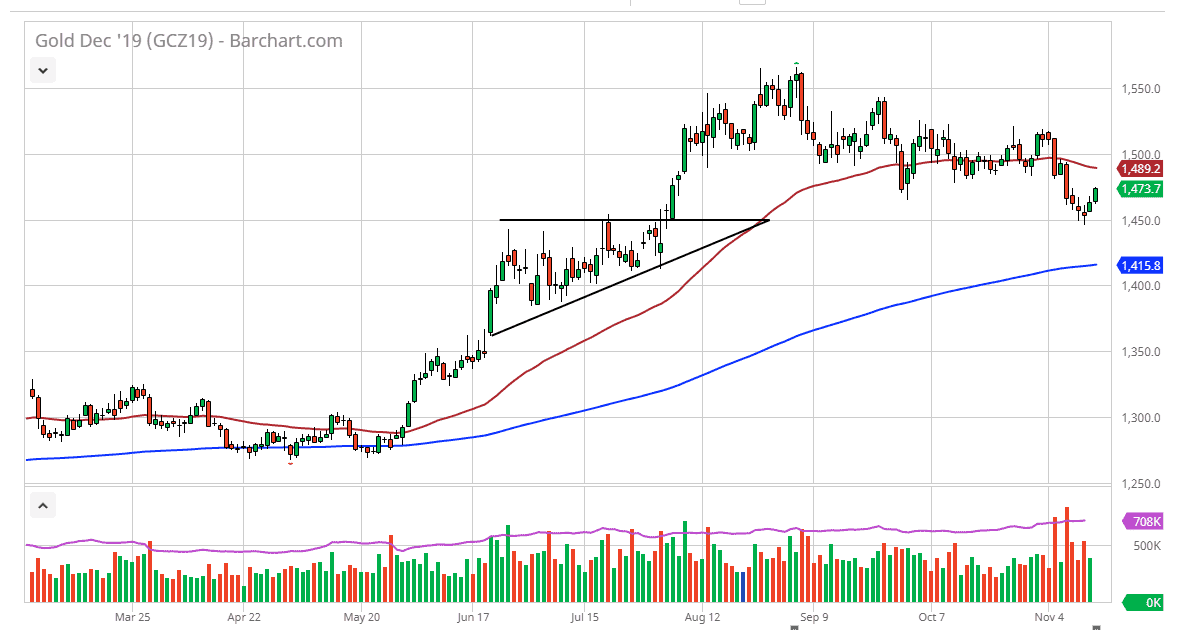

Gold markets have a good session on Thursday, breaking above the highs from the Wednesday session and continuing to go higher. The question now is whether or not we have seen the pullback should itself as gold had been so oversold in the short term. If you have been following these articles, you know that I had talked about how important the $1450 level was going to be, as it was the top of the ascending triangle that I have shown on the chart. With that being the case, the fact that we have held that level is very encouraging, but we are quite out of the woods yet.

After this bounce, I would use the $1450 level as the “floor”, and at this point I like the idea of using that as a place to put my stops just below. In the short term, I suspect that the market probably goes looking towards the 50 day EMA which is at the $1489 level, and then perhaps even the $1500 level above. That level will more than likely cause a certain amount of psychological discomfort and could cause a little bit of a pullback. However, if we were to clear that hurdle, then the market will be threatening to break out for a longer-term move to the upside yet again.

For what it’s worth, this is historically a relatively bullish time of year for gold, and as a result it wouldn’t be a huge surprise to see a recovery. Beyond that, it wouldn’t take much to scare the markets again, because quite frankly we are all sitting around waiting for the next dramatic headline coming out of the US/China trade war, or perhaps some type of central bank easing policy situation that we hadn’t anticipated. All things being equal, even though this has been a very ugly grind lower, it really only has been $100 over the last three months so it’s not like gold fell out of bed so to speak. This is a garden-variety pullback, but if we do break down below that $1450 level, then we have to rethink the entirety of the market. We are still technically in an uptrend but needless to say we are threatening to reverse that entire scenario, which of course is an entirely different conversation altogether, which would recognize that the market and everything else is suddenly in a “risk on” scenario.