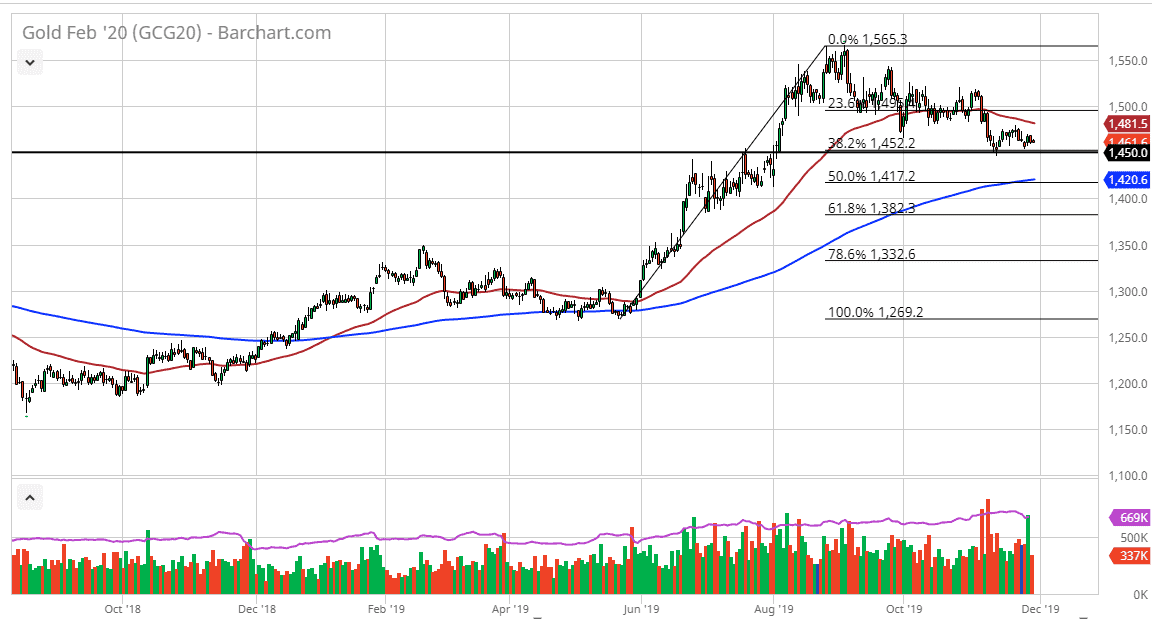

Gold markets drifted a little bit lower during the trading session on Thursday and what would have been very thin trading during the Thanksgiving Day holiday. At this point, the market is very likely to see a bit of interest at the $1450 level, and it’s likely that the previous resistance should now be support. At this point, you should also keep in mind that the 38.2% Fibonacci retracement level is to be found in this area.

The $1450 level was also the top of an ascending triangle the sent this market higher, so at this point we need to determine whether or not the $1450 level is going to offer a bit of a “double bottom”, or is it going to finally break down and allow the market to go looking towards the 200 day EMA? That is closer to the 50% Fibonacci retracement level which of course would attract a lot of attention as well. However, if the market was to bounce from this area, the 38.2% Fibonacci retracement level, then it’s a very bullish sign and should continue to bring a bit of momentum into this market, as one thing that seems to be a constant is that the more shallow the pullback, the more impulsive the rally.

This is going to come down to the US/China trade situation, and whether or not it gets better or worse. If it gets better, the gold market is going to be in a lot of trouble. However, if the US/China trade situation gets worse, then it makes sense that gold would rally quite significantly. At this point, it’s a bit of a 50-50 play, so it’s difficult to put a lot of money into it. Overall, if we were to rally from here, we could go towards the $1500 level, possibly even higher than that. Otherwise, if we do break down and reach towards the 200 day EMA, that is the last vestige of support and for the uptrend. If it gives way, then it’s likely that the market will completely unwind at that point. This is simply about risk appetite right now, and it appears that risk appetite is getting a little bit better as of late. However, it’s only can it take a couple of bad headlines to send things right back around. Gold continues to be supported just underneath but that could change rather soon.