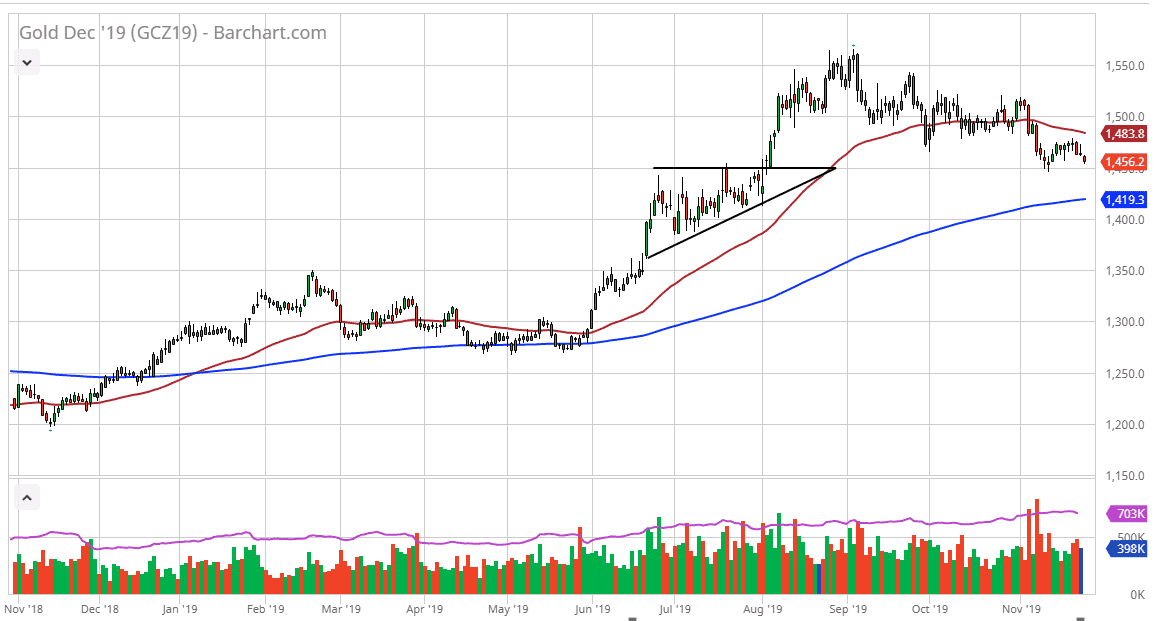

Gold markets fell again during the trading session on Monday, and with prime to test the support yet again. We have recently seen a bounce from the $1450 level, but now have given back those gains yet again. Gold looks as if it is in a bit of trouble, but the $1450 level will continue to be important. This is because it is the top of the previous ascending triangle, and therefore there should be a lot of “market memory” to be found there. It’s likely that we could see a bit of a bounce, but what does concern me is that we have already seen a bounce in now are back there. One has to wonder how long the support can hold.

The Federal Reserve is on the sidelines right now, and that does have gold being hit just a bit, mainly because the perceived tightening of monetary policy, release the lack of loosening, could work against the value of gold. There are plenty central banks around the world looking more than likely to remain loose with monetary policy, so what you may see is gold diverge a bit as far as markets are concerned. You may see gold rally against certain currency such as the Euro but fall against the US dollar.

If we do break down below the $1450 level, it opens up a move down to the 200 day EMA at the $1420 region. That’s an area that should be supportive as well, and if it gives way, that would be disastrous. I think the next couple of days we will probably see this market test the $1450 level, so it’ll be interesting to see how this plays out. Keep in mind that the United States has Thanksgiving on Thursday, so the market might be relatively quiet this week. That being said, we have a significant level to pay attention to, and if we do not break down below it, it could be the beginning of a turnaround. I think it’s probably a bit early to suggest that, but it is a possibility. A break above the 50 day EMA would be more of a confirmation move, but that is look very likely in the short term. The best thing gold can do right now is to simply bounce around in this area and consolidate to build up an opportunity to go higher. Otherwise, we could see trouble soon.