After the price of gold fell to the $1480 support, the yellow metal is trying to recoup its losses by bouncing back to the $1494 resistance, which is where it is stable at the time of writing. What contributed to these losses were investor’s risk appetite and the strength of the US dollar. The White House is finalizing the "first phase of the trade deal" agreed in principle with China on October 11, which has already prevented a new increase in US tariffs on Chinese imports. Trump is thought to be keen to suspend the trade war at least until after the US presidential election, so if the deal is confirmed in the coming weeks, it could provide a breathing space for the US central bank to abandon further US rate cuts, which means less risk to those returns that were supporting the dollar.

The transatlantic economic divergence that has driven investors out of other currencies and a to push strongly towards the dollar in the past 18 months is rooted in President Donald Trump's tax reforms in 2018 and his trade war with China. Tax cuts have boosted growth in the United States, while tariffs have impacted the global economy and severely damaged the struggling Eurozone economy. As a result, anything suggesting a tight presidential race for 2020 or Trump's defeat next year is likely to be taken seriously for the performance of the US dollar, which is moving backwards with the price of gold.

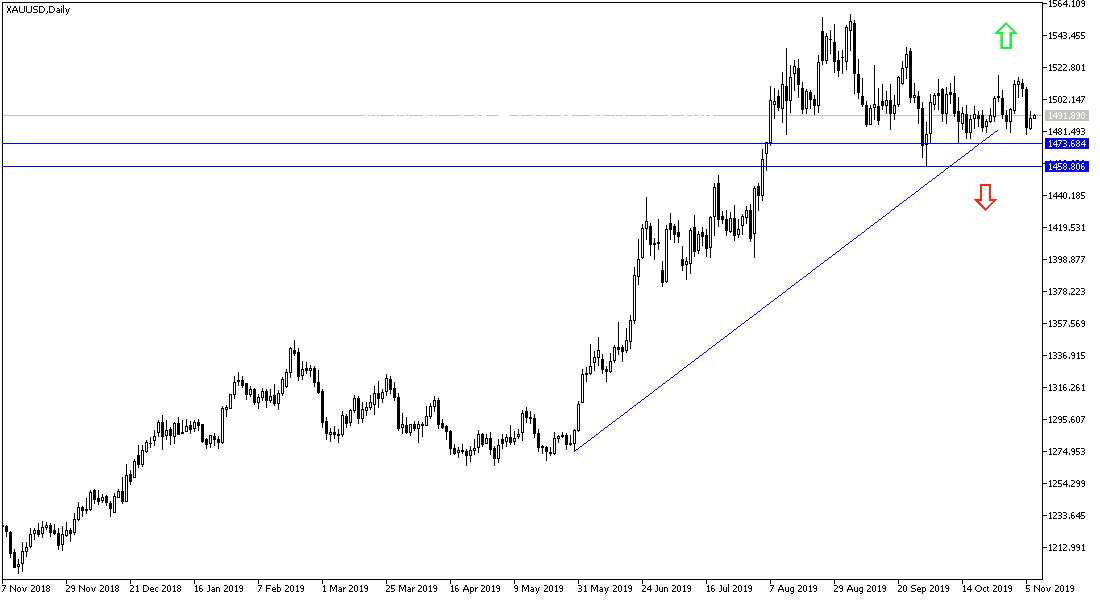

According to the technical analysis of gold: No change in my technical view for the price of gold, abandoning the $1500 psychological resistance will contribute to the test of stronger support areas and the $1480 support remains neutral awaiting incentives to move in one direction or the other, depending on the continued investor appetite for risk and the strength of the dollar. The luster of gold will return in the event of renewed global trade and geopolitical tensions. Best support levels are currently at 1485, 1477 and 1463 respectively. The strength of the bullish momentum depends on the return to stability above the $1500 psychological resistance.

As for the economic calendar data today: The performance of gold will react with the Bank of England's monetary policy announcement and the comments of Governor Mark Carney. The upgrading of the EU's economic outlook will also impact investor’s sentiment.