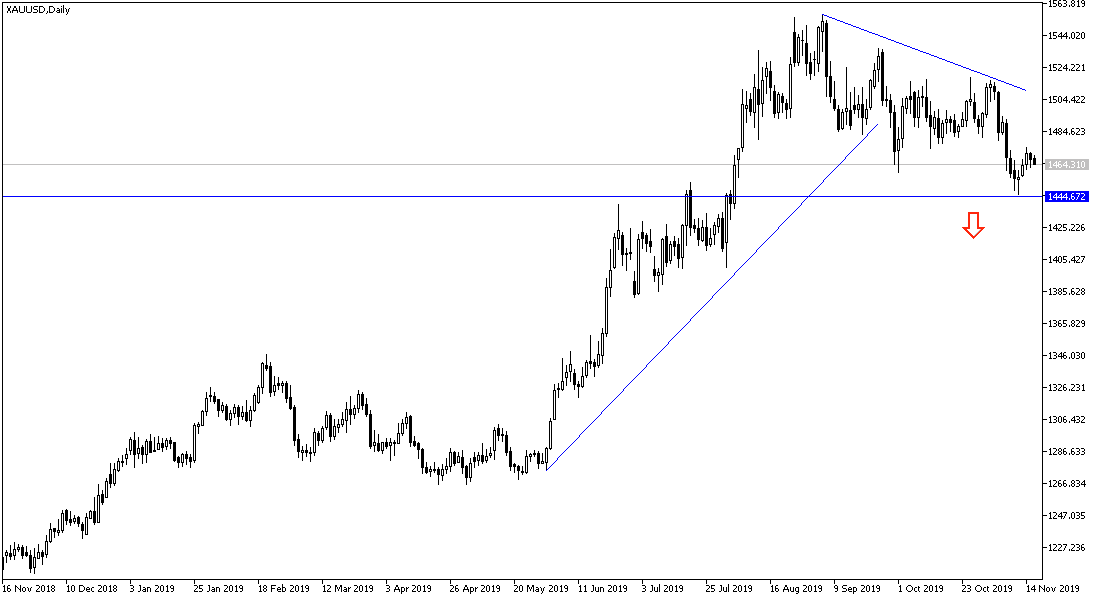

Despite the recent bounce attempts by gold prices, which reached during last week's trading to the $1475 level, in a correction attempt after the price hit the $1446 support, the lowest in more than three months. The gains in the yellow metal were supported by the dollar's decline and the return of investors' concern over the failure of the current trade talks between the two largest economies in the world to reach the first stage agreement, as the Trump administration, which calls for maintaining some tariffs to serve as a deterrent to China and pressure them to implement what was agreed upon. China, for its part, wants to remove tariffs imposed before any agreement.

The return of global trade and geopolitical tensions will be a catalyst for gold investors to move towards stronger gains.

The relationship between the US dollar and gold is inverse. The dollar index DXY fell by about a third by one percent last week, and has recently fallen in five of the past seven weeks, including the first half of Q4. Prices recovered nearly half of the losses it suffered in October, but collapsed before the weekend. The loss before the end of the week caused the dollar index to fall slightly below 98.00, and is moving in a support range between 97.60 and 97.80. A breach through this area may target a test of recent lows near 97.00. MACD and Slow Stochastic are closer to the downside.

The dollar weakened in the last half of last week, as US government bond yields continued to fall from previous highs in response to new uncertainties about the US-China “first stage” deal, as well as economic concerns, although some believe the downside will be limited in the coming days. President Trump told the New York Economic Club last Tuesday that "an important first-stage trade deal with China could occur" but then threatened: "If we don't reach an agreement, we will raise these tariffs significantly."

According to the technical analysis of gold: Confirmation of the bullish correction strength of gold is still in need of significant movement towards the $1485 resistance and $1500 psychological, otherwise the downtrend will remain valid and will strengthen if the prices drop towards support levels at 1455, 1440 and 1425 respectively. I still prefer to buy gold from every bearish level.

Today's economic calendar has significant data affecting the performance of gold prices.