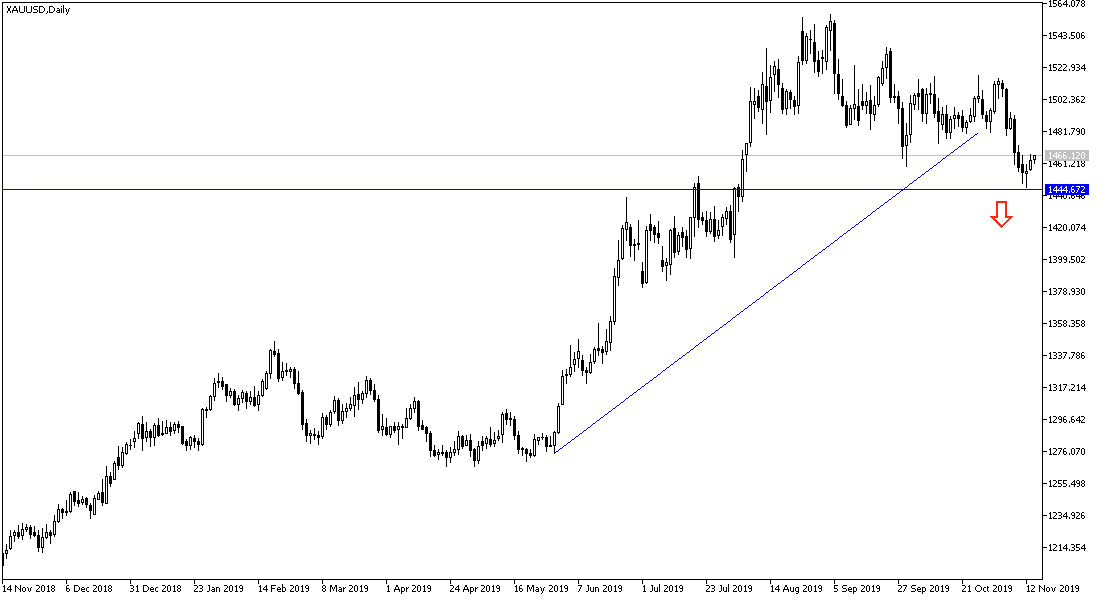

Undoubtedly, gold is an ideal safe haven for investors in times of uncertainty. With renewed concern of financial markets and investors about the uncertainty of the date and details of the trade agreement between the United States of America and China, which has not yet seen the light, that was a catalyst for the price of gold, which fell to the $1446 support, its lowest level in more than three months, bouncing back to the $1467 level. The rebound attempt was stalled as the US dollar rose after inflation figures surprised markets by rising above expectations. Investors shied away from risky expectations amid fresh concerns about the White House trade policy following President Donald Trump's speech to the New York Economic Club.

US inflation rose 0.4% last month and markets were looking for a 0.3% rise. The annual rate was higher than 1.8%, up from 1.7% last month. The “main” inflation rate became the closest to the Fed's 2% target after it recovered from 1.5% low in the New Year.

The Fed was under pressure from the White House, as the US President Trump's reiterated his harsh criticism of Jerome Powell and his monetary policy and saw what the Fed was doing as being in the opposite direction of its plans to boost the US economy, especially in light of its trade wars against global economies, to enforce the fait accompli that America's interest is above all. The US dollar remained stronger after Federal Reserve Chairman Jerome Powell told Congress that inflation remained "silent" and that the outlook for growth was favorable.

"There could be an important first-stage trade deal with China," Trump told the New York Economic Club late on Tuesday, but then threatened: "If we don't reach an agreement, we will significantly raise these tariffs." There was speculation ahead of the speech that Trump will announce further delays in deciding on European car tariffs as well as providing new information on China's talks, but has in fact eased market optimism. He did not elaborate on the details of the deal or when it will be officially signed.

Renewed global trade and geopolitical tensions would favor the return of gold's gains. The closest resistance levels are at 1477, 1485 and 1500, respectively, and the last level could be the push the bulls need to return with the yellow metal to record levels. Conversely, a return to the $1446 support will strengthen the current downward correction and may trigger bears for further selling moving towards $1400 psychological support on the short term.

As for the economic calendar data: Gold prices will react to the release of China data and then the US data concerning producer prices, jobless claims and the content of the second testimony of Federal Reserve Governor Jerome Powell.