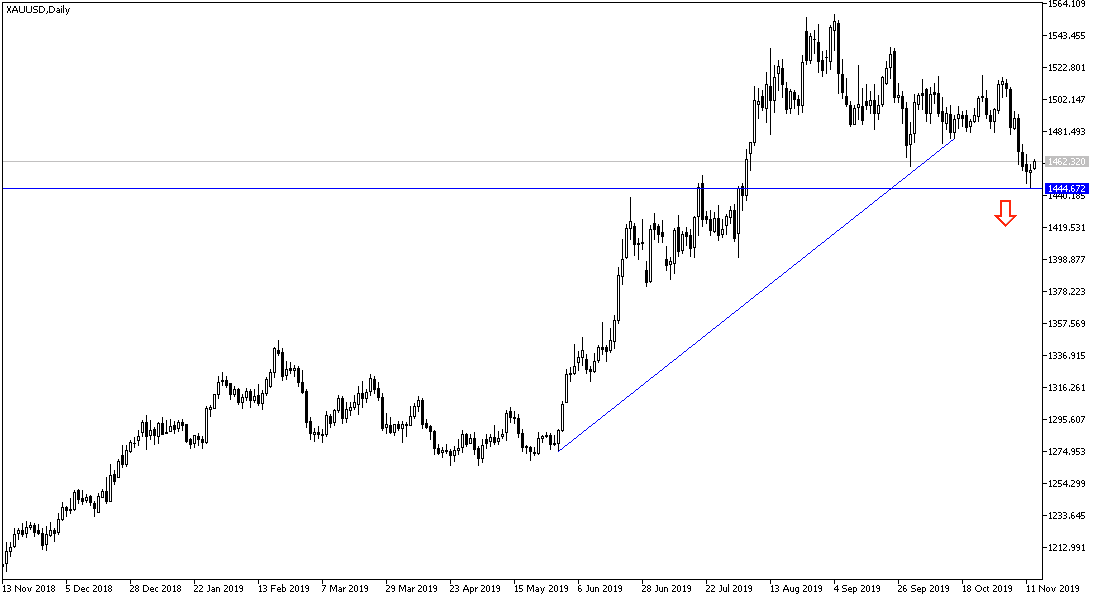

The downward correction pressure of gold pushed it towards the $1446 support level, the lowest in three months. We had advised to buy from that level in the past because it is an important support, from where the price rebounded to the $1461 level at the time of writing. Contributing to the gains and stopping losses was the lack of clarity of US President Trump in his speech yesterday on details of a trade deal with China, and when it will be officially signed. But he reiterated that the agreement was close and that it could happen sometime soon. He stressed that he would only agree to what would be in the interest of the United States and its companies. Trump again criticized the policy of the US Federal Reserve and demanded a negative interest rate as other central banks do. The three rate cuts approved by the bank throughout 2019 appear to have never been satisfactory to Trump.

On the economic level. The economic calendar for the past two days has been completely devoid of any significant US economic data and the focus will be from today until the end of the week, and from other regions. The UK labor market remained weak in the third quarter of 2019, as employment and vacancies dropped significantly ahead of the December 12 general elections amid a political stalemate over the future of Britain's exit from the EU. The employment rate fell 0.1% to 76% in the third quarter. From Germany, economic confidence was sharply boosted to a six-month high in November due to growing hopes for an improved global economic environment.

According to Gold’s technical analysis: The bearish correction of gold prices has been maintained since gold abandoned the $1500 psychological resistance, and stabilized below the $1480 support. At the same time, according to the performance of technical indicators, it reached good buying levels. The bears may have a good momentum if they return to the $1440 support, which motivates them to move towards record support areas that could push it to support $1400 in the coming days. The luster of gold will return strongly with renewed global trade and geopolitical tensions. The yellow metal is the most important safe haven asset for investors in times of uncertainty.

After the Reserve Bank of New Zealand announced its monetary policy, the focus will be on UK inflation data. Then US consumer prices, which are the main gauge of inflation in the world's largest economy. Then the reaction of the content of Federal Reserve Governor Jerome Powell testimony.