For three consecutive trading sessions, the price of gold moved up to the $1516 resistance, taking advantage of the pressure on the US dollar, which is inversely moving with the yellow metal. It closed the week around $1513. Gains were halted immediately after data from the US Department of Labor were released, showing stronger-than-expected growth in US jobs in October. The encouraging jobs data has alleviated concerns about the economy and raised expectations that the Fed may stop raising interest rates for the time being. The dollar index DXY rose to 97.45 after the jobs report, but fell to 97.16 before rising to 97.25, down 0.1% from the previous close.

On the economic front, the Labor Department said non-farm payrolls rose by 128,000 in October, compared with economists' estimates of an increase of about 89,000. The report also showed significant revisions in job growth in September and August, with revised data showing that employment jumped 180,000 jobs and 219,000 jobs, respectively. Despite stronger-than-expected jobs growth, the report said the unemployment rate rose to 3.6% in October from 3.5% in September.

Meanwhile, the ISM PMI showed a continued contraction in US manufacturing activity in October. The index rose to 48.3 in October from 47.8 in September, although a reading below the 50 level indicates a contraction in manufacturing activity. Economists had expected the index to rise to 48.9. The previous month, the index fell to 46.3, its lowest level since June 2009, the last month of the Great Depression.

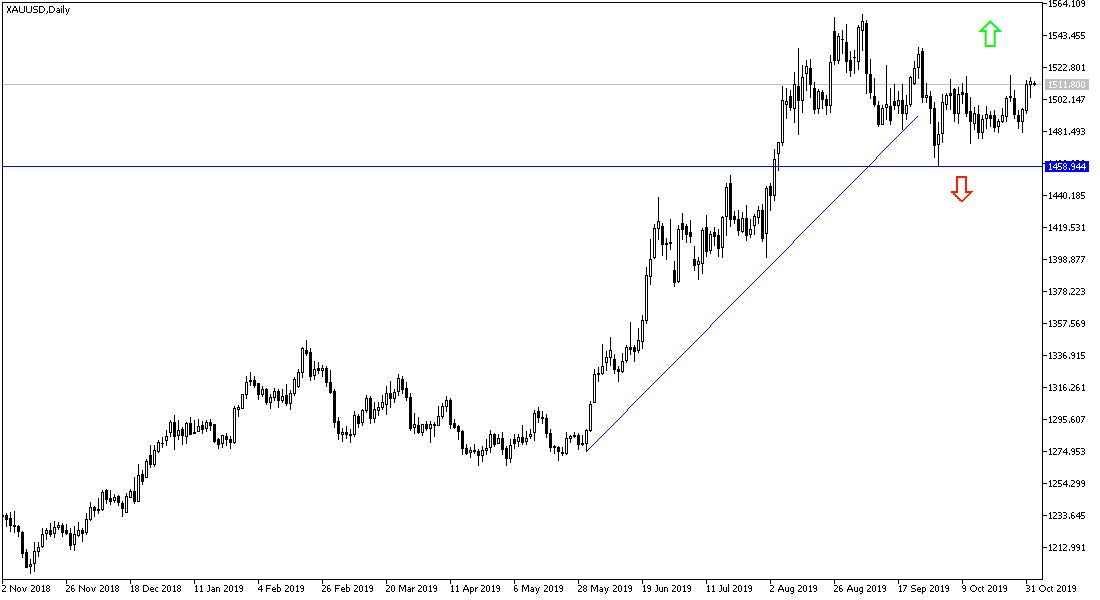

According to the technical analysis of gold: $1500 Psychological resistance is still key to the strength of the upward correction, and stability above that will support the move towards the resistance levels 1515, 1527 and 1540 respectively. Renewed trade and geopolitical tensions around the world, coupled with a weak US dollar, will increase the chance for gold to reach those levels. On the downside, gold's closest support levels are currently at 1507, 1495 and 1480 respectively. The latter level is a strong threat to the current bullish outlook.

As for the economic calendar today: We have Australian Retail Sales data, then the Eurozone Manufacturing PMI. From the UK we have Construction PMI. From the US, we factory orders. There will be an opportunity to get acquainted with the first official comments of new ECB Governor Christine Lagarde after taking over from Mario Draghi.